Konica Minolta 2008 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2008 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

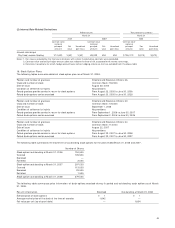

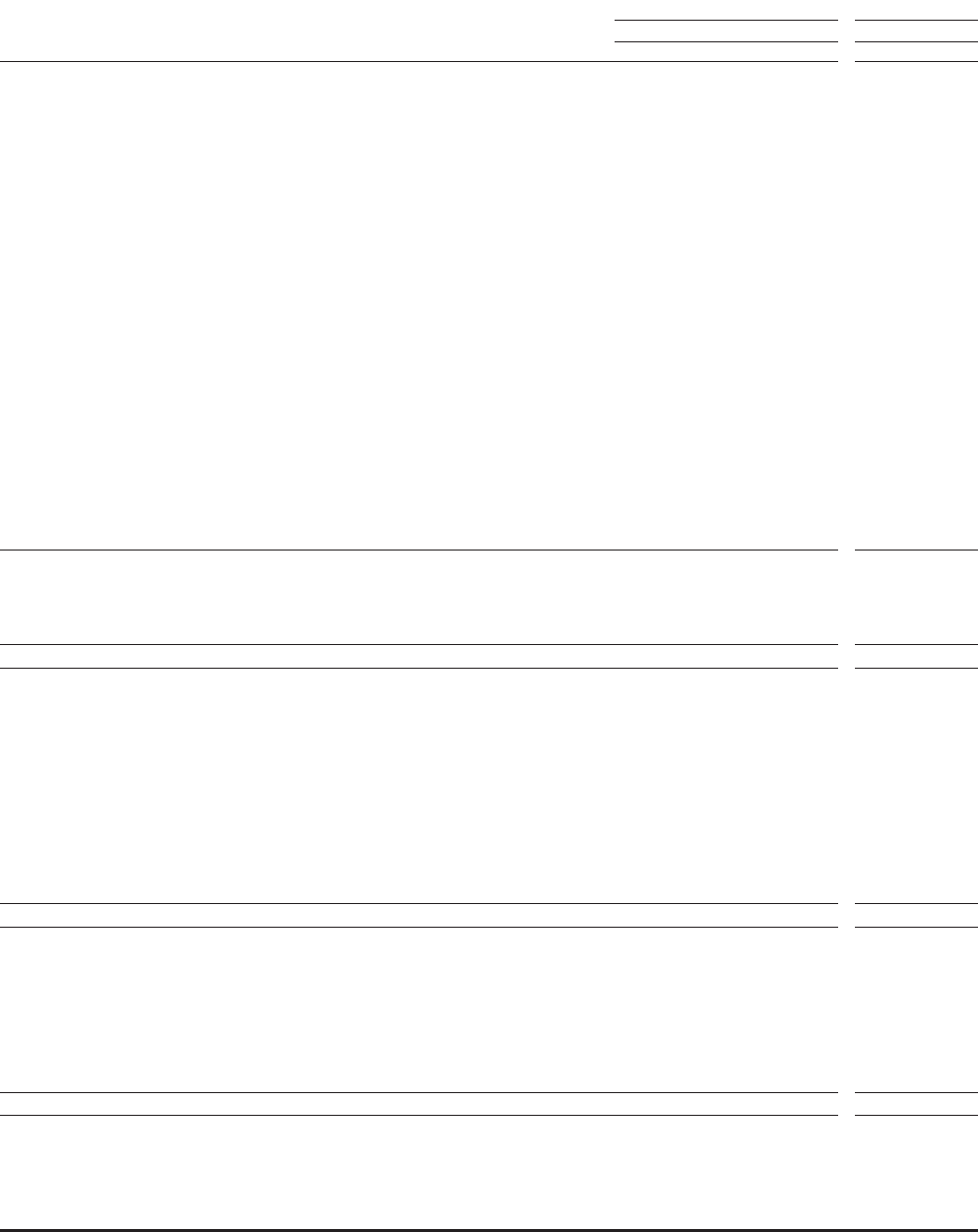

42

Thousands of

U.S. dollars

Millions of yen (Note 3)

March 31 March 31

2008 2007 2008

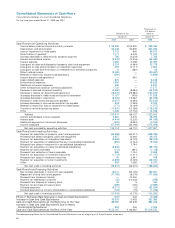

Cash Flows from Operating Activities:

Income before income taxes and minority interests ¥ 98,996 ¥104,890 $ 988,083

Depreciation and amortization 60,443 52,692 603,284

Loss on impairment of fixed assets 5,702 640 56,912

Amortization of goodwill 7,171 6,476 71,574

Increase (decrease) in allowance for doubtful accounts 780 (4,378) 7,785

Interest and dividend income (2,643) (2,316) (26,380)

Interest expense 4,465 5,088 44,565

Loss (gain) on sales and disposals of property, plant and equipment 3,224 (4,484) 32,179

Loss (gain) on sale and write-down of investment securities 293 (2,717) 2,924

Loss (gain) on sale and write-down of investments in affiliated companies 6(580) 60

Patent-related income (8,080) —(80,647)

Reversal of reserve for discontinued operations (590) —(5,889)

Loss on discontinued operations —935 —

Legal-related expenses 625 —6,238

Environmental expenses 1,856 —18,525

Additional retirement expenses 460 —4,591

Other extraordinary losses of overseas subsidiaries 1,731 —17,277

Decrease in accrued retirement benefits (4,462) (8,383) (44,535)

Decrease in reserve for discontinued operations (16,370) (29,980) (163,390)

(Increase) decrease in trade notes and accounts receivable 11,157 (976) 111,358

(Increase) decrease in inventories (6,422) 19,262 (64,098)

Decrease in trade notes and accounts payable (2,027) (5,064) (20,232)

Increase (decrease) in accrued consumption tax payable 904 (1,969) 9,023

Reversal of reserve for loss on impairment of lease assets (171) (3,129) (1,707)

Transfer of rental business-use assets (11,847) (10,168) (118,245)

Other 7,468 (17,700) 74,538

Subtotal 152,674 98,137 1,523,845

Interest and dividend income received 2,681 2,473 26,759

Interest paid (4,444) (5,220) (44,356)

Additional payments of retirement allowance (355) (6,484) (3,543)

Income taxes paid (27,543) (22,193) (274,908)

Net cash provided by operating activities 123,014 66,712 1,227,807

Cash Flows from Investing Activities:

Payment for acquisition of property, plant and equipment (62,969) (62,517) (628,496)

Proceeds from sales of property, plant and equipment 2,907 12,064 29,015

Payment for acquisition of intangible fixed assets (5,864) (6,703) (58,529)

Payment for acquisition of additional shares of consolidated subsidiaries (855) (2,744) (8,534)

Proceeds from sales of investments in consolidated subsidiaries —1,744 —

Payment for acquisition of newly consolidated subsidiaries (6,832) —(68,190)

Payment for loans receivable (113) (891) (1,128)

Proceeds from collection of loans receivable 265 1,142 2,645

Payment for acquisition of investment securities (1,718) (1,411) (17,147)

Proceeds from sales of investment securities 35 3,461 349

Payment for acquisition of other investments (2,609) (2,129) (26,041)

Other 939 1,585 9,372

Net cash used in investing activities (76,815) (56,401) (766,693)

Cash Flows from Financing Activities:

Net increase (decrease) in short-term loans payable 16,314 (53,125) 162,831

Repayment of long-term loans payable (17,159) (8,079) (171,265)

Proceeds from issuance of bonds —70,300 —

Payment for redemption of bonds (30) (14,002) (299)

Proceeds from disposal of treasury stock 16 9160

Payment for purchase of treasury stock (289) (190) (2,885)

Dividend payments (9,271) (12) (92,534)

Dividend payments to minority shareholders in consolidated subsidiaries (126) (70) (1,258)

Net cash used in financing activities (10,545) (5,170) (105,250)

Effect of Exchange Rate Changes on Cash and Cash Equivalents (347) 322 (3,463)

Increase in Cash and Cash Equivalents 35,305 5,463 352,380

Cash and Cash Equivalents at the Beginning of the Year 86,587 80,878 864,228

Increase in Cash and Cash Equivalents Due to Newly

Consolidated Subsidiaries 294 245 2,934

Cash and Cash Equivalents at the End of the Year ¥122,187 ¥ 86,587 $1,219,553

The accompanying Notes to the Consolidated Financial Statements are an integral part of these financial statements.

Consolidated Statements of Cash Flows

Konica Minolta Holdings, Inc. and Consolidated Subsidiaries

For the fiscal years ended March 31, 2008 and 2007