Konica Minolta 2008 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2008 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

Consolidated Financial Review

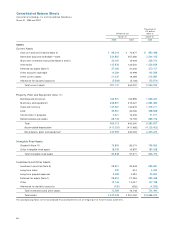

Scope of Consolidation

The Konica Minolta Group comprises Konica Minolta Holdings, Inc., 108 subsidiaries, 23 non-

consolidated subsidiaries and seven affiliates.

The Group maintains five segments that reflect the nature of its products, markets, businesses,

and administration. These segments are Business Technologies, Optics, Medical and Graphic

Imaging, Sensing, and Other Businesses. The Group exited its Photo Imaging business in the fiscal

year ended March 31, 2008.

Performance

Net Sales

Net sales in the fiscal year ended March 31, 2008 rose ¥43.9 billion, to ¥1,071.6 billion. We

achieved this year-on-year increase despite exiting the Photo Imaging business, which cut ¥47.8

billion from revenues, owing to substantial growth in the core Business Technologies and Optics

segments. Sales growth was particularly pronounced in the mainstay Optics segment, which

contributed significantly to overall revenues.

Business Technologies sales increased 6.4% , to ¥701.0 billion, on strong lineups of color and

production printing MFPs and contributions from direct marketing operations and alliances with

leading dealers. Optics sales rose 31.2% , to ¥182.3 billion, reflecting significant market share

growth in high-performance TAC films and outstanding performances in such memory areas as

optical pickup lenses, glass hard disk substrates, and image input and output components.

Medical and Graphic Imaging sales were up 1.5% , to ¥161.1 billion, owing to concentrated

marketing of digital systems for the medical and healthcare and printing fields. Sensing sales

were almost unchanged, at ¥9.9 billion. Performance benefited from a focus on developing key

next-generation products, which led to three new offerings that complemented efforts to boost

competitiveness. Sales from the Industrial Inkjet business, which is included in Other business,

increased 15.4% , to ¥6.9 billion, on higher domestic revenues and successful marketing to

overseas manufacturers.

Cost of Sales and Selling, General and Administrative Expenses

The cost of sales was ¥540.2 billion. The cost of sales ratio was 50.4% , down 1.4 percentage points

from the preceding year, owing to higher sales and the implementation of cost-cutting programs.

Selling, general and administrative expenses increased ¥20.8 billion, to ¥411.7 billion, and

represented 38.4% of net sales, up 0.3 percentage point. Main factors were higher R&D invest-

ments in the Business Technologies and Optics businesses and personnel expansion, which raised

labor spending.

Business Technologies

Optics

Medical and Graphic Imaging

Sensing, Industrial Inkjet

Holdings, Others

Photo Imaging

Net Sales

(Billions of Yen)

0

300

600

900

1,200

06 07 08

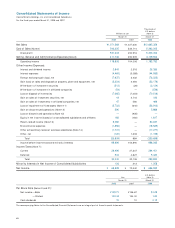

Cost of Sales

(left scale)

Cost of Sales Ratio

(right scale)

Cost of Sales and

Cost of Sales Ratio

(Billions of Yen, % )

0

15

30

45

60

0

200

400

600

800

06 07 08