Konica Minolta 2005 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2005 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PROFILE

On August 2003, Konica Corporation and Minolta Co., Ltd. integrated their respective managements and

established a new holding company, Konica Minolta Holdings, Inc. The new company represents an

organic union of the revolutionary technologies long accumulated by the two companies, centering on a

comprehensive imaging business—from input to output. Moreover, the new Group is pursuing a

portfolio-oriented management strategy based on five business domains—business technologies, optics,

photo imaging, medical and graphic imaging and sensing. The Konica Minolta Group has annual sales of

over one trillion yen, conducts its business operations in approximately 40 nations worldwide and has

approximately 33,000 employees. Based on an underlying management principle of “New Value Creation”

and driven by its corporate message of “The essentials of imaging”, Konica Minolta aims to provide

inspired creativity in the field of imaging in becoming an innovative, technologically sophisticated,

reliable and market leading global company that is able to enhance corporate value and respond to the

expectations of its stakeholders through corporate creativity.

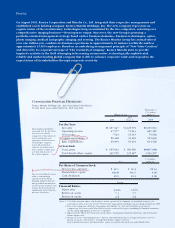

CONSOLIDATED FINANCIAL HIGHLIGHTS

Konica Minolta Holdings, Inc. and Consolidated Subsidiaries

For the fiscal years ended March 31, 2005 and 2004

For the Year:

Net sales

Operating income

Net income

Capital expenditure

R&D expenditures

At Year-End:

Total assets

Total shareholders’ equity

¥1,123,591

73,213

19,343

43,128

63,194

¥ 969,589

335,427

2005

2004

(Note 2)

Millions of yen

Thousands of

U.S. dollars

(Note 1)

2005

Per Share of Common Stock:

Net income—primary

Shareholders’ equity

Cash dividends

¥ 36.4

631.5

10.0

Yen

U.S. dollars

(Note 1)

Financial Ratios:

Equity ratio

Return on assets

Return on equity

34.6%

7.7

5.8

Percent

Notes: 1. U.S. dollar amounts above and elsewhere in this report for the Company are translated from yen, for

convenience only, at the rate of ¥107.39=US$1, the approximate exchange rate prevailing at March 31, 2005.

2. Due to the integration of Konica Corporation and Minolta Co., Ltd. and to facilitate year-on-year

comparisons, fiscal year ended March 2004 business results in this report, excluding the financial statements,

are the simple aggregation of prior two companies.

3. Figures for the March 2003 fiscal year in this report, excluding the financial statements, represent former

Konica figures only.

4. Return on assets = (Operating income + Interest and dividend income) ÷ Average total assets × 100 (%).

Return on equity = Net income ÷ Average shareholders’ equity × 100 (%)

End of period total assets and shareholders’ equity are used for the fiscal year ended March 2004.

Total capital expenditure

increased 31% for the fiscal

year and was mainly

composed of investment in

metal molding for new

equipment in the Business

Technologies segment,

increased production

capacity for polymerized

toner, and for a third LCD-

use TAC film factory in

the Optics segment.

Due to extraordinary losses

such as restructuring

expenses for the Photo

Imaging segment and one-

time goodwill amortization

for the camera business, net

income for the period was

significantly lower than the

previous fiscal year.

¥1,067,447

67,577

7,524

56,448

65,994

¥ 955,542

339,729

$9,939,911

629,267

70,062

525,636

614,526

$8,897,868

3,163,507

¥ 14.1

639.8

10.0

$0.13

5.96

0.09

35.6%

7.2

2.2