Konica Minolta 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

segment increased 41% year-on-year to ¥8.3 billion, centering on next generation

optical products. Total R&D expenditures including development costs for Business

Technologies, Optics, and advanced technologies accounted for 73% of total R&D

expenditures. As the result of focused selection and concentration of management

resources, R&D expenditures in the Photo Imaging segment declined 20% year-on-

year to ¥8.9 billion, while R&D expenditures in the Medical and Graphic Imaging

segment were flat compared with the previous fiscal year at ¥7.6 billion. In addition,

R&D expenditures in the Sensing segment were ¥1.0 billion.

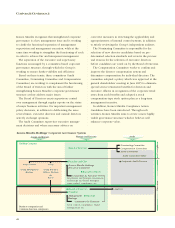

Segment Information

Sales in the Business Technologies segment, reflecting adjustments because of the

merger, were flat year-on-year at ¥564.8 billion, while operating income declined by

¥3.0 billion from the previous fiscal year to ¥55.8 billion. While growth in color MFP

was strong, this growth was not enough to offset a shift to low speed monochrome

MFPs with lower prices, and price declines in LBP due to intensified competition.

On the other hand, Optic segment sales increased ¥6.8 billion for the fiscal year to

¥91.7 billion. The main factor was strong growth in TAC film for LCDs supported by

the diffusion of LCD TVs.

Sales in the Photo Imaging segment, including adjustments for a change in

accounting term due to the merger and changes in the content of this segment,

declined by ¥28.8 billion to ¥268.5 billion. This decline was mainly due to shrinkage

in the color film market, in addition to declining selling prices due to intensified

competition in the digital camera market. As profitability in the film business, which

is the major source of earnings for the segment, deteriorated further, the operating

loss in the segment increased as compared to previous fiscal year.

Medical and Graphic Imaging segment sales in actual terms were slightly higher

for the fiscal year at ¥129.9 billion. While digital input/output equipment for on-site

medical use and related dry film sales were healthy, the rise in total sales for the

segment was limited by a decline in film sales in the Graphic Imaging business.

Operating income for the segment declined slightly from the previous

fiscal year, reflecting a sharp rise in the cost of film materials.

Sensing segment sales, adjusted for changes in segment content as a result of the

merger, were slightly higher than in the previous fiscal year at ¥5.3 billion. Strong

light source color analyzer, spectrophotometer and 3D digitizer equipment sales

supported total sales for the segment. Operating income, again after making slight

adjustments because of the change in segment content, increased slightly from

the previous fiscal year.

By Segment Billions of yen

Net Sales Operating Income (Loss)

Value Value

2005 2004 change 2005 2004 change

Business Technologies 564.8 625.8 –61.0 55.8 62.9 –7.0

Optics 91.7 85.8 5.9 16.0 15.3 0.7

Photo Imaging 268.5 277.7 –9.2 (8.7) (6.7) -2

Medical and Graphic Imaging 129.9 120.9 9.0 6.7 7.9 –1.2

Sensing 5.3 8.0 –2.7 1.6 1.8 –0.2

Other 7.2 5.4 1.8 (3.9) (7.9) 4.0

Total 1067.4 1123.6 -56.2 67.6 73.2 -5.6

* Includes former Minolta totals for first half FY2004

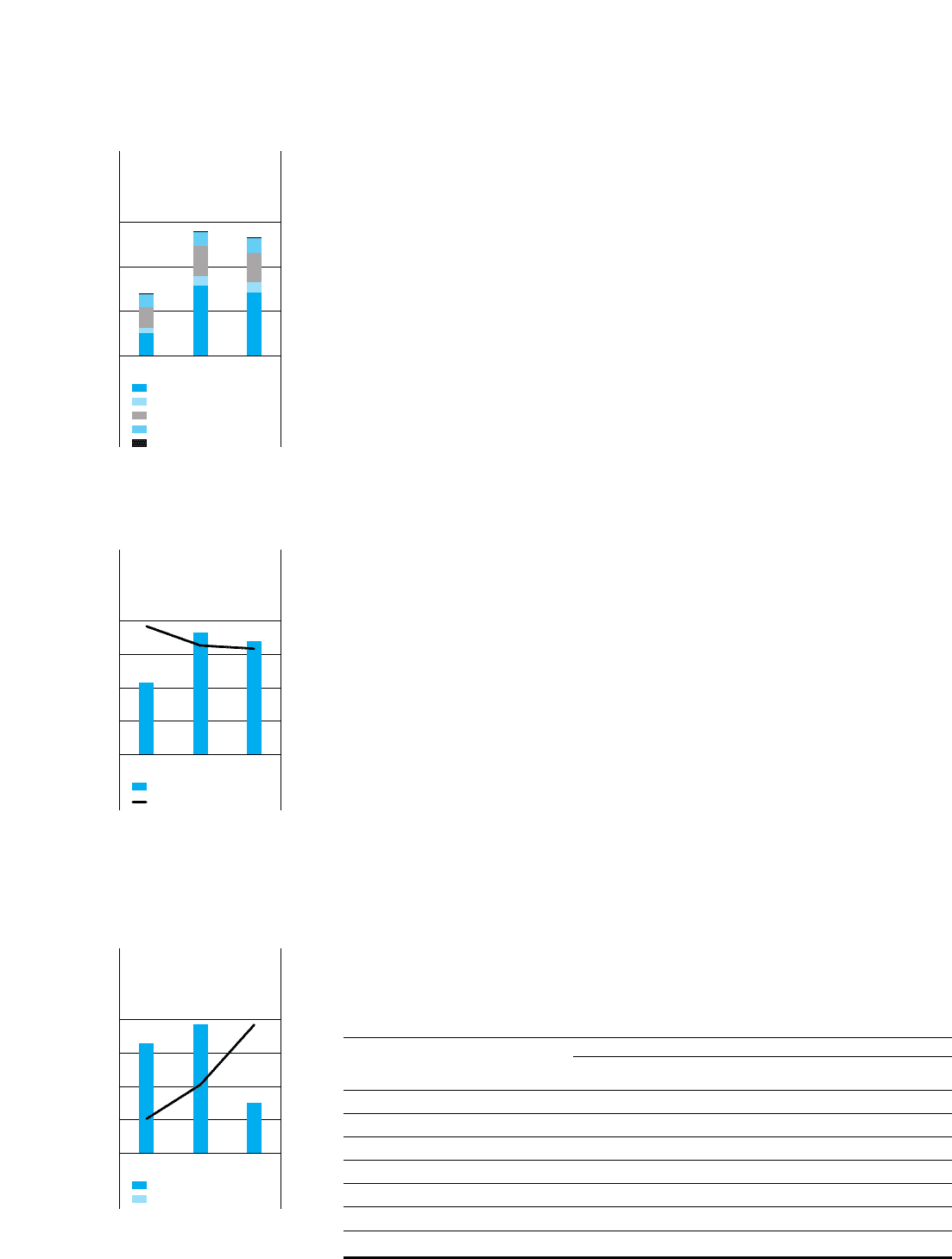

Net Income and

Earnings per Share

(EPS) (¥ billions, %)

0

20

15

10

5

Net Income

Earnings per Share (EPS)

0

80

60

40

20

20042003 2005

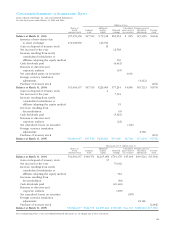

Operating Income

Operating Income Ratio

Operating Income and

Operating Income Ratio

(¥ billions, %)

0

80

0

8

60 6

40 4

20 2

20042003 2005

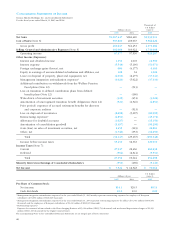

Business Technologies

Optics

Photo Imaging

Medical and Graphic Imaging

Sensing

Net Sales

(¥ billions)

0

1,200

400

800

20042003 2005