Kia 2010 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2010 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company documents, at the inception of the transaction, the relationship between hedging instruments and hedged items, as well as

its risk management objective and strategy for undertaking various hedge transactions. The Company also documents its assessment, both

at hedge inception and on an ongoing basis, of whether the derivatives that are used in hedging transactions are highly effective in

offsetting the changes in fair values or cash flows of hedged items.

Fair value hedge

Changes in the fair value of derivatives that are designated and qualify as fair value hedges are recorded in the statement of income,

together with any changes in the fair value of the hedged asset or liability that are attributable to the hedged risk.

Cash flow hedge

The effective portion of changes in the fair value of derivatives that are designated and qualify as cash flow hedges and changes resulting

from the changes in currency exchange rate are recognized in equity. The gain or loss relating to any ineffective portion is recognized

immediately in the statement of income. Amounts accumulated in equity are recycled to the statement of income in the periods in which

the hedged item will affect income or expense. When a hedging instrument expires or is sold, or when a hedge no longer meets the criteria

for hedge accounting, any cumulative gain or loss existing in equity at the time remains in equity and is recognized when the forecast

transaction is ultimately recognized in the statement of income. When a forecast transaction is no longer expected to occur, the cumulative

gain or loss that was reported in equity is immediately transferred to the statement of income.

Derivatives that do not qualify for hedge accounting

Changes in the fair value of derivative instruments that are not designated as fair value or cash flow hedges are recognized immediately in

the statement of income.

Separable embedded derivatives

Changes in the fair value of separable embedded derivatives are recognized immediately in the statement of income.

(r) Share-Based Payments

For equity-settled share-based payment transactions, the Company measures the goods or services received, and the corresponding

increase in equity as a capital adjustment at the fair value of the goods or services received, unless that fair value cannot be estimated

reliably. If the entity cannot estimate reliably the fair value of the goods or services received, the Company measures their value, and

the corresponding increase in equity, indirectly, by reference to the fair value of the equity instruments granted. If the fair value of the

equity instruments cannot be estimated reliably at the measurement date, the Company measures them at their intrinsic value and

recognizes the goods or services received based on the number of equity instruments that ultimately vest.

For cash-settled share-based payment transactions, the Company measures the goods or services acquired and the liability incurred at the

fair value of the liability. Until the liability is settled, the Company remeasures the fair value of the liability at each reporting date and at the

date of settlement, with changes in fair value recognized in profit or loss for the period.

(s) Provision, Contingent Assets and Contingent Liabilities

Provisions are recognized when all of the following are met: (1) an entity has a present obligation as a result of a past event, (2) it is

probable that an outflow of resources embodying economic benefits will be required to settle the obligation, and (3) a reliable estimate can

be made of the amount of the obligation. Where the effect of the time value of money is material, a provision is recorded at the present

value of the expenditures expected to be required to settle the obligation.

Where the expenditure required to settle a provision is expected to be reimbursed by another party, the reimbursement is recognized as

a separate asset when, and only when, it is virtually certain that reimbursement will be received if the Company settles the obligation. The

expense relating to a provision is presented net of the amount recognized for a reimbursement.

Provision for warranties

The Company generally provides warranty to the ultimate consumer for each product sold and accrues warranty expense at the time of

sale based on the history of actual claims. Also, the Company accrues potential expenses, which may occur due to any product liability

suits or voluntary recall campaigns pending as of the end of the reporting period. The difference between the nominal value and present

value of these is amortized using the effective interest method.

(t) Income Taxes

Income tax on the income or loss for the year comprises current and deferred tax. Income tax is recognized in the statement of income

except to the extent that it relates to items recognized directly in equity, in which case it is recognized in equity.

Current tax is the expected tax payable on the taxable income for the year, using tax rates enacted.

Deferred tax is provided using the asset and liability method, providing for temporary differences between the carrying amounts of assets

and liabilities for financial reporting purposes and the amounts used for tax purposes. The amount of deferred tax provided is based on the

expected manner of realization or settlement of the carrying amount of assets and liabilities, using tax rates enacted or substantively

enacted at the end of the reporting period.

A deferred tax asset is recognized only to the extent that it is probable that future taxable income will be available against which the unused

tax losses and credits can be utilized. Deferred tax assets are reduced to the extent that it is no longer probable that the related tax benefit

will be realized.

Deferred tax assets and liabilities are classified as current or non-current based on the classification of the related asset or liability for

financial reporting or the expected reversal date of the temporary difference for those with no related asset or liability such as loss

carryforwards and tax credit carryforwards. The deferred tax amounts are presented as a net current asset or liability and a net non-current

asset or liability.

(u) Earnings per Share

Earnings per share are calculated by dividing net income attributable to stockholders of the Company by the weighted-average number of

shares outstanding during the period.

Diluted earnings per share are determined by adjusting net income attributable to stockholders and the weighted-average number of shares

outstanding for the effects of all dilutive potential shares, which comprise stock options granted to employees.

(v) Use of Estimates

The preparation of consolidated financial statements in accordance with accounting principles generally accepted in the Republic of Korea

requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and

related notes to consolidated financial statements. Actual results could differ from those estimates.

(w) Elimination of the Investments of Investing Company and the Stockholders’ Equity of the Investees

In eliminating the investment of the investing company and the stockholders’ equity of the investee, the portion of the investee’s

stockholders’ equity that belongs to minority interest is separately presented. The elimination of the investments of the investing company

and the stockholders’ equity of the investees are recorded as of the date of acquisition of controlling interest. The nearest closing date from

acquisition of controlling interest is deemed to be the acquisition date when the acquisition date of interest of subsidiaries is different from

the closing date of subsidiaries.

(x) Elimination of Inter-Company Transactions

Inter-company transactions of the company are eliminated and related unrealized inter-company gains and losses are treated as follows:

(a) Calculation of unrealized gains and losses

Unrealized gains or losses to be eliminated with respect to Company’s inventories, fixed assets and intangible assets are computed based

upon average gross profit ratio of the concerned transaction. When the actual gross profit ratio is deemed materially different from the

average gross profit ratio, the actual gross profit ratio of the concerned transaction is used.

(b) Elimination of unrealized gains and losses

Unrealized gains or losses arising from downstream intercompany transactions are fully eliminated and it is attributed to the company’s

investment. Unrealized gains or losses arising from upstream transactions are fully eliminated and it is attributed to the company’s

investment proportionately to the equity interest of the company and minority interest.

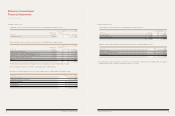

Notes to Consolidated

Financial Statements

December 31, 2010 and 2009

68 COMPONENTS OF SUSTAINABLE GROWTH 69

KIA MOTORS ANNUAL REPORT 2010