Konica Minolta 2005 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2005 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

REVIEW OF FISCAL 2004

In fiscal 2004, ended March 2005, the emphasis in the MFP business was on

expanding sales of high value-added products such as color models and high-speed

monochrome models, where the Group worked to maintain and expand market

share. In the MFP segment where the shift to color is evolving rapidly in developed

markets, the Group’s strategic bizhub C350 model made a significant contribution.

Marketed from March 2004, the bizhub C350, which features industry leading

polymerized toner based high picture quality, high reliability and high operability,

was well received by customers. This supported strong sales growth in the color

segment, particularly in Europe and the U.S.

On the other hand, the Group was able to generate favorable sales growth in the

high-speed segment with the bizhub PRO 1050, which features an output speed of

105 pages per minute, and by strengthening its presence in the print-on-demand

market where expected growth is higher, despite intensified competition in the

medium-to-high-speed monochrome MFP segment.

In the LBP market, the Group introduced the magicolor 2400 series in the low-

speed segment amid intensifying competition for low-speed color models in the

European and U.S. markets and the magicolor 5430DL in the high-speed segment as it

worked to strengthen its color model product lineup. In addition, efforts were made

to expand sales under the Group’s own brand in the Japanese market by signing

agreements with mass retailers to carry Konica Minolta brand products.

However, profit margins deteriorated given a more-rapid-than expected shift to

color in the business technologies market, and in particular there were unit price

declines in the color LBP market.

Business Technologies

Sales Trend

(Billions of Yen)

0

200

400

600

800

1,000

20042003 2005 2009

(Plan)

Trend of

Business Technologies

Operating Income

(Billions of Yen)

0

30

60

90

120

20042003 2005 2009

(Plan)

Business Technologies

Business Technologies Key Strategies

1. Increase color MFP ratio

1) Strengthen R&D to expand product lineup with new models

2) Reinforce direct sales force in Japan, U.S., and Europe

2. Strengthen cost competitiveness

1) New plant for polymerized toner (Fall 2005):

Industry-leading production capacity with 8,000 tons/year

2) New plant in Wuxi, China (Dec. 2005):

Production capacity increase and procurement

reinforcement in China

3. Boost own-brand color LBP business

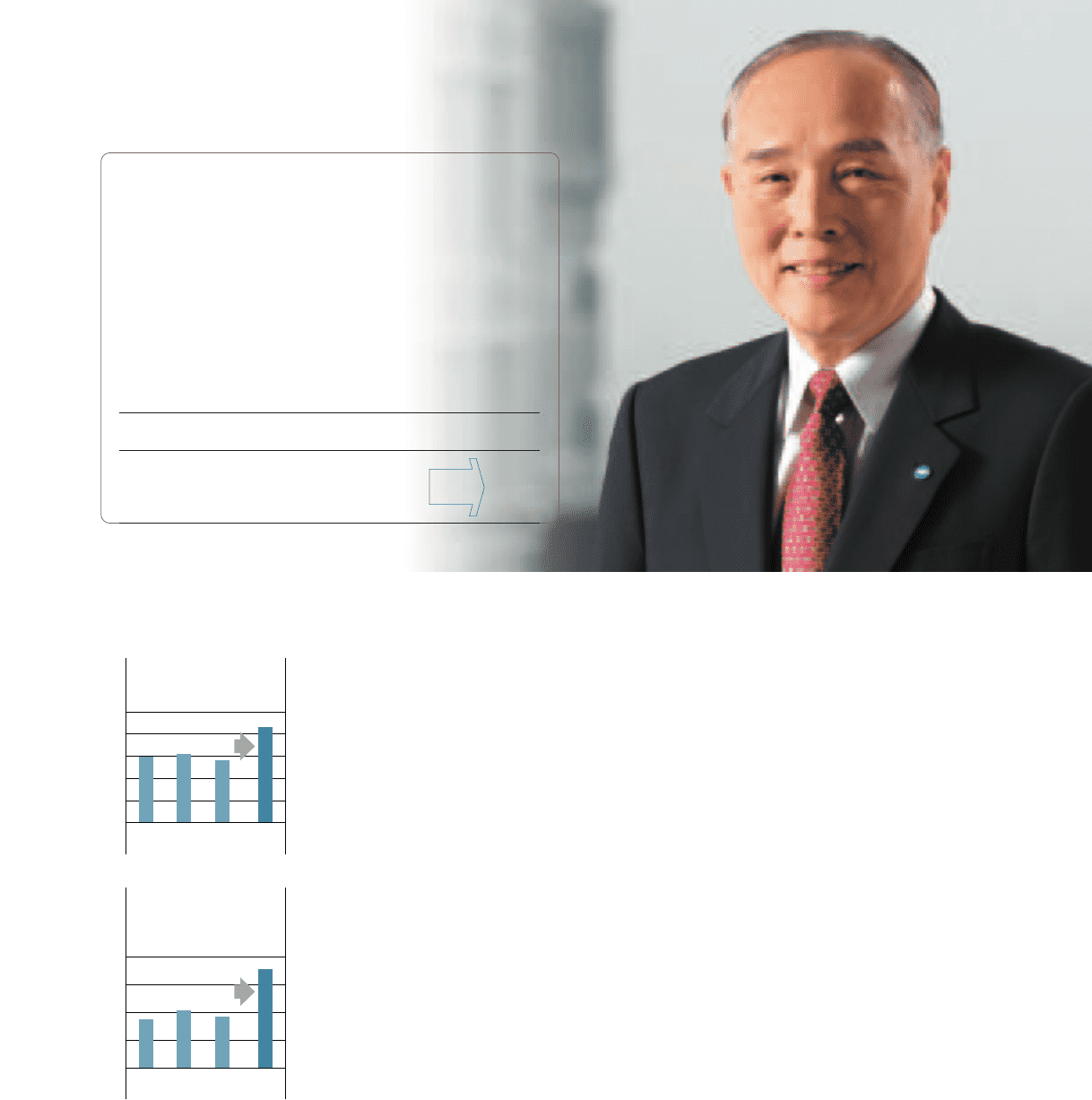

Net Sales ¥564.8 ¥860.0

Operating Income 55.8 107.0

Business Targets (Billions of Yen)

March 2009

(Projected)

March 2005

(Actual)

Yoshikatsu Ota

President, Konica Minolta Business Technologies, Inc.