Konica Minolta 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

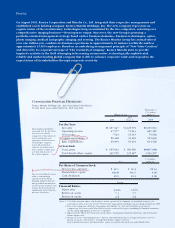

9

Monochrome LBP

Color LBP

0

2,500

2,000

1,500

1,000

500

20042003 2005 2009

(Plan)

Color LBP /

Monochrome LBP

Unit Sales

(Thousands units)

recombination of sales companies forced us to revise the V-5 Plan for the fiscal year

ending March 2006. In order to make up for this delay, the Group plans to upgrade

its product lineup by successively introducing new color products beginning with the

bizhub C450 in parallel with the introduction of new monochrome MFP products

incorporating the new integrated firmware.

Under the V-5 Plan, the Group intends to introduce 15 new color MFP models in

order to achieve color MFP sales in the segment 2 and above category of 450,000

units and to gain a worldwide market share of over 20% in the final year of

the V-5 Plan.

THE CHANGING MARKETPLACE AND KONICA MINOLTA’S RESPONSE

Driven by the shift to color office documents in Japan, the United States, Europe and

other developed country markets, the color MFP market is rapidly expanding, with

unit shipments forecast to rapidly rise from approximately 500,000 units in fiscal 2004

to 2 million units in fiscal 2008. On the other hand, as the color LBP market is

growing on dramatic declines in unit prices and faster-than-expected changes in the

market environment, unit volumes are foreseen rising from 1.9 million units in fiscal

2004 to 3.2 million units in fiscal 2008.

Given these market conditions, the Group has created its V-5 Plan with the aim of

proactively responding to changes in market conditions by pursuing further selection

and concentration and adopting a strategy that focuses the Group’s resources on the

development and sales of color products, in order to significantly raise the ratio of

color products to the overall product mix. The Group believes it is necessary to focus

on its strengths and resolutely pursue an effective genre-top strategy in order to

maintain superior competitiveness.

STRENGTHENING GLOBAL COMPETITIVENESS

The shift to color in global MFP markets is proceeding at a very rapid pace, with

particularly rapid demand growth being seen in the European and U.S. markets.

Konica Minolta’s market position in the European and U.S. markets is steadily

growing, and while market share in Europe slipped slightly in fiscal 2004, market

share in the U.S. improved from 14% to 16%. Under the V-5 Plan, the Group aims to

achieve market shares in the color market as defined by segment 2 or above products

of 25% in Europe and 20% in the United States by the end of fiscal 2008.

In addition to the high market shares the Group is maintaining in Europe, market

share is recovering in Japan where the Group had previously been struggling, thanks

to the introduction of the strategic bizhub C450.

In the LBP market, as competition has intensified further in mainly the low-speed

color LBP market segment in Europe and the U.S., the Group aims to strengthen its

product lineup in the high speed product segment.

In terms of marketing, the key is manufacturer direct selling power. Here, the