Konica Minolta 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

REVIEW OF FISCAL 2004

In fiscal 2004, ended March 2005, the photo materials market saw significant

shrinkage in demand in its main color film segment owing to the diffusion of digital

cameras. The Group was able to limit the decline in sales volumes by strategically

strengthening sales to developing markets in Asia including China, India and Africa,

where the impact of digital camera diffusion has been less noticeable. In addition, as

demand for over-the-counter digital print services is expanding, good growth was

seen in unit sales of digital minilabs in Europe and Asia. On the other hand, the

photographic paper segment remained weak due to inventory corrections. In inkjet

media, sales volume growth was seen mainly in the Japanese market even though

price competition is intensifying.

In the camera business, the DYNAX 7D* high end digital single lens reflex camera

recorded sales growth on strong support from users, while unit prices as a whole

continued to decline centering on compact digital cameras. The DYNAX 7D* features

a proprietary anti-shake technology in the camera’s body and lens interchangability

with all DYNAX/Maxxum/αseries lenses. In terms of profitability, restructuring

contributed to reductions in fixed costs. These efforts could not however offset the

significant impact on overall profitability from a rapid deterioration in the film market

and unit price declines in digital cameras.

As a result, consolidated sales for the Photo Imaging business in fiscal year ended

March 2005 were ¥268.5 billion, while the operating loss was ¥8.7 billion.

* The DYNAX 7D is marketed as Maxxum 7D in North America and α-7 DIGITAL in Japan and China.

Photo Imaging

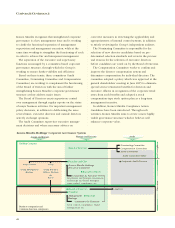

Sales Trend

(Billions of Yen)

0

90

180

270

360

20042003 2005 2009

(Plan)

Trend of Photo

Imaging Operating

Income (Loss)

(Billions of Yen)

–10

0

10

20

20042003 2005 2009

(Plan)

Photo Imaging

Net Sales ¥268.5 ¥160.0

Operating Income/Loss –8.7 2.0

Business Targets (Billions of Yen)

March 2009

(Projected)

March 2005

(Actual)

Photo Imaging Key Strategies

1. Scale back business size

1) Scale back film and photo paper businesses

2) Camera business:

✓ Scale back business size

✓ Concentrate on high-value-added products

✓ Break away from chronic deficits

2. Speedy restructuring

1) An extraordinary loss of 34 billion yen

in total for 4 years

(Fiscal years ended March2006–

March 2009)

2) Continue to execute restructuring

programs

Tsuyoshi Miyachi

President, Konica Minolta Photo Imaging, Inc.