Kia 2010 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2010 Kia annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

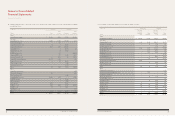

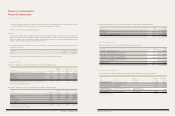

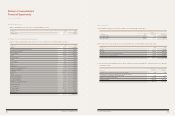

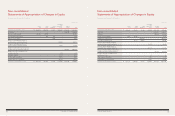

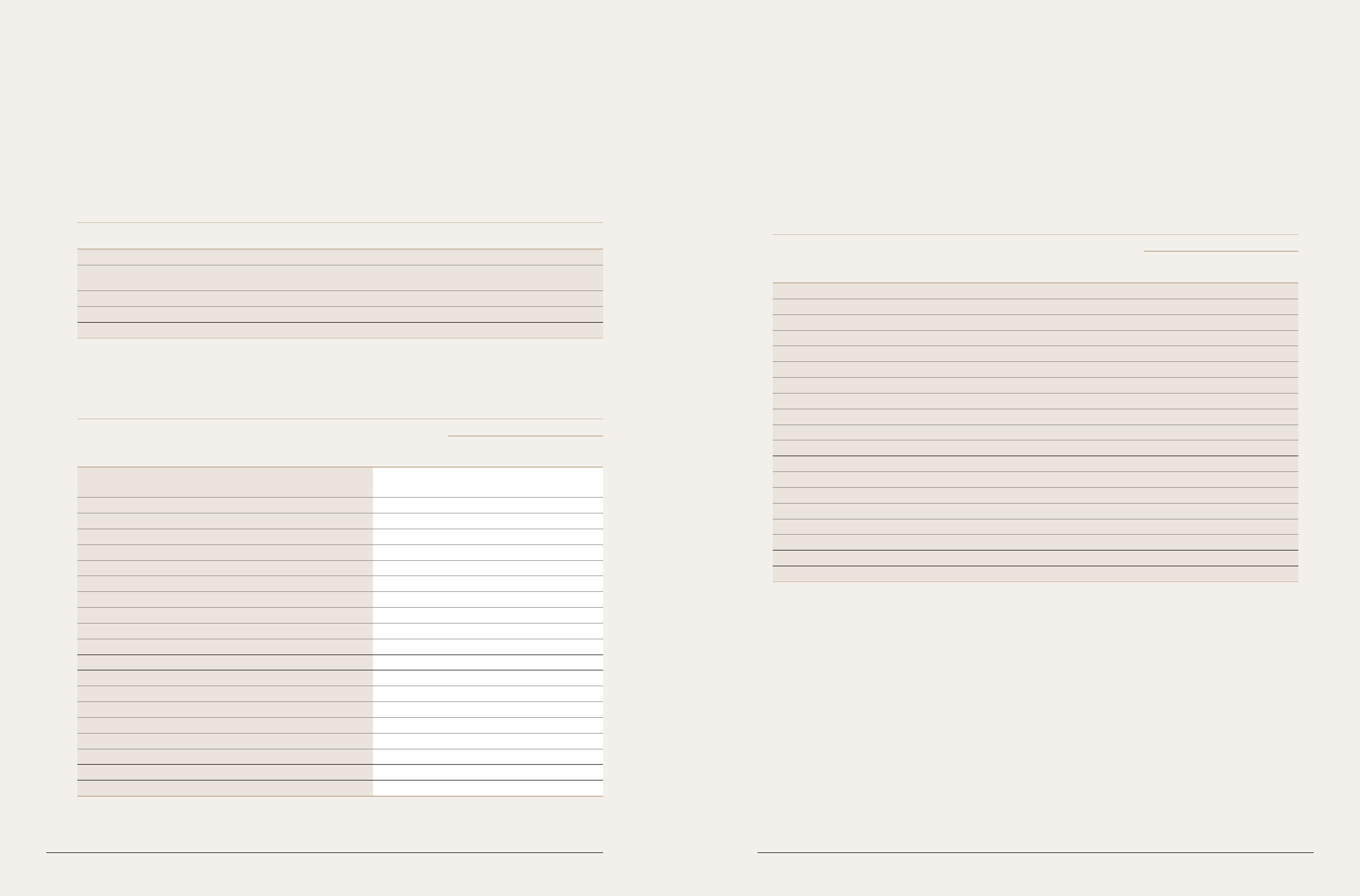

(d) The deferred tax assets and liabilities that were directly charged or credited to accumulated other comprehensive income as of December

31, 2009 are as follows:

Temporary Deferred tax assets

In millions of won differences (liabilities)

Effective portion of changes in fair value of cash flow hedges, net ₩ 4,030 887

Effective portion of changes resulting from the changes in currency exchange

rate of non-derivative financial instrument 75,807 16,677

Valuation of investments in securities (361,945) (79,628)

Revaluation surplus (1,348,227) (296,610)

₩ (1,630,335) (358,674)

Notes to Consolidated

Financial Statements

December 31, 2010 and 2009

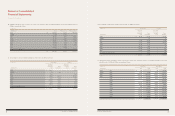

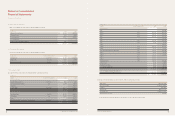

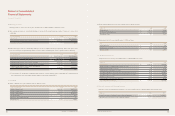

(e) In accordance with SKAS No. 16 Income Taxes the deferred tax amounts should be presented as a net current asset or liability and a net

non-current asset or liability. In addition, the Company is required to disclose aggregate deferred tax assets (liabilities). As of December 31,

2010, details of aggregate deferred tax assets (liabilities) are as follows:

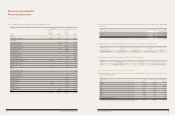

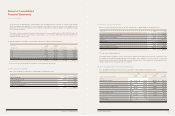

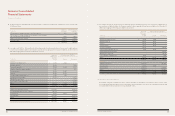

(f) In accordance with SKAS No. 16 Income Taxes the deferred tax amounts should be presented as a net current asset or liability and a net

non-current asset or liability. In addition, the Company is required to disclose aggregate deferred tax assets (liabilities). As of December 31,

2009, details of aggregate deferred tax assets (liabilities) are as follows:

Deferred tax assets (liabilities)

In millions of won Current Non-current

ASSETS

Allowance for doubtful accounts ₩ 108,165 26,232 -

Bad debts written off 249,919 - 54,982

Provision for warranties 764,248 58,784 104,726

Valuation of derivatives and non-derivatives 10,320 - 2,270

Accrued expenses 212,029 84,851 -

Inventory 565,860 135,672 -

Foreign exchange translation gain, net 24,684 5,589 -

Subsidiaries advertising support 200,786 44,173

Operating loss carryforward - - 84,472

Carryforwards of unused tax credits - - 283,832

Others 1,235,018 76,918 122,674

3,371,029 388,046 697,129

LIABILITIES

Valuation of investments in securities (3,069,038) - (638,314)

Accumulated depreciation in excess of tax limit (555,519) - (62,419)

Accrued income (47,670) (11,536) -

Revaluated land (1,288,235) - (283,412)

Others (881,500) - (243,282)

(5,841,962) (11,536) (1,227,427)

NET DEFERRED TAX ASSET (LIABILITY) ₩ (2,470,933) 376,510 (530,298)

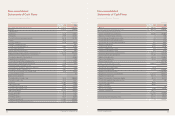

Deferred tax assets (liabilities)

In millions of won Current Non-current

ASSETS

Allowance for doubtful accounts ₩ 114,456 27,698 -

Bad debts written off 256,405 56,409 -

Inventory 260,027 64,048 -

Accrued expenses 191,370 66,979 -

Provision for warranties 590,424 - 139,783

Foreign exchange translation gain, net 177,050 38,950 -

Carryforwards of unused tax credits - - 372,251

Operating loss carryforward - - 146,148

Loss on valuation of derivatives, net 79,837 - 17,564

Others 1,194,108 181,198 60,941

2,863,677 435,282 736,687

LIABILITIES

Valuation on investment (1,618,414) - (471,620)

Accrued income (32,578) (7,884) -

Revaluated land (1,348,227) - (296,610)

Others (365,804) - (154,641)

(3,365,023) (7,884) (922,871)

NET DEFERRED TAX ASSET (LIABILITY) ₩ 501,346 427,398 (186,184)

Temporary

differences at

December

31, 2010

Temporary

differences at

December

31, 2009

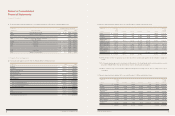

29. Changes in Accounting Estimate

The Company changed the estimated useful lives to compute amortization on development costs from three years to economic useful

lives of related finished goods in 2010. As a result of this change in accounting estimate, net income for the year ended December 31, 2010

increased by ₩80,117 million and inventories decreased by ₩4,031 million.

104 COMPONENTS OF SUSTAINABLE GROWTH 105

KIA MOTORS ANNUAL REPORT 2010