Kia 2010 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2010 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

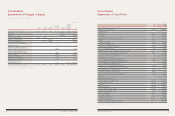

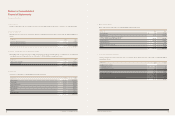

Consolidated

Statements of Changes in Equity

In millions of won

For the years ended December 31, 2010 and 2009

Minority

Accumulated interest in

other equity of

Capital Capital Capital comprehensive Retained consolidated

stock surplus adjustments income earnings subsidiaries Total

BALANCE AT JANUARY 1, 2010 ₩ 2,054,355 1,659,216 (2,249) 1,161,128 1,873,878 557,766 7,304,094

Net income - - - - 2,640,659 201,540 2,842,199

Dividends - - - - (96,999) - (96,999)

Exercise of stock warrants 47,417 10,362 - - - - 57,779

Acquisition of treasury stock - - (162,321) - - - (162,321)

Proceeds from treasury stock - 36,244 150,055 - - - 186,299

Change in fair value of available-for-sale

securities, net of tax - - - 27 - - 27

Change in capital adjustments-gain of

equity method accounted investments - - - 80,898 - - 80,898

Change in capital adjustments-loss of

equity method accounted investments - - - 5,462 - - 5,462

Revaluation surplus - - - (10,861) - - (10,861)

Valuation gains in derivatives - - - 1,758 - - 1,758

Valuation gains in non-derivatives - - - 52,465 - - 52,465

Foreign operation currency

translation differences, net - - - (37,114) - (18,488) (55,602)

BALANCE AT DECEMBER 31, 2010 ₩ 2,101,772 1,705,822 (14,515) 1,253,763 4,417,538 740,818 10,205,198

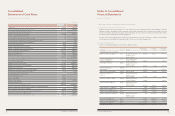

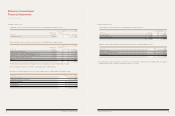

In millions of won

2010 2009

CASH FLOWS FROM OPERATING ACTIVITIES

Net income of controlling interest ₩ 2,842,199 1,020,632

Adjustments for:

Depreciation 826,893 662,921

Amortization 238,827 270,767

Accrual for retirement and severance benefits 308,130 264,748

Salaries 36,244 -

Provision for warranties 776,245 376,070

Allowance for doubtful accounts 5,911 5,849

Foreign currency translation loss (gain), net (43,739) (10,092)

Loss on scrapped inventories 6,991 9,016

Equity in earnings of equity method accounted investees, net (838,125) (723,542)

Dividend income from equity method accounted investees 69,334 49,361

Loss (gain) on disposition of investments, net 77 (58,290)

Impairment loss on investments 14 689

Loss on sale of property, plant and equipment, net 35,109 22,967

Loss on impairment of property, plant and equipment, net 8,681 28,760

Loss on impairment of intangible assets, net - 34,644

Interest income - reversal of present value discount (2,818) (883)

Interest expense - amortization of discount on debentures 8,712 14,320

Reversal of allowance for doubtful accounts (9,544) -

Loss (gain) on valuation of derivatives, net (6,651) 2,973

Loss on sale of accounts and notes receivable - trade 32,549 87,557

Other, net 50 17,147

Changes in assets and liabilities:

Accounts and notes receivable - trade (1,778,092) (518,906)

Accounts receivable - other (85,465) (142,001)

Inventories 902,381 2,231,945

Other current assets (140,308) 142,975

Accounts and notes payable - trade 1,239,469 284,100

Accounts and notes payable - other 320,818 196,717

Other current liabilities (135,622) 866,072

Income taxes payable 279,024 (25,036)

Deferred income tax assets 363,091 37,634

Payment of warranty costs (431,475) (457,279)

Payment of retirement and severance benefits ₩ (216,713) (330,136)

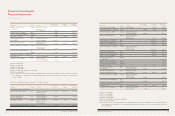

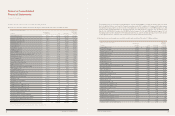

Consolidated

Statements of Cash Flows

For the years ended December 31, 2010 and 2009

See accompanying notes to consolidated financial statements.

See accompanying notes to consolidated financial statements.

56 COMPONENTS OF SUSTAINABLE GROWTH 57

KIA MOTORS ANNUAL REPORT 2010