Kia 2010 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2010 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Notes to Consolidated

Financial Statements

December 31, 2010 and 2009

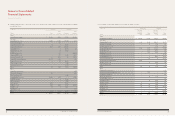

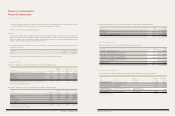

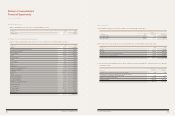

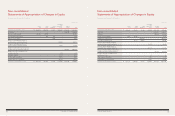

23. Derivative Instruments and Hedge Accounting

(a) The Company has entered into derivative instrument contracts including swaps, forwards, and options to hedge its foreign currency and

interest rate risk exposures. Details of derivative instrument contracts as of December 31, 2010 and 2009 are summarized as follows:

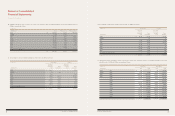

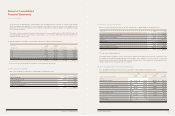

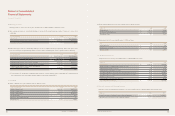

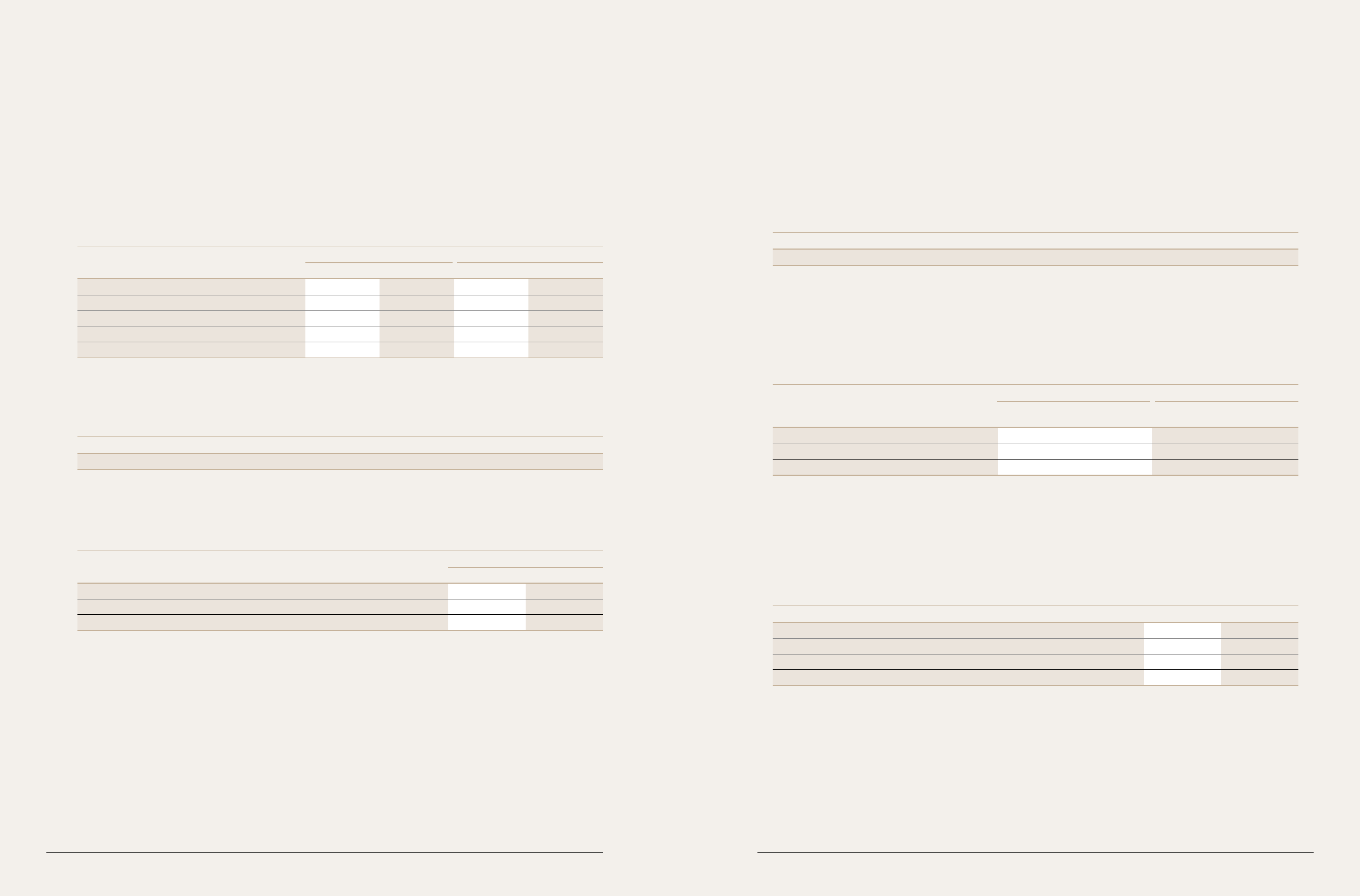

24. Common Stock

(a) Capital stock as of December 31, 2010 is summarized as follows:

25. Capital Surplus

Capital surplus as of December 31, 2010 and 2009 are summarized as follows:

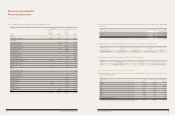

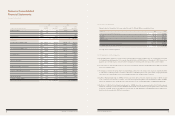

(b) Changes in stockholders’ equity for the years ended December 31, 2010 and 2009 are as follows:

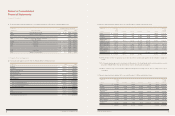

(c) As of December 31, 2010, the 378,116 shares of treasury stock (0.10% of total stock) lost voting rights under paragraph 2 of Article 369 of

the Korean Commercial Code and the law for the capital market and financial investment.

(*) Other includes gain from re-issuance of treasury stock and consideration for stock warrants.

The Company retired 10 million shares of treasury stock on July 2, 2003, which had been acquired for such retirement purposes based on

the decision of the Board of Directors on May 9, 2003. Also, the Company retired 12.5 million shares of treasury stock on May 28, 2004,

which had been acquired for ₩136,701 million for such retirement purposes based on the decision of the Board of Directors on March 19,

2004. Due to these stock retirements, the aggregate par value of issued shares differs from the common stock amount.

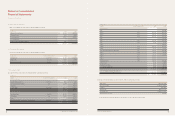

(b) The Company designated foreign currency borrowings to hedge the cash flow risk associated with a highly probable forecast transaction.

Detail of designated foreign currency borrowings as of December 31, 2010 are summarized as follows:

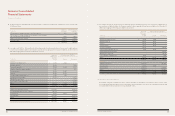

(d) The Company applied cash flow hedges to transactions expected to occur in the period ending December 31, 2010 and the amount of gain

on valuation of derivatives before tax included in accumulated other comprehensive loss expected to be recognized as current income

within the twelve months from December 31, 2010 is ₩ 8,050 million.

(e) The Company recorded ₩67,717 million and ₩2,146 million as gain on transaction of derivatives and loss on transaction of derivatives for

the year ended December 31, 2010, respectively, from the termination of derivative instrument contracts.

(e) The Company recognized the net income of ₩6,864 million and the net loss of ₩213 million as other income (loss) for the year ended

December 31, 2010 on valuation of the ineffective portion of such instruments and the other derivative instruments in current operations.

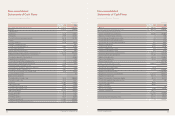

(c) The Company deferred the net loss on valuation of the effective portion of derivative instruments for cash flow hedging purposes

as accumulated other comprehensive loss. Detail of accumulated other comprehensive loss as of December 31, 2010 and 2009 are

summarized as follows:

In millions of won and thousands of USD and EUR Contract amounts Fair value

Derivative instrument 2010 2009 2010 2009

Interest rate swaps KRW 350,000 KRW 350,000 ₩ (3,767) (6,805)

Interest rate and currency swaps - USD 55,000 - 11,829

Foreign currency forwards USD 210,000 USD 110,000 3,010 4,205

Foreign currency options USD 340,000 USD 210,000 1,616 1,757

EUR 240,000 - 4,015 -

Designated financial instrument Contract amount

Foreign currency borrowings USD 61,600

Authorized Issued Outstanding Par value Won (millions)

820,000,000 397,854,423 397,476,307 ₩ 5,000 ₩ 2,101,772

In thousands of USD

In millions of won Other comprehensive loss

Financial instrument 2010 2009

Derivative instruments ₩ (1,386) (3,144)

Non-derivative financial instruments (6,664) (59,129)

₩ (8,050) (62,273)

In millions of won 2010 2009

Paid-in capital in excess of par value ₩ 1,546,603 1,534,206

Gain on capital reduction 119,859 119,859

Other(*) 39,360 5,151

₩ 1,705,822 1,659,216

2010 2009

Number of Number of

shares Amount shares Amount

BALANCE AT BEGINNING OF YEAR 388,371,048 ₩ 2,054,355 347,230,455 ₩ 1,848,652

Exercise of stock warrants 9,483,375 47,417 41,140,593 205,703

BALANCE AT END OF YEAR 397,854,423 ₩ 2,101,772 388,371,048 ₩ 2,054,355

100 COMPONENTS OF SUSTAINABLE GROWTH 101

KIA MOTORS ANNUAL REPORT 2010