Konica Minolta 2008 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2008 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

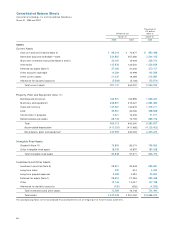

Retained earnings were ¥176.7 billion, up ¥61.0 billion, mainly because from the contribution

of ¥68.8 billion in net income. The unrealized gains on securities, net of taxes, and the foreign

currency translation adjustments were down ¥4.5 billion and ¥6.3 billion, respectively, owing to

sluggish equity markets and a higher yen. Total net assets thus rose ¥49.7 billion. The equity ratio

was 43.0% , up 4.4 percentage points.

Capital Expenditure and Depreciation and Amortization

Capital expenditure increased ¥11.3 billion, to ¥75.3 billion, mainly to expand production facilities.

Spending for the core Business Technologies business declined ¥7.9 billion, to ¥16.6 billion,

although Optics business allocations rose ¥17.5 billion, to ¥42.0 billion. Medical and Graphic

Imaging business expenditures were ¥4.6 billion.

Noteworthy developments during the term included the construction of a fifth TAC film plant,

in Kobe, Japan, and spending on a glass hard disk substrate facility in Malaysia.

Cash Flows

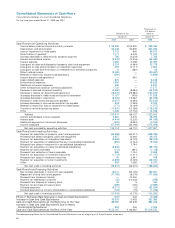

Net cash provided by operating activities was ¥123.0 billion, up ¥56.3 billion. This reflected lower

outflows from a decrease in reserve for discontinued operations in line with the exit from the

Photo Imaging business and higher inflows from a decrease in trade notes and accounts receivable.

Net cash used in investing activities was ¥76.8 billion, up ¥20.4 billion. This stemmed from

a significant fall in inflows from proceeds from sales of property, plant and equipment, and

outflows from payment for acquisition of newly consolidated subsidiaries.

Net cash used in financing activities was ¥10.5 billion, up ¥5.4 billion. Key factors included an

increase in repayment of long-term loans payable and the restoration of interim cash dividend

payments, which raised dividend outlays.

Cash and cash equivalents at the end of the year were thus ¥122.2 billion, up ¥35.6 billion

from the start of the term.

Future Financial Strategies

The Group will accelerate sustainable growth to ensure superior global competitiveness, com-

pleting its steady progress toward targets it set in its FORWARD 08 medium-term management

strategy. Management seeks a net asset ratio exceeding 50% and a debt-to-equity ratio of less

than 0.5 times.

Capital Expenditure

(Billions of Yen)

0

20

40

60

80

06 07 08

Total Assets

(left scale)

Net Assets

(left scale)

Return on Equity (ROE)

(right scale)

Total Assets, Net Assets

and Return on Equity (ROE)

(Billions of Yen, % )

0

250

500

750

1,000

06 07 08

0

15

30

–30

–15