Konica Minolta 2008 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2008 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

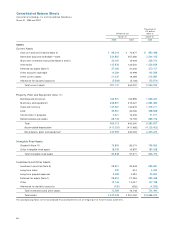

46

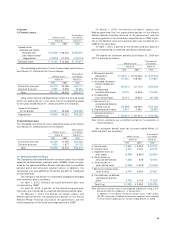

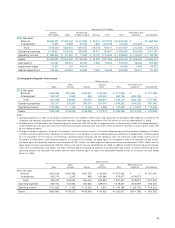

6. Short-Term Debt and Long-Term Debt

Short-term debt was principally unsecured and generally represents

bank overdrafts. The amounts as of March 31, 2008 and 2007

were ¥93,875 million ($936,970 thousand) and ¥79,927 million,

respectively, and the weighted-average interest rates were

approximately 3.4% and 3.3% , respectively.

Long-term debt as of March 31, 2008 and 2007, including

current portion, consisted of the following:

Bonds Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

2.3% bonds due in 2007 ¥—¥ 9 $—

2.5% bonds due in 2007 —9—

2.4% bonds due in 2007 —9—

2.825% unsecured

bonds due in 2008 5,000 5,000 49,905

Zero coupon convertible

unsecured bonds due

in 2009 30,166 30,266 301,088

Zero coupon convertible

unsecured bonds due

in 2016 40,000 40,000 399,241

¥75,166 ¥75,296 $750,235

Less—Current portion

included in current liabilities (5,000) (29) (49,905)

¥70,166 ¥75,266 $700,329

Zero coupon convertible unsecured bonds due in 2009 and

2016 above are bonds with share subscription rights issued on

December 7, 2006. Details of the share subscription rights are as

follows: 2009 bonds 2016 bonds

Class of stock Common Stock Common Stock

Issue price of shares (Yen) Zero Zero

Initial conversion prices

(Yen/per share) ¥2,175 ¥2,383

Total issue price

(Millions of yen) ¥30,000 ¥40,000

Ratio of granted rights (% ) 100 100

Period share subscription From December From December

rights can be exercised 21, 2006 to 21, 2006 to

December 1, November 22,

2009 2016

Long-term loans Thousands of

Millions of yen Interest U.S. dollars

March 31 rate March 31

2008 2007 2008 2008

Loans principally

from banks, due

through 2020 ¥56,983 ¥ 74,140 1.4% $568,749

Less—Current portion

included in current

liabilities (6,363) (17,075) (63,509)

¥50,620 ¥ 57,065 $505,240

The aggregate annual maturities of long-term loans at March

31, 2008 are as follows: Amount

Thousands of

Years ending March 31 Millions of yen U.S. dollars

2009 ¥ 6,363 $ 63,509

2010 12,103 120,800

2011 27,502 274,498

2012 11,002 109,811

2013 2 20

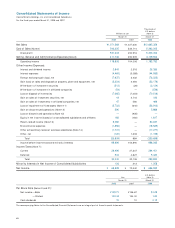

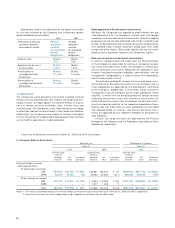

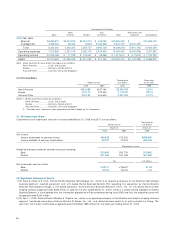

7. Income Taxes

The income taxes of the Company and its domestic consolidated

subsidiaries consist of corporate income taxes, local inhabitants’

taxes and enterprise taxes.

The reconciliation of the Japanese statutory income tax rate to

the effective income tax rate for the years ended March 31, 2008

and 2007 is as follows:

2008 2007

Statutory income tax rate 40.7% 40.7%

Decrease in valuation allowance (4.9) (9.3)

Tax credits (4.3) (2.6)

Non-taxable income (4.7) (0.7)

Difference in statutory tax rates

of foreign subsidiaries (0.0) (0.3)

Expenses not deductible for

tax purposes 2.6 1.7

Amortization of goodwill 2.7 1.9

Other, net (1.8) (0.8)

Effective income tax rate per

consolidated statements of income 30.3% 30.6%

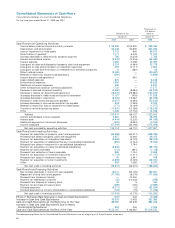

At March 31, 2008 and 2007, significant components of

deferred tax assets and liabilities in the consolidated financial

statements are as follows:

Thousands of

Millions of yen U.S. dollars

March 31 March 31

2008 2007 2008

Deferred tax assets:

Net operating tax loss

carried forward ¥ 27,061 ¥ 25,244 $ 270,097

Accrued retirement benefits 26,973 28,949 269,218

Elimination of unrealized

intercompany profits 20,131 18,121 200,928

Reserve for discontinued

operations 9,565 12,901 95,469

Accrued bonuses 5,768 5,181 57,571

Depreciation and amortization 5,710 4,298 56,992

Write-down of assets 4,151 7,658 41,431

Enterprise taxes 2,059 2,148 20,551

Tax effects related to

investments 1,721 8,720 17,177

Allowance for doubtful

accounts 1,169 986 11,668

Other 8,657 16,194 86,406

Gross deferred tax assets 112,970 130,405 1,127,558

Valuation allowance (34,639) (49,902) (345,733)

Total deferred tax assets 78,331 80,502 781,825

Deferred tax liabilities:

Retained earnings of

overseas subsidiaries (5,455) (3,194) (54,447)

Unrealized gains on securities (3,265) (6,374) (32,588)

Gains on securities

contributed to employees’

retirement benefit trust (3,042) (3,124) (30,362)

Special tax-purpose

reserve for condensed

booking of fixed assets (800) (1,086) (7,985)

Other (377) (291) (3,763)

Total deferred tax liabilities (12,941) (14,072) (129,165)

Net deferred tax assets ¥ 65,389 ¥ 66,430 $ 652,650

Deferred tax liabilities

related to revaluation:

Deferred tax liabilities

on land revaluation ¥(4,010) ¥(4,028) $(40,024)