Konica Minolta 2005 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2005 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

20

REVIEW OF FISCAL 2004

In fiscal 2004, ended March 2005, the main optical pickup lens business saw

declining sales volumes on extended inventory adjustment for DVD players and other

consumer electronic equipment. In addition, the lens unit business also recorded

lower sales volumes on weaker demand for lens units used in digital cameras and

video cameras, owing to inventory adjustments in these final products.

On the other hand, overall TAC film sales for LCDs were strong, mainly supported

by continued diffusion of LCD panels for televisions. In particular, profit margins also

improved supported by an expanding proportion of high value-added LCD-use

TAC film.

In addition, the Group actively promoted sales of products with highly functional

features in the domestic market based on Konica Minolta’s proprietary technology in

micro lens units and microcamera modules for camera-equipped mobile phones,

including mega pixel class high image quality auto-focus and optical zoom lenses.

Moreover, in glass substrates for hard disk drives, new 1.8-inch products for hand-

held audio players were added to the lineup of existing 2.5-inch products, which

supported strong sales of small diameter products for mobile equipment applications.

As a result, consolidated fiscal year ended March 2005 sales for the Optics Business

were ¥91.7 billion, while operating income was ¥16.0 billion.

ANALYSIS OF OPTICS RELATED MARKETS IN FISCAL 2004

In optical pickup lenses, the competition to develop DVD standards is nearly over,

and the segment now faces a new age of price competition. Since diffusion ratios in

Japan for DVD players have exceeded 70%, unit prices are beginning to soften. On

Optics

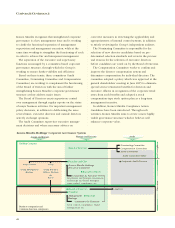

Sales Trend

(Billions of Yen)

0

50

100

150

200

20042003 2005 2009

(Plan)

Trend of Optics

Operating Income

(Billions of Yen)

0

12

24

36

20042003 2005 2009

(Plan)

Optics

Net Sales ¥91.7 ¥170.0

Operating Income 16.0 31.0

Business Targets (Billions of Yen)

March 2009

(Projected)

March 2005

(Actual)

Optics Key Strategies

1. Optical pickup lens:

Ensure top market share in next generation DVDs with

industry-leading technologies.

2. Film for LCD:

Expand production capacity and business scale in response

to market growth.

3. Microcamera/micro lens units for mobile phones:

Capture major accounts and develop new business

opportunities.

4. DSC/VCR lens units:

Develop new customers

5. Glass substrates for hard disks:

Expand business focusing on small-diameter models.

Takashi Matsumaru

President, Konica Minolta Opto, Inc.