Konica Minolta 2008 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2008 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

On March 1, 2004, the Ministry of Health, Labour and

Welfare permitted that the substitutional portion of the Minolta

Welfare Pension Fund be returned to the government, and the

remaining portion of the Fund was integrated into a CDBP. A por-

tion of the Minolta lump-sum payament plan was transferred to a

CDBP on the same date.

On April 1, 2004, a portion of the Minolta lump-sum payment

plan was transferred to a defined contribution pension plan.

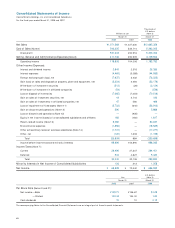

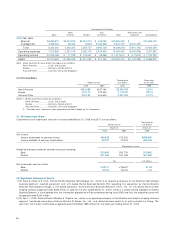

The reserve for retirement benefits as of March 31, 2008 and

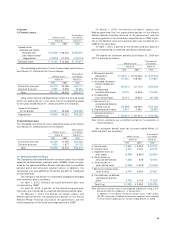

2007 is analyzed as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

a. Retirement benefit

obligations ¥(144,011) ¥(149,936) $(1,437,379)

b. Plan assets 91,360 108,766 911,867

c. Unfunded retirement

benefit obligations

(a+b) (52,651) (41,170) (525,512)

d. Unrecognized

actuarial differences 10,276 (4,528) 102,565

e. Unrecognized

prior service costs (8,131) (9,557) (81,156)

f. Net amount on

consolidated balance

sheets (c+d+e) (50,506) (55,256) (504,102)

g. Prepaid pension costs 2,861 2,690 28,556

h. Accrued retirement

benefits (f-g) ¥ (53,367) ¥ (57,947) $ (532,658)

Note: Certain subsidiaries use a simplified method for the calculation of

benefit obligation.

Net retirement benefit costs for the years ended March 31,

2008 and 2007 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

a. Service costs ¥ 5,662 ¥ 6,383 $ 56,513

b. Interest costs 4,410 4,244 44,016

c. Expected return on

plan assets (3,095) (2,887) (30,891)

d. Amortization of

actuarial differences 1,248 338 12,456

e. Amortization of

prior service costs (1,426) (1,529) (14,233)

f. Retirement benefit costs

(a+b+c+d+e) 6,799 6,549 67,861

g. Contributions to defined

contribution pension

plans 3,199 2,745 31,929

Total (f+g) ¥ 9,998 ¥ 9,295 $ 99,790

Note: Retirement benefit costs of consolidated subsidiaries using a sim-

plified method are included in “ a. Service costs” .

In addition to the above retirement benefit costs, ¥460 million

($4,591 thousand) of additional retirement expenses were recorded

in other income (expenses) for the year ended March 31, 2008.

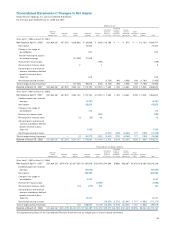

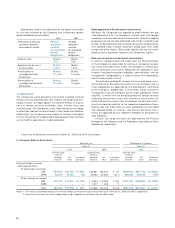

As Lessor

1) Finance Leases

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Leased rental

business-use assets:

Purchase cost ¥ 22,648 ¥ 28,524 $ 226,051

Less: Accumulated

depreciation (13,523) (17,940) (134,974)

Net book value ¥ 9,125 ¥ 10,584 $ 91,077

The scheduled maturities of future finance lease rental income

as of March 31, 2008 and 2007 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Due within one year ¥4,179 ¥5,089 $41,711

Due over one year 4,945 3,953 49,356

Total ¥9,125 ¥9,043 $91,077

Lease rental income and depreciation under the finance leases

which are accounted for in the same manner as operating leases

for the years ended March 31 , 2008 and 2007 are as follows:

Lease rental income

for the period ¥4,267 ¥5,638 $42,589

Depreciation ¥3,936 ¥5,312 $39,285

2) Operating Leases

The scheduled maturities of future operating lease rental income

as of March 31, 2008 and 2007 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Due within one year ¥2,238 ¥1,694 $22,338

Due over one year 3,420 1,677 34,135

Total ¥5,658 ¥3,372 $56,473

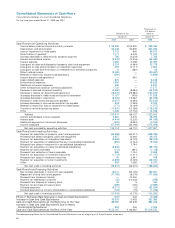

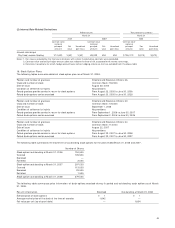

17. Retirement Benefit Plans

The Companies have defined benefit retirement plans that include

corporate defined benefit pensions plans (CDBPs), which are gov-

erned by the Japanese Welfare Pension Insurance Law, tax-qualified

pension plans and lump-sum payment plans. In addition, the

Companies may pay additional retirement benefits to employees

at their discretion.

The Company and certain of its domestic subsidiaries changed

their retirement plans, as follows:

On April 1, 2003, Konica’s tax-qualified benefit plan was

transferred to a CDBP.

On April 30, 2003, a portion of the Konica lump-sum pay-

ment plan was transferred to a defined contribution pension plan.

On February 1, 2004, the Ministry of Health, Labour and

Welfare permitted that the substitutional portion of the Konica

Welfare Pension Fund be returned to the government, and the

remaining portion of the Fund was integrated into a CDBP.