Konica Minolta 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

18

As a result, Business Technologies sales for fiscal year ended March 2005 were

¥564.8 billion, while operating income was ¥55.8 billion.

THE GENRE-TOP STRATEGY

In order to grow sales in the rapidly expanding color MFP market, the Group is

targeting specific product models and segments as part of its genre-top strategy in

MFP. As Konica Minolta is particularly competitive in the segment 2 and higher

tandem engine-based market segments, it has established leading market shares in

this genre in the European and U.S. markets and is also working to increase market

share in other segments. The current driver of the Group’s genre-top strategy is the

bizhub C450, which was marketed in the spring of 2005. Featuring bizhub open API

platform firmware and compatibility with various office network environments, it is

Konica Minolta’s strategic color MFP product. As sales in Japan have been recording

strong growth since it was first marketed, the Group believes this strategic product

will make a significant contribution to performance in fiscal 2005 on full-fledged

overseas sales.

Under the V-5 Plan, the Group is aiming for a market share in excess of 20% and

sales of 450,000 units in segment 2 or above color MFPs by the end of fiscal 2008.

POLYMERIZED TONER PRODUCTION CAPACITY AND STRATEGY

Polymerized toner demand is expanding along with progress in the shift to color.

Consequently, the Group aims to raise the production ratio of polymerized toner to

over 80% by fiscal 2008. Polymerized toner has superior image quality, cost and dura-

bility characteristics, and in addition is an environmentally-conscious toner for the next

generation, where carbon dioxide (Co2), nitrogen oxide (NOx), and sulfur oxide (SOx)

emissions are reduced 40% in the production process compared to conventional toner.

Additional polymerized toner production capacity scheduled to be completed in the

fall of 2005 in Yamanashi, Japan, and a new plant scheduled to be built in Nagano,

Japan in 2006 are expected to result in total annual production capacity of 15,000

tons, making Konica Minolta the largest producer of polymerized toner in the world.

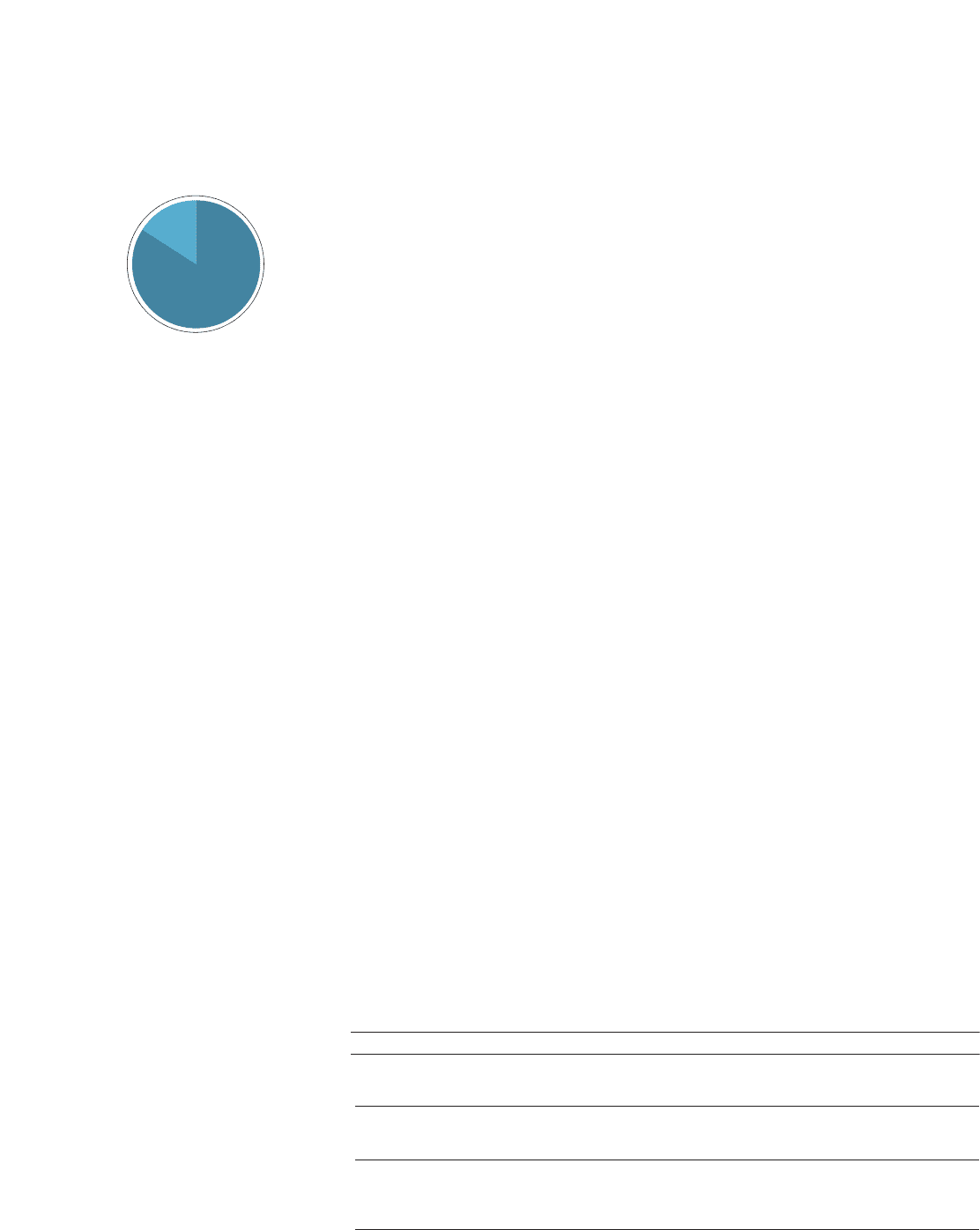

Share of Sales by Product

(Fiscal year ended March 2005)

MFP

¥475.0

Billion

LBP

¥89.8

Billion

Business Technologies

Location

Annual Production

Capacity

Completed

Yamanashi, Japan

May 2003

(To be expanded in

November 2005)

~6,000 Tons

Factory No. 2

Nagano, Japan

September 2006

~7,000 Tons

Factory No. 3

Yamanashi, Japan

December 2000

~2,000 Tons

Factory No. 1

Polymerized Toner Production Capacity