Konica Minolta 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

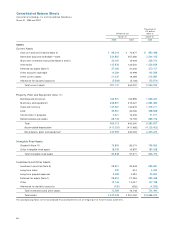

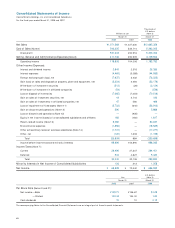

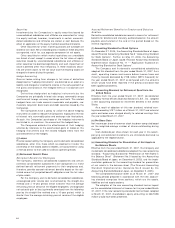

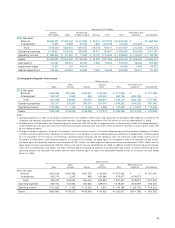

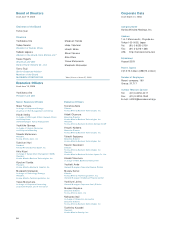

12. Discontinued Operations

The amounts included in the statements of income for discon-

tinued operations for the years ended March 31, 2008 and 2007

represent:

Amount

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Reversal of excess reserve made

for discontinued operations

in the previous fiscal year ¥ 8,425 ¥17,567 $ 84,090

Loss on discontinued operations

in the fiscal year under review (7,834) (18,502) (78,191)

¥ 590 ¥ (935) $ 5,889

13. Patent-Related Income

Regarding patent-related income, amounts for patents related to

the Photo Imaging business are aggregate figures that include

both patent royalties and gains on patent transfers.

14. Extraordinary Losses of Overseas Subsidiaries

Extraordinary losses of overseas subsidiaries include ¥581 million

($5,799 thousand) of additional allowance for doubtful accounts

and correction of deferred income in a British subsidiary; ¥838

million ($8,364 thousand) of correction of inventory amounts in

a British subsidiary; and ¥312 million ($3,114 thousand) of

correction of deferred income in the Danish subsidiary.

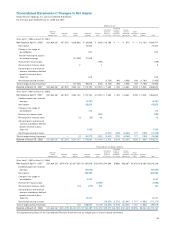

15. Actuarial Gains and Losses of Overseas Subsidiaries

Defined Benefit Retirement Plans

The actuarial gains and losses of overseas subsidiaries defined

benefit retirement plans included in retained earnings in the

consolidated statements of changes in net assets results from

the accounting treatment of retirement benefits that affected

certain consolidated subsidiaries in the United Kingdom and the

United States.

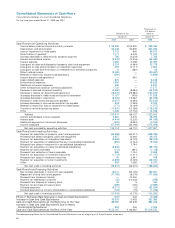

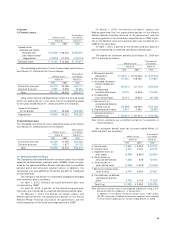

16. Lease Transactions

Proforma information on the Company and its domestic consoli-

dated subsidiaries’ finance lease transactions (except for those

which are deemed to transfer the ownership of the leased assets

to the lessee) and operating lease transactions is as follows:

As Lessee

1) Finance Leases Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Purchase cost:

Buildings and structures ¥ 8,426 ¥ 8,841 $ 84,100

Machinery and equipment 2,466 2,435 24,613

Tools and furniture 6,074 11,348 60,625

Rental business-use assets 2,750 4,173 27,448

Intangible fixed assets 153 358 1,527

19,871 27,158 198,333

Less: Accumulated

depreciation (12,369) (16,037) (123,455)

Loss on impairment of

leased assets (21) (15) (210)

Net book value ¥ 7,480 ¥ 11,106 $ 74,658

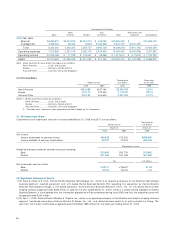

The scheduled maturities of future lease rental payments on

such lease contracts at March 31, 2008 and 2007 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Due within one year ¥3,037 ¥ 2,913 $30,312

Due over one year 4,464 8,236 44,555

Total ¥7,502 ¥11,150 $74,878

Lease rental expenses and depreciation equivalents under the

finance leases which are accounted for in the same manner as

operating leases for the years ended March 31, 2008 and 2007

are as follows:

Lease rental expenses

for the period ¥3,395 ¥ 4,168 $33,886

Depreciation equivalents ¥3,378 ¥ 1,081 $33,716

Depreciation equivalents are calculated based on the straight-

line method over the lease terms of the leased assets.

Accumulated loss on impairment of leased assets as of March

31, 2008 and 2007 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Reserve for loss ¥21 ¥15 $210

Loss on impairment and reversals of loss on impairment of leased

assets for the years ended March 31, 2008 and 2007 are as

follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Loss on impairment ¥23 —$230

Reversals of loss ¥16 ¥3,087 $160

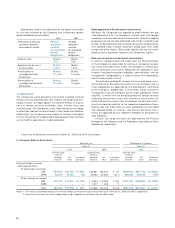

2) Operating Leases

The scheduled maturities of future operating lease rental pay-

ments as of March 31, 2008 and 2007 are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Due within one year ¥ 5,468 ¥ 5,052 $ 54,576

Due over one year 14,016 14,676 139,894

Total ¥19,485 ¥19,728 $194,480