Konica Minolta 2008 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2008 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

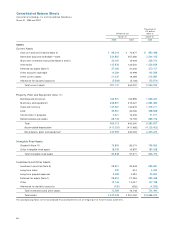

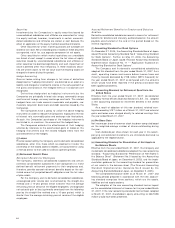

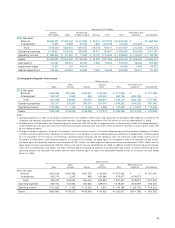

Net deferred tax assets are included in the following items in

the consolidated balance sheets:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Current assets –

deferred tax assets ¥37,086 ¥41,336 $370,157

Fixed assets –

deferred tax assets 28,604 27,306 285,498

Current liabilities –

other current liabilities (248) (21) (2,475)

Long-term liabilities –

other long-term liabilities (53) (2,191) (529)

Net deferred tax assets ¥65,389 ¥66,430 $652,650

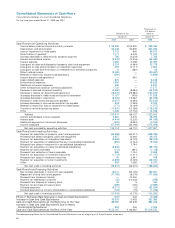

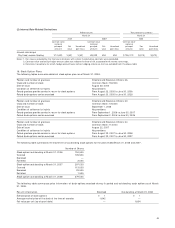

8. Research and Development Costs

Research and development costs included in cost of sales and

selling, general and administrative expenses for the years ended

March 31, 2008 and 2007 are ¥81,370 million ($812,157

thousand) and ¥72,142 million, respectively.

9. Net Assets

The Japanese Corporate Law became effective on May 1, 2006,

replacing the Commercial Code. Under Japanese laws and

regulations, the entire amount paid for new shares is required to

be designated as common stock. However, a company may, by a

resolution of the Board of Directors, designate an amount not

exceeding one half of the price of the new shares as additional

paid-in capital, which is included in capital surplus.

The Japanese Corporate Law provides that an amount equal

to 10% of distributions from retained earnings paid by the

Company and its Japanese subsidiaries be appropriated as addi-

tional paid-in capital or legal earnings reserve. Legal earnings

reserve is included in retained earnings in the accompanying

consolidated balance sheets. No further appropriations are

required when the total amount of the additional paid-in capital

and the legal earnings reserve equals 25% of their respective

stated capital. The Japanese Corporate Law also provides that

additional paid-in capital and legal earnings reserve are available

for appropriations by the resolution of the Board of Directors.

Cash dividends and appropriations to the additional paid-in

capital or the legal earnings reserve charged to retained earnings

for the years ended March 31, 2008 and 2007 represent dividends

paid out during those years and the related appropriations to the

additional paid-in capital or the legal earnings reserve.

Retained earnings at March 31, 2008 do not reflect current

year-end dividends in the amount of ¥3,979 million ($39,715

thousand) approved by the Board of Directors, which will be

payable in May 2008.

The amount available for dividends under the Japanese

Corporate Law is based on the amount recorded in the Company’s

nonconsolidated books of account in accordance with accounting

principles generally accepted in Japan.

On November 1, 2007, the Board of Directors approved cash

dividends to be paid to shareholders of record as of September

30, 2007, totaling ¥3,980 million ($39,725 thousand), at a rate of

¥7.5 per share. On May 9, 2008, the Board of Directors approved

cash dividends to be paid to shareholders of record as of March

31, 2008, totaling ¥3,979 million ($39,715 thousand), at a rate of

¥7.5 per share.

10. Contingent Liabilities

The Companies were contingently liable at March 31, 2008 for

loan and lease guarantees of ¥3,266 million ($32,598 thousand)

and at March 31, 2007 for loan and lease guarantees of ¥2,236

million.

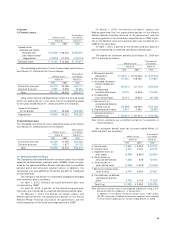

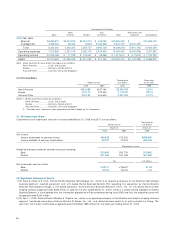

11. Loss on Impairment of Fixed Assets

The Companies have recognized loss on impairment of ¥5,702

million ($56,912 thousand) and ¥640 million for the following

groups of assets for the years ended March 31, 2008 and 2007,

respectively:

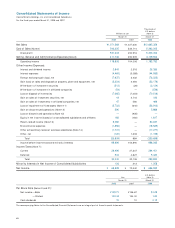

Description Classification Amount

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Manufacturing Machinery and ¥2,361 ¥— $23,565

facilities of equipment,

medical and Tools and

graphic film furniture, Others

Rental assets Rental business- 91 117 908

use assets

Idle assets Land, 328 522 3,274

Buildings and

structures,

Machinery, Others

Others Goodwill 2,921 —29,155

Total ¥5,702 ¥640 $56,912

(1) Identifying the cash-generating unit to which an asset belongs

Each cash-generating unit is identified based on product lines

and geographical areas as a group of assets. For rental assets,

cash-generating units are identified based on rental contracts

and each geographical area. Each idle asset is also identified

as a cash-generating unit.

(2) The Companies have written the assets down to the recover-

able value and recognized an impairment loss due to worsen-

ing of the market environment in the Medical and Graphic

business, the decline in real estate value, poor performance

and profitability of rental and idle assets, and the revaluation

of goodwill.

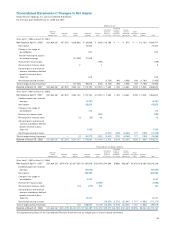

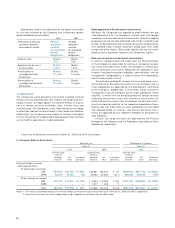

(3) Details of impairment of fixed assets

Amount

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Buildings and structures ¥ — ¥ 87 $ —

Rental business-use assets —117 —

Machinery and equipment 2,451 —24,464

Goodwill 2,921 —29,155

Others 330 435 3,294

(4) Measuring recoverable amount

The recoverable amount of a cash-generating unit is the fair

value less costs to sell. The fair value is supported by an

appraisal report for land and buildings and structures, or a

management estimate for rental business-use assets.