Kia 2010 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2010 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

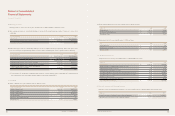

Notes to Consolidated

Financial Statements

December 31, 2010 and 2009

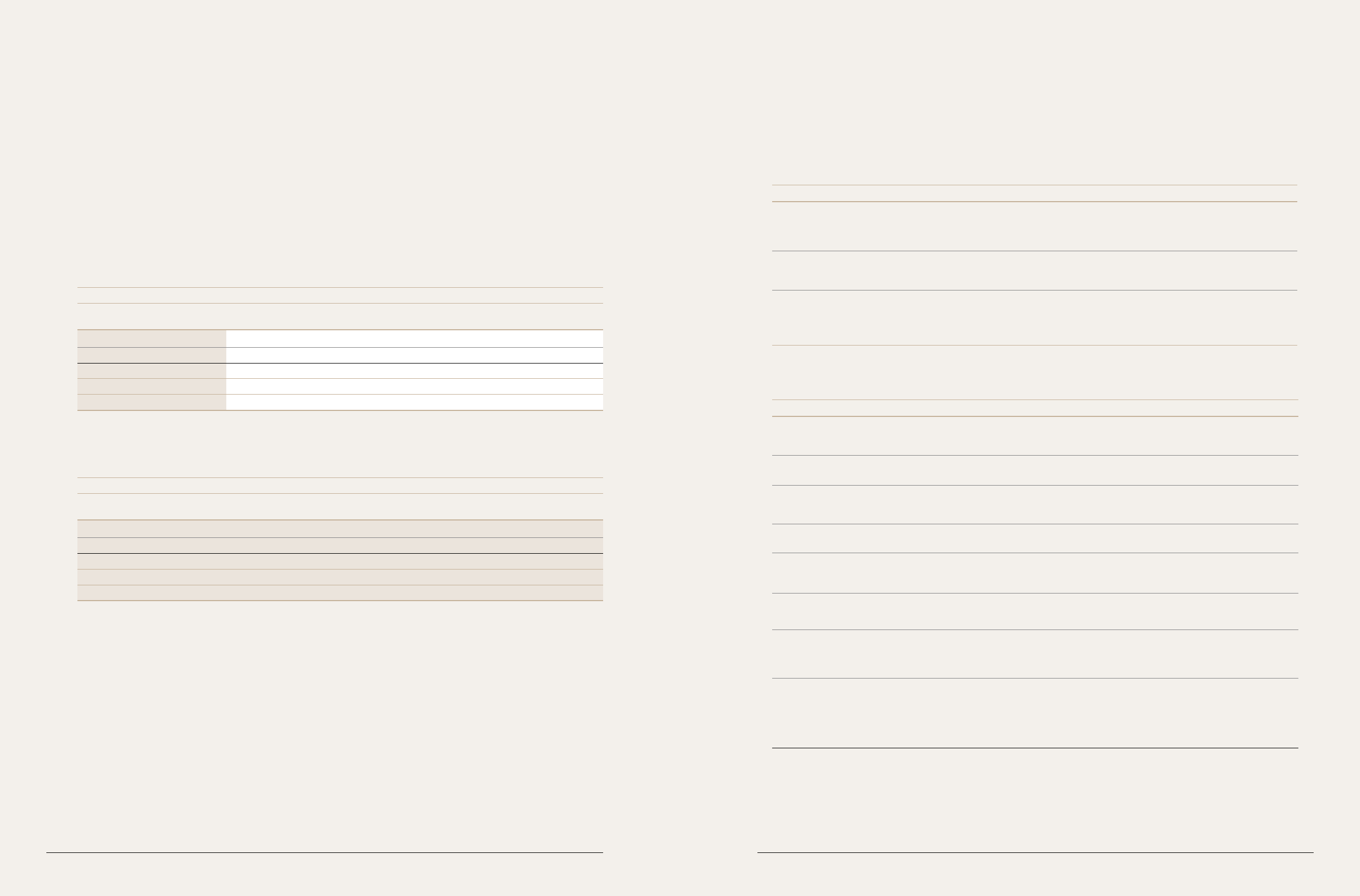

2010

North Consolidation Consolidated

In millions of won Domestic America Europe Others adjustments amounts

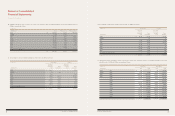

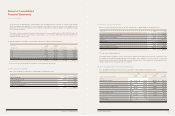

Gross sales ₩ 23,316,488 12,939,454 14,228,949 5,405,965 (13,600,516) 42,290,340

Inter-company sales (7,093,705) (2,687,327) (3,819,484) - 13,600,516 -

Net sales ₩ 16,222,783 10,252,127 10,409,465 5,405,965 - 42,290,340

Operating income ₩ 1,686,646 159,561 94,727 431,351 463,825 2,836,110

Total assets ₩ 19,116,875 4,183,877 6,852,844 2,692,586 (5,253,023) 27,593,159

34. Geographic Segment Information

The Company conducts business globally and is managed geographically. The following tables provide information on each geographic

segment for the years ended December 31, 2010 and 2009:

(a) Results of operations and total assets, by region where the Parent Company and its subsidiaries for the year ended and as of December 31,

2010 are located, are as follows:

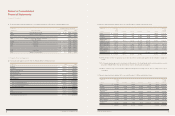

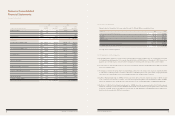

(b) Results of operations and total assets, by region where the Parent Company and its subsidiaries for the year ended and as of December 31,

2009 are located, are as follows:

2009

North Consolidation Consolidated

In millions of won Domestic America Europe Others adjustments amounts

Gross sales ₩ 18,464,713 7,130,940 11,689,539 4,046,724 (12,074,524) 29,257,392

Inter-company sales (6,876,314) (1,133) (5,197,077) - 12,074,524 -

Net sales ₩ 11,588,399 7,129,807 6,492,462 4,046,724 - 29,257,392

Operating income ₩ 1,147,331 (81,590) (681,513) 153,263 657,715 1,195,206

Total assets ₩ 17,247,011 4,303,613 6,704,765 2,221,537 (4,514,050) 25,962,876

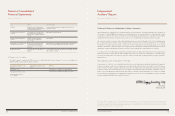

35. Subsequent Event

The Company which is a part of Hyundai Motor Group Consortium, signed a stock acceptance contract to acquire shares of Hyundai

Engineering & Construction Co., Ltd. with the shareholder council of Hyundai Engineering & Construction Co., Ltd. on March 4, 2011. As

a result of the stock acceptance contract the Company will acquire 5,831,850 shares (5.23% of total stock) of Hyundai Engineering &

Construction Co., Ltd. paying ₩744,010 million within one month after the contract.

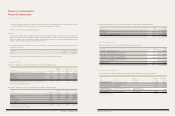

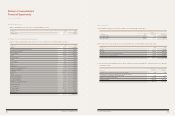

36. Planning and Adoption of K-IFRS

(a) K-IFRS Adoption Plan and current status of progress

The Parent Company subsequently plans to issue financial statements prepared in accordance with K-IFRS from 2011. In August of 2008, the

Parent Company organized a Task Force Team to perform preliminary analysis of the effects of K-IFRS adoption and establish accounting systems

to apply the new accounting treatments, and trained its relevant personnel internally and externally. The Task Force Team regularly reports the

details and status of the Adoption Plan to its board of directors and management. The details of the K-IFRS Adoption Plan are as follows:

Main Activities Preparation Plan State at December 31, 2010

Formation of the K-IFRS Adoption

Task Force Team and analysis

of the likely effects of K-IFRS

adoption

Training

Alignment of accounting

systems

Complete the K-IFRS Adoption Plan

by the end of 2010

Acquire the skills required for K-IFRS

conversion by the end of Nov. 2010

Complete the establishment of

accounting systems to apply the

new accounting treatments under

K-IFRS by the end of Dec. 2010

Aug. 2008 – Established the K-IFRS Adoption Task Force Team

Aug. 2008 - Engaged an accounting firm to carry out an analysis

of the likely effects of K-IFRS adoption

Aug. 2009 – Held training for headquarters staff

Sep. 2010 – Held training for foreign subsidiaries staff

Completed the analysis of the scope of required changes to the

system

The establishment of accounting systems under K-IFRS

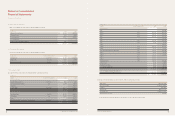

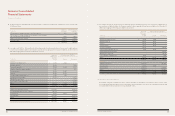

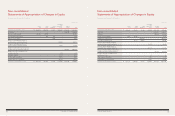

(b) Differences between accounting under K-IFRS and under K-GAAP

Area K-IFRS Current (K-GAAP)

Financial asset

Employee benefits

The Company records the discount of account receivables

when substantially all risks and rewards are transferred

Under the Projected Unit Credit Method, the Company recognizes

a defined benefit obligation calculated using an actuarial technique

and a discount rate based on the present value of the projected

benefit obligation

The Company records

the discount of account

receivables when control is

transferred

The Company establishes

an allowance for severance

liability equal to the amount

which would be payable if

all employees left at the end

of the reporting period

First-time

adoption of

K-IFRS

Investments in subsidiaries, joint

ventures and associates under

separate financial statements

Changes in scope of consolidation

Business

combinations

Cumulative translation

differences

Investments in

subsidiaries

Borrowing costs

K-IFRS 1103 (Business Combinations) will not be applied

retroactively to business combinations occurring prior to January 1,

2010 (the date of transition to K-IFRS)

The cumulative translation difference of foreign operations as of January

1, 2010 (the date of transition to K-IFRS) will be regarded as nil

Carrying amount of investments in subsidiaries, joint venture and

associates under previous GAAP for separate financial statements

are recorded at cost on the date of transition to K-IFRS

Interest expenses are capitalized after January 1, 2010 (the date of

transition to K-IFRS)

Apply cost method

Regardless of amount of total assets, a subsidiary over which a

parent company has control is consolidated

Not applicable

Not applicable

Not applicable

All interest is presented as

expense

Apply equity method

A subsidiaries whose total

assets are less ₩10 billion is

excluded from consolidation

108 COMPONENTS OF SUSTAINABLE GROWTH 109

KIA MOTORS ANNUAL REPORT 2010