Kia 2010 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2010 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

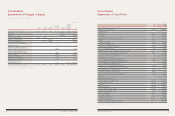

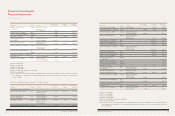

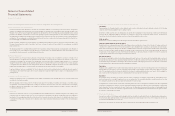

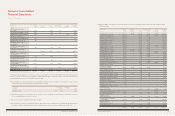

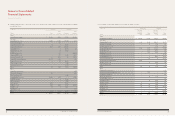

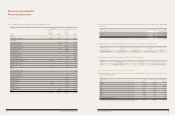

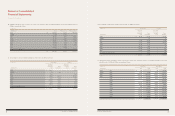

Notes to Consolidated

Financial Statements

December 31, 2010 and 2009

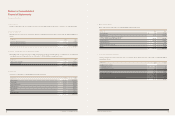

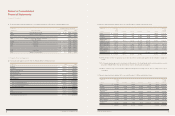

(a) Available-for-sale securities

(i) Marketable securities recorded at fair value as of December 31, 2010 and 2009 are summarized as follows:

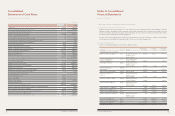

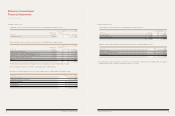

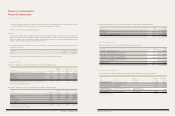

(b) Held-to-maturity securities

Held-to-maturity securities as of December 31, 2010 and 2009 are summarized as follows:

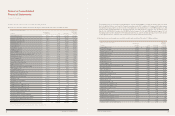

(c) The Company has provided 1,500 shares of common stock of the Korea Defence Industry Association (“KDIA”), which are included in

available-for-sale securities to the KDIA for a performance guarantee on a contract.

Maturities of debt securities classified as held-to-maturity as of at December 31, 2010 and 2009 are as follows:

(ii) Non-marketable securities recorded at cost as of December 31, 2010 and 2009 are summarized as follows:

(iii) Changes in unrealized holding gains (losses) for the years ended December 31, 2010 and 2009 are summarized as follows:

These non-marketable securities are recorded at cost as fair value cannot be reliably estimated.

2010 2009

Percentage of Acquisition

In millions of won ownership cost Fair value Fair value

SeAH Besteel Co., Ltd. 0.0049% ₩ 20 64 29

Book value

In millions of won Face value 2010 2009

Government bonds ₩ 8,964 8,964 9,335

Corporate debt securities 8,000 8,000 8,000

₩ 16,964 16,964 17,335

2010 2009

Percentage of Acquisition

In millions of won ownership cost Book value Book value

Kihyup Technology Banking Corp. 2.41% ₩ 700 700 700

DY Metalworks, Inc.(formerly, Dongyung Industries Co., Ltd.) 19.23% 241 241 241

Namyang Ind. Co., Ltd. (formerly, Namyang Industrial Co., Ltd.) 8.00% 200 200 200

International Convention Center Jeju Co., Ltd. 0.30% 500 500 500

Other(*) 1,195 1,195 1,248

₩ 2,836 2,836 2,889

(*) The Company recognized ₩14 million of impairment loss as non-operating loss for the year ended December 31, 2010.

In millions of won 2010 2009

BEGINNING BALANCE ₩ 9 44

Realized gain on disposition of securities - (35)

Changes in unrealized gain 35 -

Ending balance 44 9

Income tax effect (10) (2)

NET BALANCE AT END OF YEAR ₩ 34 7

In millions of won 2010 2009

Due before one year ₩ 731 598

Due after one year through five years 14,928 15,323

Due after five years 1,305 1,414

₩ 16,964 17,335

72 COMPONENTS OF SUSTAINABLE GROWTH 73

KIA MOTORS ANNUAL REPORT 2010