Kia 2010 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2010 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

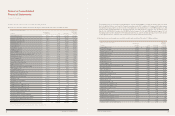

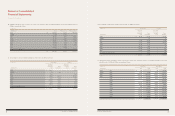

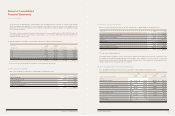

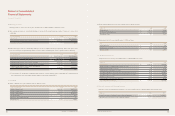

In millions of won 2010 2009

Advances from customers ₩ 511,163 283,665

Unearned income 16,935 32,888

Accrued expenses 607,921 955,088

Accrued dividends 22 15

Current portion of derivatives liabilities 3,981 -

1,140,022 1,271,656

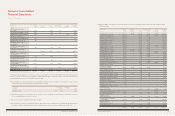

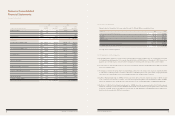

In millions of won Annual interest rate(%) 2010 2009

General loans 2.00~5.31 ₩ 810,768 1,122,968

Usance bills 1.10~2.54 110,888 35,468

Discount on trade bills 1.10~5.90 1,027,083 2,593,774

1,948,739 3,752,210

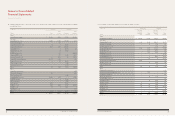

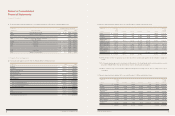

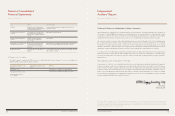

Lender Annual interest rate(%) 2010 2009

LOCAL CURRENCY

Kookmin Bank and others 2.25~3.00 ₩ 6,994 7,998

The Korea Development Bank 3.97 29,166 45,833

Hana Bank - - 370,000

Kookmin Bank 4.28~6.97 490,000 700,000

526,160 1,123,831

FOREIGN CURRENCY

Korea Exim Bank 1.14~3.18 221,516 326,873

SC First Bank 3.09 174,064 64,218

Calyon - - 376,713

Woori Investment & Securities Co., Ltd. and others 0.99~5.00 1,356,173 1,358,677

1,751,753 2,126,481

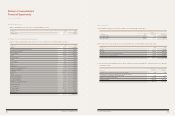

DEBENTURES:

264th - - 502,284

266-2nd 5.19 200,000 200,000

268-2nd 5.01 150,000 150,000

269th 5.33 300,000 300,000

270th - - 190,000

272th 7.00 200,000 200,000

273th 8.90 70,000 70,000

274-1st - - 180,000

274-2nd 8.40 160,000 160,000

274-3rd 8.60 60,000 60,000

275th (Bond with warrant(see (b) below)) 1.00 279,623 280,042

276-1st 5.85 90,000 90,000

276-2nd 6.80 110,000 110,000

277-1st 4.27 100,000 -

277-2nd 4.69 100,000 -

Forign debentures 4.76 341,670 350,280

Less discount (5,170) (8,236)

Redemption premium 40,740 40,801

Stock warrants adjustment (3,950) (15,711)

2,192,913 2,859,460

Less current portion of long-term debt, net of

discount of ₩467 in 2010 and ₩510 in 2009 (1,361,752) (1,851,686)

₩ 3,109,074 4,258,086

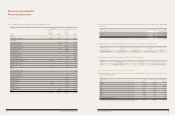

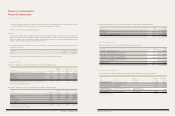

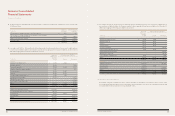

Lender Annual interest rate(%) 2010 2009

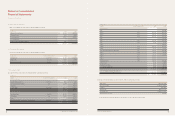

Notes to Consolidated

Financial Statements

December 31, 2010 and 2009

15. Other Current Liabilities

Other current liabilities as of December 31, 2010 and 2009 are as follows:

16. Short-term Borrowings

Short-term borrowings as of December 31, 2010 and 2009 are as follows:

17. Long-term Debt

(a) Long-term debt as of December 31, 2010 and 2009 are summarized as follows:

(b) Details of bonds with warrant as of December 31, 2010 are summarized as follows:

(*) The amount represents principal portion only and does not reflect discount on present value.

In millions of won

Date issued March 19, 2009

Amount of issue(*) ₩ 400,000 million

Issued at Face value

Maturity date March 19, 2012

Convertible until February 19, 2012

Conversion price (in won) ₩ 6,880

In millions of won

94 COMPONENTS OF SUSTAINABLE GROWTH 95

KIA MOTORS ANNUAL REPORT 2010