Kia 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

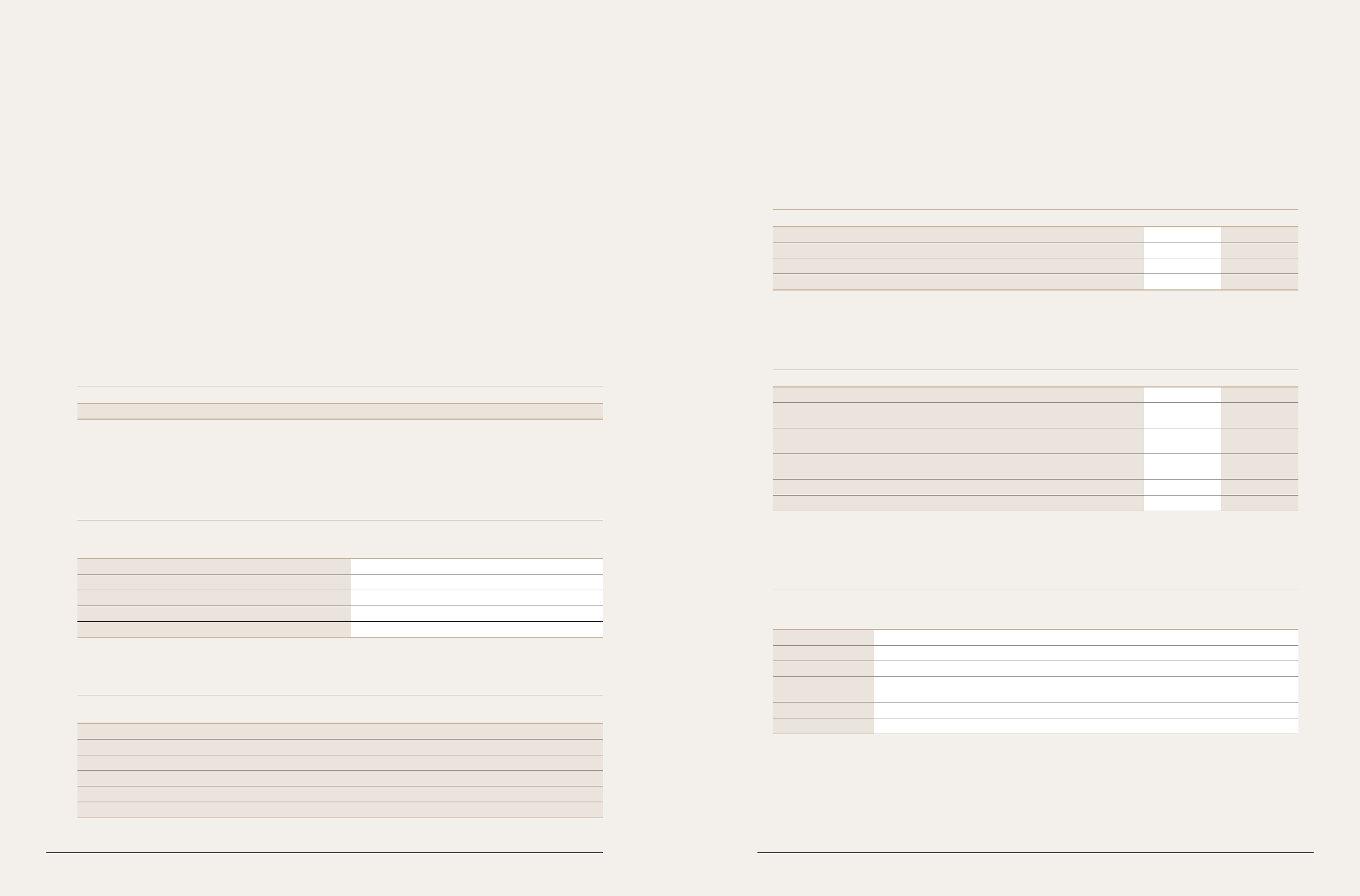

Notes to Consolidated

Financial Statements

December 31, 2010 and 2009

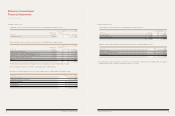

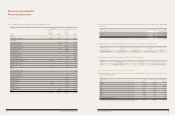

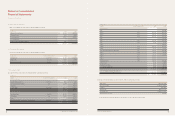

(c) Research and development costs for the years ended December 31, 2010 and 2009 are summarized as follows:

In millions of won 2010 2009

Development costs ₩ 369,720 355,168

Cost of sales 152,067 96,866

Selling, general and administrative expenses 341,568 265,258

863,355 717,292

(e) The officially declared value of land located in Korea as of December 31, 2010, as announced by the Minister of Construction and

Transportation, is as follows:

In millions of won Book value Declared value

Land ₩ 2,790,144 2,144,581

The officially declared value, which is used for government purposes, is not intended to represent fair value.

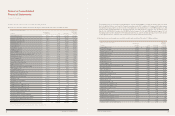

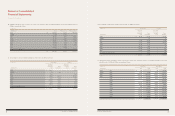

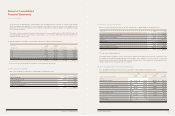

12. Intangible Assets

(a) Changes in intangible assets for the year ended December 31, 2010 are summarized as follows:

(*) Foreign currency translation adjustment

Industrial

property Facility usage Development

In millions of won Goodwill rights rights costs

NET BALANCE AT BEGINNING OF YEAR ₩ 24,375 6,312 25,596 1,067,378

Additions - 22,728 4,378 369,720

Amortization (4,864) (6,205) (10,017) (217,741)

Other changes(*) (2,278) (252) (6,973) (239)

NET BALANCE AT END OF YEAR ₩ 17,233 22,583 12,984 1,219,118

(b) Changes in intangible assets for the year ended December 31, 2009 are summarized as follows:

(*) Foreign currency translation adjustment

Industrial Facility usage Development

In millions of won Goodwill property rights rights costs

NET BALANCE AT BEGINNING OF YEAR ₩ 34,681 6,573 25,906 963,547

Additions 29,718 1,233 14,209 355,168

Amortization (5,366) (1,494) (12,570) (251,337)

Loss on impairment (34,644)

Other changes(*) (14) - (1,949) -

NET BALANCE AT END OF YEAR 24,375 6,312 25,596 1,067,378

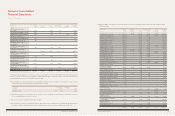

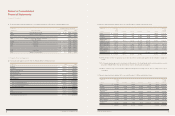

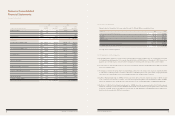

13. Other Non-Current Assets

Other non-current assets as of December 31, 2010 and 2009 are summarized as follows:

14. Pledged Assets and Guarantees

The following assets are pledged as collateral for the Company’s long-term debt and others as of December 31, 2010:

In millions of won 2010 2009

Long-term financial instruments (note 3) ₩ 20,251 20,552

Long-term accounts receivable - trade, less discount on

present value of ₩1,104 in 2010 and ₩2,071 in 2009 7,597 11,647

Long-term accounts receivable - other, less allowance

for doubtful accounts of ₩319 in 2010 and ₩936 in 2009 22,048 10,722

Long-term loans, less allowance for doubtful accounts of

₩4,695 in 2010 and ₩4,983 in 2009 - 323

Guarantee deposits 212,320 193,689

₩ 262,216 236,933

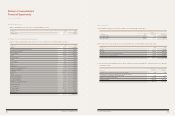

In millions of won

Type of Borrowing Collateralized

Asset Lender borrowings amount amount

Land and buildings, etc. The Korea Development Bank General loan ₩ 29,369 432,001

Kookmin Bank and others 3,957 6,017

Kookmin Bank 490,000 910,000

Long-term securities Korea Defense Industry Association Guarantee deposit for

performance of contact - 526

Land and buildings Bank of China and others Long-term debt 162,293 170,835

₩ 685,619 1,519,379

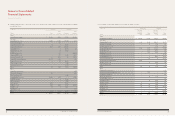

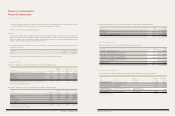

(*1) The Company signed an agreement for investments with Government of the Slovak Republic and the related consideration received

amounted to ₩360,878 million which was presented as a reduction of property, plant and equipment.

(*2) “Other” includes foreign currency translation adjustment.

(d) Insurance

As of December 31, 2010, inventories, buildings, structures, machinery and equipment and dies, molds and tools are insured against fire

damage up to ₩7,134,277 million. In addition, the Company carries general insurance for vehicles, workers’ compensation and casualty

insurance for employees. Also, as of December 31, 2010, the Company maintains insurance to cover potential product liabilities up to USD

85,000 thousand in North America and Europe and ₩1,000 million in Korea.

92 COMPONENTS OF SUSTAINABLE GROWTH 93

KIA MOTORS ANNUAL REPORT 2010