Kia 2010 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2010 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

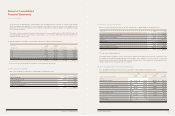

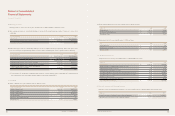

The exercise prices are adjusted by the following conditions, when the additional stocks are issued due to new stock issuing for paid-in

capital, stock dividends, and capitalization of reserves at lower price than market price before the exercise of stock warrants, when the

adjustment of exercise price is necessary due to merger, reduction of capital, split of stock and consolidation of stock, and when the market

price of the stock is decreased.

The number of shares issued upon the exercise of stock warrants for the year ended December 31, 2010 is 9,483,375 shares. The

accumulated number of shares exercised and the remaining shares to be exercised are 50,623,968 shares and 7,510,498 shares,

respectively, as of December 31, 2010.

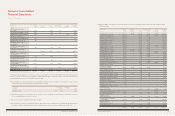

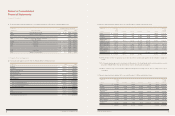

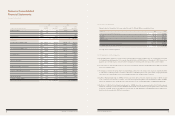

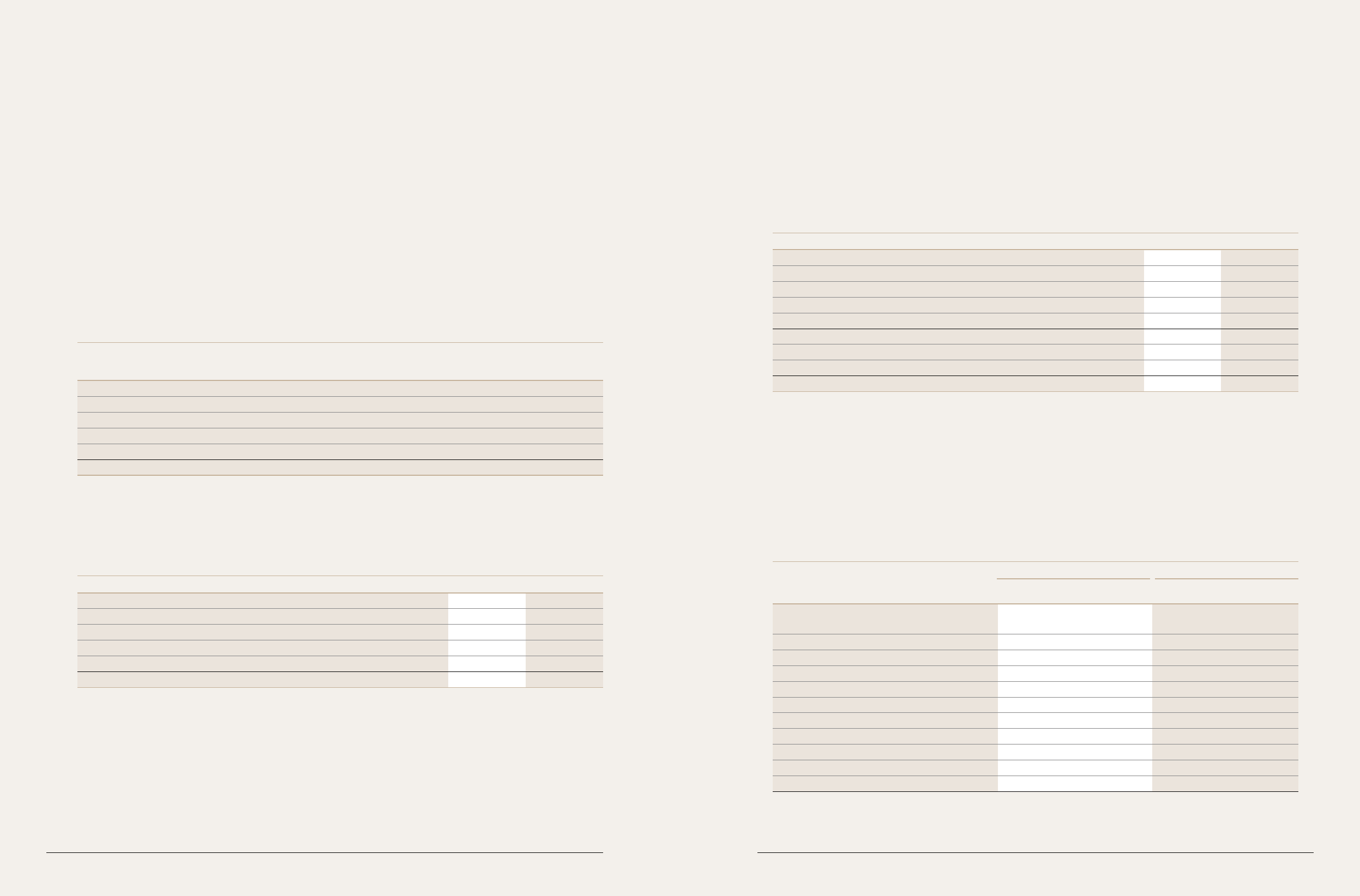

(c) Aggregate maturities of the Company’s long-term debt as of December 31, 2010 are summarized as follows:

(*) The amount represents principal portion only and does not reflect discount on present value.

Notes to Consolidated

Financial Statements

December 31, 2010 and 2009

In millions of won Local Foreign

currency currency

December 31 borrowings(*) borrowings(*) Debentures(*) Total

2011 ₩ 367,420 214,799 780,000 1,362,219

2012 13,247 374,715 1,071,293 1,459,255

2013 140,742 114,741 100,000 355,483

2014 806 165,851 110,000 276,657

2015 and thereafter 3,945 881,647 100,000 985,592

₩ 526,160 1,751,753 2,161,293 4,439,206

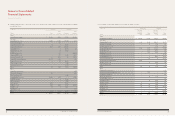

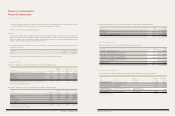

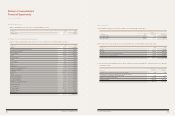

In millions of won 2010 2009

Capital lease liabilities ₩ 1,538 2,229

Leasehold deposits received 320,955 316,842

Derivative instruments - 7,030

Advance deposit for sale of land 92,297 92,547

Long-term non-trade payables 2,050 -

₩ 416,840 418,648

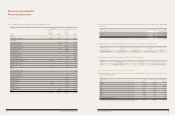

In millions of won 2010 2009

ESTIMATED RETIREMENT AND SEVERANCE BENEFITS AT BEGINNING OF YEAR ₩ 1,081,114 1,145,863

Accrual for retirement and severance benefits 308,130 264,748

Transfer-in from associate companies (2,833) 639

Payments (216,713) (330,136)

Other changes(*) 22 -

ESTIMATED RETIREMENT AND SEVERANCE BENEFITS AT END OF YEAR 1,169,720 1,081,114

Transfer to National Pension Fund (6,063) (7,553)

Deposit for severance benefit insurance (974,728) (744,689)

NET BALANCE AT END OF YEAR ₩ 188,929 328,872

18. Other Non-Current Liabilities

Other non-current liabilities as of December 31, 2010 and 2009 are summarized as follows:

19. Retirement and Severance Benefits

Changes in retirement and severance benefits for the years ended December 31, 2010 and 2009 are summarized as follows:

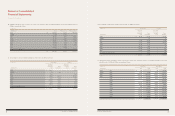

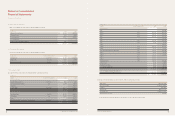

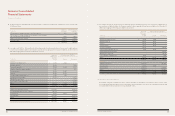

20. Assets and Liabilities Denominated in Foreign Currency

Assets and liabilities denominated in foreign currency as of December 31, 2010 and 2009 are summarized as follows:

(*) Foreign currency translation adjustment

The Company maintains an employees’ severance benefit insurance arrangement with Samsung Life Insurance Co., Ltd. and others. Under

this arrangement, the Company has made a deposit in the amount equal to 83.3% and 68.9% of the reserve balances of retirement and

severance benefits as of December 31, 2010 and 2009, respectively. This deposit is to be used to guarantee the required payments to prior

employees and accounted for as a reduction of the reserve balance.

2010 2009

Foreign Won Foreign Won

In millions of won and in thousands of foreign currency currency equivalent currency equivalent

ASSETS

Cash and cash equivalents USD 275,304 ₩ 313,544 281,695 ₩ 328,907

EUR 111,160 168,252 108,533 181,715

Others - 338,501 - 726,092

Accounts and notes receivable - trade USD 426,651 485,913 395,558 461,854

EUR 830,543 1,257,109 554,942 929,128

Others - 1,330,521 - 723,472

Accounts receivable - other USD 61,793 70,376 29,819 34,817

EUR 126,094 190,856 12,335 20,652

Others - 82,922 - 139,838

Short-term loans EUR 109 165

Other - - - 97

96 COMPONENTS OF SUSTAINABLE GROWTH 97

KIA MOTORS ANNUAL REPORT 2010