Konica Minolta 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

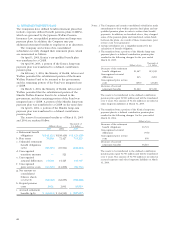

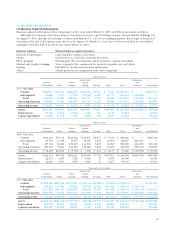

12. RETIREMENT BENEFIT PLANS

The Companies have defined benefit retirement plans that

include corporate defined benefit pensions plans (CDBPs),

which are governed by the Japanese Welfare Pension

Insurance Law, tax-qualified pension plans and lump-sum

payment plans. In addition, the Company may pay

additional retirement benefits to employees at its discretion.

The Company and certain of its consolidated

subsidiaries recently changed their retirement plans, which

are summarized as follows.

On April 1, 2003, Konica’s tax-qualified benefit plan

was transferred to a CDBP.

On April 30, 2003, a portion of the Konica lump-sum

payment plan was transferred to a defined contribution

pension plan.

On February 1, 2004, the Ministry of Health, Labour and

Welfare permitted the substitutional portion of the Konica

Welfare Pension Fund to be returned to the government,

and the remaining portion of the Fund was integrated into

a CDBP.

On March 1, 2004, the Ministry of Health, Labour and

Welfare permitted that the substitutional portion of the

Minolta Welfare Pension Fund to be returned to the

government, and the remaining portion of the Fund was

integrated into a CDBP. A portion of the Minolta lump-sum

payment plan was transferred to a CDBP on the same date.

On April 1, 2004, a portion of the Minolta lump-sum

payment plan was transferred to a defined contribution

pension plan.

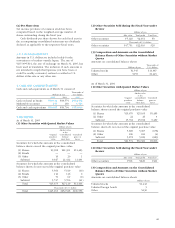

The reserve for retirement benefits as of March 31, 2005

and 2004 are analyzed follws:

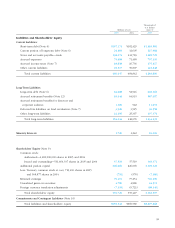

Thousands of

Millions of yen U.S. dollars

2005 2004 2005

a. Retirement benefit

obligations ¥(142,123) ¥(138,418) $(1,323,429)

b. Plan assets 76,808 72,427 715,225

c. Unfunded retirement

benefit obligations

(a+b) (65,315) (65,991) (608,204)

d. Unrecognized

transition amounts —521 —

e. Unrecognized

actuarial differences 14,638 14,425 136,307

f. Unrecognized

prior service costs (10,345) (11,808) (96,331)

g. Net amount on

consolidated

balance sheets

(c+d+e+f) (61,022) (62,853) (568,228)

h. Prepaid pension

costs 2,021 2,061 18,819

i. Accrued retirement

benefits (g-h) ¥(63,044) ¥(64,915) $(587,057)

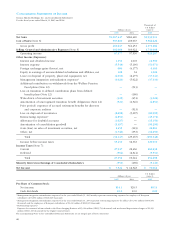

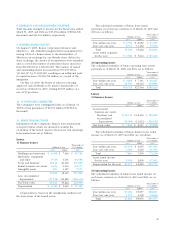

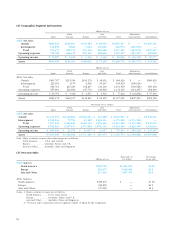

Notes: 1. The Company and certain consolidated subsidiaries made

amendments to their welfare pension fund plans and tax-

qualified pension plans in order to reduce their benefit

payments. In addition, as described above, they changed

some of the pension plans and transferred certain funds

between the plans. As a result of these transactions, prior

service costs were generated.

2. Certain subsidiaries use a simplified method for the

calculation of benefit obligation.

3. The transition from a portion of the Minolta lump-sum

payment plan to a defined contribution pension plan

resulted in the following changes for the year ended

March 31, 2005:

Thousands of

Millons of yen U.S. dallars

Decrease of the retirement

benefit obligations ¥1,667 $15,523

Unrecognized actuarial

differences 243 2,263

Unrecognized prior service

costs (250) (2,328)

Decrease of accrued

retirement benefits ¥1,660 $15,458

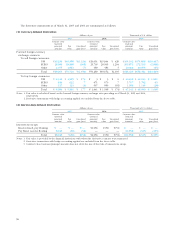

The assets to be transferred to the defined contribution

pension plan equal ¥1,500 million and will be transferred

over 4 years. The amount of ¥1,161 million is recorded as

other long-term liabilities at March 31, 2005.

4. The transition from a portion of the Konica lump-sum

payment plan to a defined contribution pension plan

resulted in the following changes for the year ended

March 31, 2004:

Millons of yen

Decrease of the retirement

benefit obligations ¥4,721

Unrecognized actuarial

differences (769)

Unrecognized prior service

costs 658

Decrease of accrued

retirement benefits ¥4,610

The assets to be transferred to the defined contribution

pension plan equal ¥4,790 million and will be transferred

over 4 years. The amount of ¥4,790 million is recorded as

accrued expenses and other long-term liabilities at March

31, 2004.