Konica Minolta 2005 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2005 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

previous fiscal year-end to ¥246.3 billion. Short-term debt declined by ¥25.3 billion.

On the other hand, long-term borrowings and outstanding corporate bonds,

including debt due for repayment within one year, increased by ¥3.7 billion. This

reflected a focus on raising the proportion of long-term debt to improve the balance

of long-term and short-term debt. Within shareholders’ equity, foreign currency

translation adjustments improved by ¥2.4 billion for the fiscal year owing to a

weakening in the yen’s exchange rate towards the end of the period. As a result of

the above, shareholders’ equity improved ¥4.3 billion from the end of the previous

fiscal year, and shareholders’ equity ratio improved one percentage point to 35.6%.

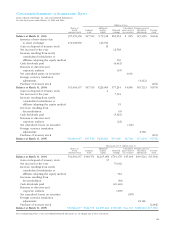

Capital Expenditure, Depreciation and Amortization

Capital expenditure increased by ¥56.4 billion and was centered on increased

production capacity. Capital expenditure for the Business Technologies segment was

¥24.3 billion and used to expand polymerized toner production lines and for metal

molding or new products. Capital expenditure for the Optics segment was used to

construct a third LCD-use TAC film plant, and to increase production capacity for

microcamera units used in mobile phones with built-in cameras, and glass hard disk

substrates. Capital expenditure in the Photo Imaging segment was ¥7.4 billion and

mainly used for investments to maintain the business. In addition, ¥3.7 billion and

¥0.2 billion was spent on capital expenditure for the Medical and Graphic Imaging

and Sensing segments, respectively.

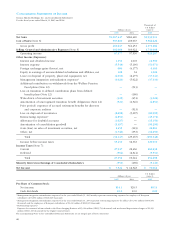

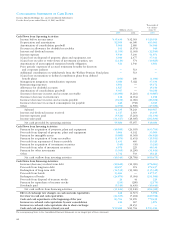

Cash Flows

Net cash provided by operating activities was ¥55.7 billion for the fiscal year, and

mainly reflected an increase in operating capital of ¥23.2 billion, centering on an

increase in notes and accounts receivable (¥14.1 billion), and a decrease in notes and

accounts payable (¥9.2 billion).

Net cash used in investing activities was ¥49.3 billion. This outflow was mainly due

to acquisitions of property, plant and equipment, as well as intangible assets.

Property, plant and equipment acquisitions are outlined in the capital expenditures

section, and were ¥46.6 billion, largely consisting of the acquisition of computer

system software. On the other hand, liquidations of marketable securities resulted in

a ¥5.0 billion cash inflow.

Net cash from financing activities were ¥31.6 billion, and were mainly the result of

¥24.9 billion for the redemption of corporate bonds, as well as efforts to reduce

interest-bearing debt.

Future Financial Strategies

Interest-bearing debt was reduced by ¥21.6 billion during the fiscal year, and the

debt/equity ratio improved from 0.80 times to 0.73 times. The targets under the V-5

Plan, the Group’s medium-term business plan, are to further reduce interest-bearing

debt to ¥145.0 billion by the fiscal year ending March 31, 2009 and to improve the

debt/equity ratio to 0.25 times.

In the interest of enhancing the Company’s credit rating, Konica Minolta will

continue working to improve earnings and shrink operating capital to create cash

flow and to reduce interest-bearing debt.

20042003 2005

Cash Flows

(¥ billions)

-60

120

0

60

Cash flows from

operating activities

Cash flows from

investing activities

Cash flows from

Financing activities

20042003 2005

Capital Expenditures

(¥ billions)

0

60

45

30

15