Konica Minolta 2008 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2008 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.43

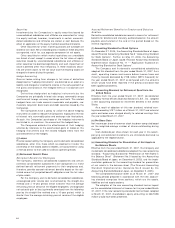

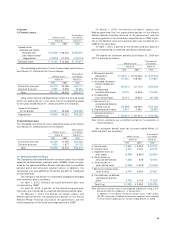

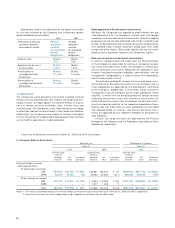

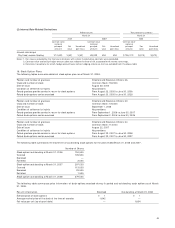

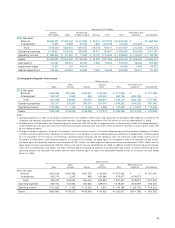

Notes to the Consolidated Financial Statements

Konica Minolta Holdings, Inc. and Consolidated Subsidiaries

For the fiscal years ended March 31, 2008 and 2007

1. Basis of Presenting Financial Statements

The accompanying consolidated financial statements of Konica

Minolta Holdings, Inc., (the “ Company” ) and its consolidated

subsidiaries (the “ Companies” ) are prepared on the basis of

accounting principles generally accepted in Japan, which are

different in certain respects as to application and disclosure

requirements of International Financial Reporting Standards, and

are compiled from the consolidated financial statements prepared

by the Company as required by the Securities and Exchange Law

of Japan. Accounting principles generally accepted in Japan allow

consolidation of foreign subsidiaries based on their financial state-

ments in conformity with accounting principles generally accepted

in their respective country of domicile.

The accompanying consolidated financial statements incor-

porate certain reclassifications in order to present them in a form

that is more familiar to readers outside Japan. In addition, the

notes to the consolidated financial statements include information

that is not required under generally accepted accounting principles

in Japan, but which is provided herein as additional information.

Certain comparative amounts have been reclassified to

conform to the current year classifications.

As permitted under the Securities and Exchange Law of Japan,

amounts of less than one million have been omitted. As a result,

the totals shown in the accompanying consolidated financial state-

ments (both in yen and in dollars) do not necessarily agree with

the sums of the individual amounts.

2. Summary of Significant Accounting Policies

(a) Principles of Consolidation

The consolidated financial statements include the accounts of the

Company and, with certain exceptions which are not material,

those of its 108 subsidiaries (120 subsidiaries for 2007) in which it

has control. All significant intercompany transactions, balances

and unrealized profits among the Companies are eliminated on

consolidation.

Investments in 8 unconsolidated subsidiaries (10 uncon-

solidated subsidiaries for 2007) and 3 significant affiliates (3

significant affiliates for 2007) are accounted for using the equity

method. Investments in other unconsolidated subsidiaries and

affiliates are stated at cost, since they have no material effect on

the consolidated financial statements.

The excess of cost over the underlying investments in

subsidiaries is recognized as goodwill and is amortized on a

straight-line basis over a period not exceeding 20 years.

(b) Translation of Foreign Currencies

Translation of Foreign Currency Transactions and Balances

All monetary assets and liabilities denominated in foreign

currencies, whether long-term or short-term, are translated into

Japanese yen at the exchange rates prevailing at the balance sheet

date and revenues and costs are translated using the average

exchange rates for the period.

Translation of Foreign Currency Financial Statements

The translation of foreign currency financial statements of

overseas consolidated subsidiaries into Japanese yen is made by

applying the exchange rates prevailing at the balance sheet dates

for balance sheet items, except common stock, additional paid-in

capital and retained earnings accounts, which are translated at

the historical rates, and the statements of income and retained

earnings which are translated at average exchange rates.

(c) Cash and Cash Equivalents

Cash and cash equivalents in the consolidated cash flow state-

ments comprises cash on hand and short-term investments that

are due for redemption in three months or less and that are easily

converted into cash with little risk to a change in value.

(d) Allowance for Doubtful Accounts

The allowance for doubtful accounts is provided for possible losses

from uncollectible receivables based on specific doubtful accounts

and considering historic experience.

(e) Inventories

The Company and its domestic consolidated subsidiaries’ invento-

ries are mainly stated at cost as determined by the average

method. Overseas consolidated subsidiaries’ inventories are

mainly stated at the lower of cost or market value, where cost is

determined using the first-in, first-out method.

(f) Property, Plant and Equipment

Depreciation of property, plant and equipment for the Company

and domestic consolidated subsidiaries is computed mainly using

the declining balance method, except for depreciation of buildings

acquired after April 1, 1998, based on the estimated useful lives of

the assets. Depreciation of buildings acquired after April 1, 1998 is

computed using the straight-line method. Depreciation for

overseas consolidated subsidiaries is computed mainly using the

straight-line method.

Changes in Accounting Policy

Effective from the year ended March 31, 2008, the Company and

its domestic consolidated subsidiaries changed their depreciation

method for tangible fixed assets acquired on or after April 1, 2007

in accordance with the revision of Japanese Corporate Tax Law

(Partial Revision of Income Tax Law, Law No. 6 of March 30, 2007;

Partial Revision of Income Tax Law Enforcement Ordinance,

Cabinet Order No. 83 of March 30, 2007). As a result of this

change, compared with the method employed for the previous

fiscal year, operating income and ordinary income were each

¥2,894 million ($28,885 thousand) lower than the previous

method and income before income taxes and minority interests

was ¥2,886 million ($28,805 thousand) lower than it would have

been under the previous method.

Pursuant to an amendment to the Japanese Corporate Tax

Law, effective from the year ended March 31, 2008, the Company

and its domestic consolidated subsidiaries depreciate the differ-

ence between the original residual value of 5% of acquisition cost

of assets acquired before April 1, 2007 and the new residual value

of 1 Yen (memorandum value) by the straight line method over 5

years commencing from the fiscal year following the year in which

the asset becomes fully depreciated to the original residual value.

As a result of this change in accounting method, for the fiscal year

under review, operating income was ¥1,240 million ($12,376

thousand) lower, ordinary income was ¥1,241 million ($12,386

thousand) lower and income before income taxes and minority

interests was ¥1,030 million ($10,280 thousand) lower than under

the previous method for calculating depreciation.

(g) Income Taxes

Deferred income taxes are recognized based on temporary

differences between the tax basis of assets and liabilities and those

as reported in the consolidated financial statements.

(h) Research and Development Costs

Research and development costs are expensed as incurred.

(i) Financial Instruments

Derivatives

All derivatives are stated at fair value, with changes in fair value

included in net income for the period in which they arise, except

for derivatives that are designated as “ hedging instruments” (see

Hedge Accounting below).