Kia 2010 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2010 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

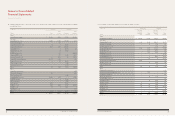

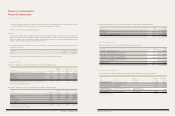

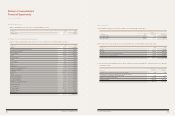

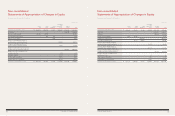

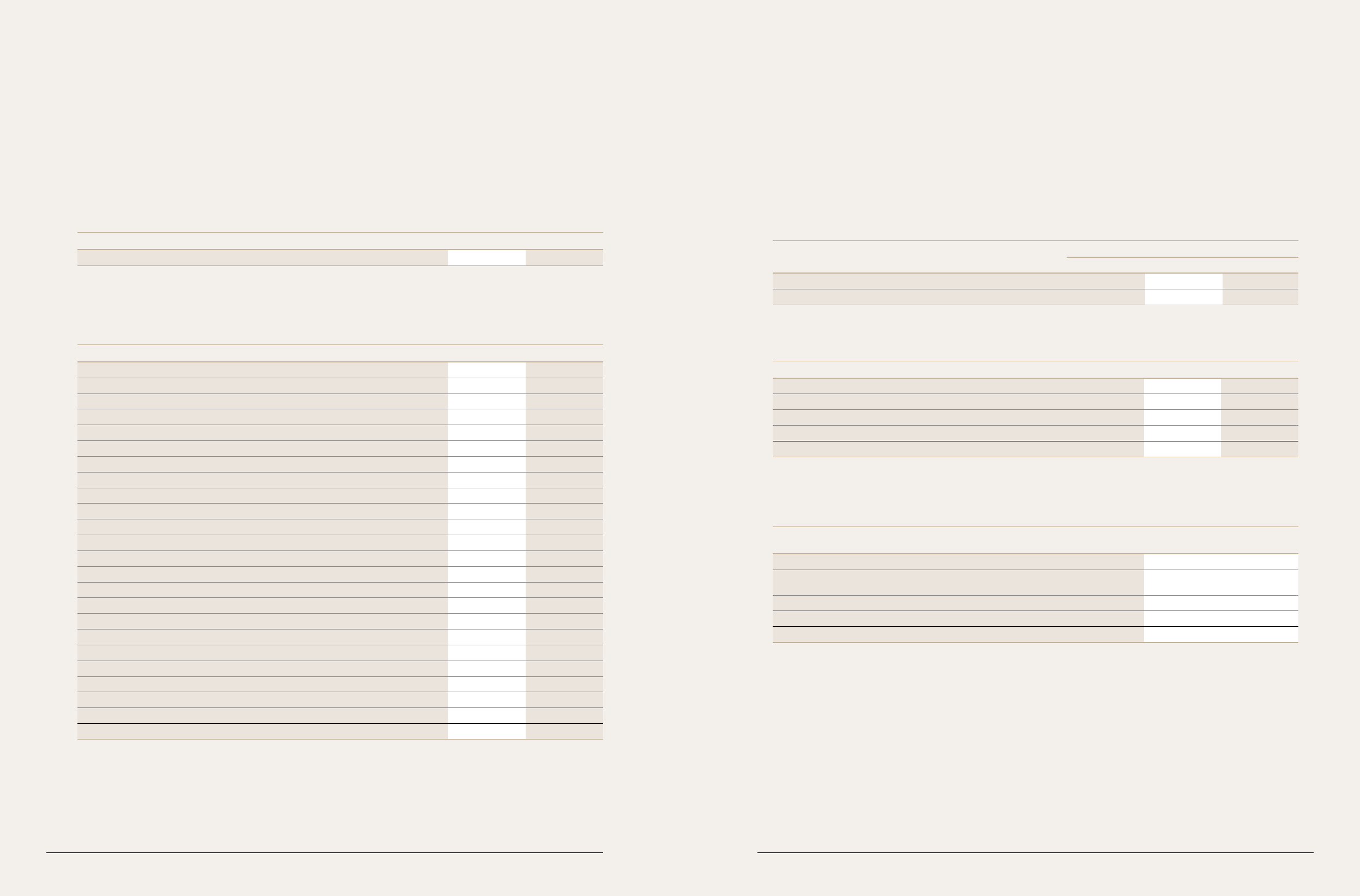

26. Capital Adjustments

Details of capital adjustments as of December 31, 2010 and 2009 are as follows:

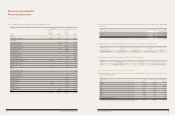

27. Selling, General and Administrative Expenses

Details of selling, general and administrative expenses for the years ended December 31, 2010 and 2009 are as follows:

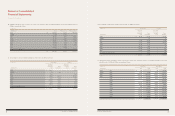

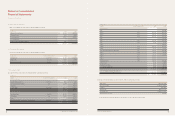

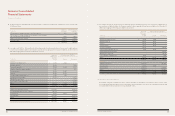

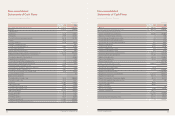

28. Income Taxes

(a) The Company was subject to income taxes on taxable income at the following normal tax rates.

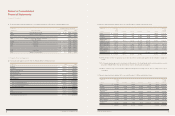

(b) The components of income tax expense for the years ended December 31, 2010 and 2009 are summarized as follows:

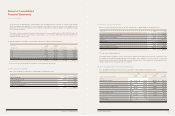

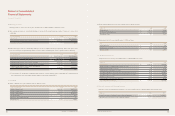

(c) The deferred tax assets and liabilities that were directly charged or credited to accumulated other comprehensive income as of December

31, 2010 are as follows:

In millions of won 2010 2009

Treasury stock ₩ (14,515) (2,249)

In millions of won 2010 2009

Current ₩ 377,302 53,708

Deferred 395,002 233,971

Charged directly to other comprehensive income (13,639) (34,315)

Tax effect due to consolidation entries (90,254) (53,282)

₩ 668,411 200,082

Temporary

Deferred tax assets

In millions of won differences (liabilities)

Effective portion of changes in fair value of cash flow hedges ₩ 1,777 391

Effective portion of changes resulting from the changes in currency

exchange rate of non-derivative financial instrument 8,543 1,879

Valuation of investments in securities (376,493) (91,171)

Revaluation surplus (1,288,235) (283,412)

₩ (1,654,408) (372,313)

In millions of won 2010 2009

Salaries ₩ 781,930 719,320

Accrual for retirement and severance benefits 93,065 105,275

Other employee benefits 112,741 107,245

Sales promotion 1,155,498 1,060,404

Travel 39,898 29,580

Communications 15,310 17,032

Utilities 13,423 18,717

Taxes and dues 27,375 19,670

Rent 57,017 43,748

Depreciation 61,889 75,472

Amortization of intangible assets 25,674 19,450

Repairs and maintenance 33,382 38,293

Advertising 1,014,255 885,093

Freight 345,773 277,932

Supplies and stationery 18,173 15,307

Commissions and fees 227,983 227,379

Education and training 12,716 10,776

Ordinary research and development 341,568 265,258

Overseas marketing 142,183 83,493

Export expenses 743,388 580,960

Warranty expense 881,245 411,038

Bad debt expense 5,911 5,849

Miscellaneous 205,852 169,042

₩ 6,356,249 5,186,333

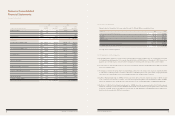

Notes to Consolidated

Financial Statements

December 31, 2010 and 2009

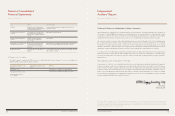

Tax rate

Taxable income 2009 2010 & 2011 Thereafter

Up to ₩200 million 12.1% 11.0% 11.0%

Over ₩200 million 24.2% 24.2% 22.0%

102 COMPONENTS OF SUSTAINABLE GROWTH 103

KIA MOTORS ANNUAL REPORT 2010