Konica Minolta 2005 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2005 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

in Wuxi, China to expand equipment manufacturing capacity and new facilities for

increased polymerized toner production capacity in Japan in response to the ongoing

shift to color products. In addition, we are investing to increase direct sales capacity

and acquiring dealers in order to expand marketing capacity.

In the optics business, construction has begun on the third and the fourth plants for

TAC film used in liquid crystal displays (LCDs) in response to expanding demand.

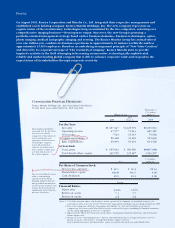

BALANCE SHEET IMPROVEMENTS

During the fiscal year, interest-bearing debt continued to decline, falling by ¥21.6

billion from the previous fiscal year-end to ¥246.3 billion.

Shareholders’ equity increased by ¥4.3 billion from the end of the previous fiscal

year to ¥339.7 billion. As a result, shareholders’ equity ratio at the end of the fiscal

year improved by 1 percentage point from the previous year-end.

PENDING ISSUES

As the market environment is likely to become even more severe, we need to remain

vigilant. In particular, the shift to color in the MFP market is occurring faster than

anticipated, and we believe the keys to win will be timely responses to market

opportunities and global market share expansion. Given this environment, Konica

Minolta intends to actively expand sales of popular color products, while

emphasizing increased sales of optical devices and components as well as LCD

materials in the Optics segment.

On the other hand, we believe the Photo Imaging segment will continue to be

plagued by shrinking demand, pricing competition and a generally severe operating

environment. We therefore intend to achieve thorough structural reforms by

implementing early corrective measures to address structural earnings deficiencies

in the business.

CORPORATE GOVERNANCE PHILOSOPHY

Konica Minolta regards the strengthening of corporate governance as a key manage-

ment issue and, in addition to adopting a committee-based corporate governance

system, aims to improve management transparency and efficiency. During the fiscal

year under review, the functioning of the Group’s corporate governance organs—

from the Board of Directors to the Audit Committee, the Nominating Committee and

the Compensation Committee—was strengthened and policies were implemented

with these goals in mind. All of these efforts reflect Konica Minolta’s emphasis on

achieving fair returns for all stakeholders. For our shareholders in particular, Konica

Minolta’s management priority is the early achievement of our business performance

goals as a means of enhancing corporate value.

June 2005

Fumio Iwai

President & CEO, Representative Executive Officer

0

600

450

300

150

20072006 2008 2009

Shareholders’ Equity

Interest-Bearing Debt

Shareholders’ Equity /

Interest-Bearing Debt

(Planned 2006–2009)

(Billions of Yen)

0

0.8

0.6

0.4

0.2

Debt/Equity Ratio

(Planned 2006–2009)

(Times)

20072006 2008 2009

The goal is to further enhance

management transparency and

efficiency.