Home Depot 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

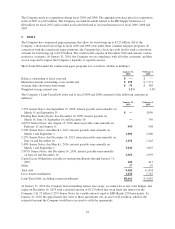

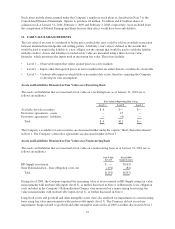

under the caption “Goodwill and Other Intangible Assets.” Impairment charges related to long-lived assets in

fiscal 2009 were not material, as further discussed in Note 1 under the caption “Impairment of Long-Lived

Assets.”

The aggregate fair value of the Company’s Senior Notes, based on quoted market prices (level 1), was $9.5

billion at January 31, 2010 compared to a carrying value of $9.3 billion.

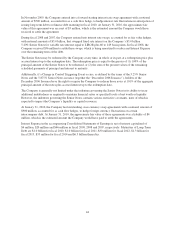

12. COMMITMENTS AND CONTINGENCIES

At January 31, 2010, the Company was contingently liable for approximately $434 million under outstanding

letters of credit and open accounts issued for certain business transactions, including insurance programs, trade

contracts and construction contracts. The Company’s letters of credit are primarily performance-based and are

not based on changes in variable components, a liability or an equity security of the other party.

On January 27, 2010, the Superior Court of the County of Los Angeles in California approved the Company’s

settlement with the plaintiffs in five lawsuits containing multiple class-action allegations that the Company

failed to provide meal breaks. The complaints were filed by current and former hourly associates from the first

quarter of 2004 through the fourth quarter of 2008. The disposition of this matter is now complete. As

previously disclosed, the Company established a reserve for this settlement in the fourth quarter of fiscal 2008.

The settlement did not have a material effect on the Company’s consolidated financial condition or results of

operations.

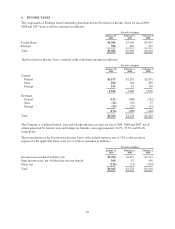

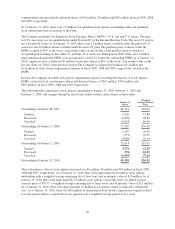

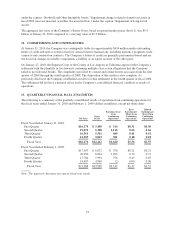

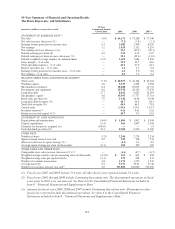

13. QUARTERLY FINANCIAL DATA (UNAUDITED)

The following is a summary of the quarterly consolidated results of operations from continuing operations for

the fiscal years ended January 31, 2010 and February 1, 2009 (dollars in millions, except per share data):

Net Sales Gross

Profit

Earnings (Loss)

from

Continuing

Operations

Basic

Earnings per

Share from

Continuing

Operations

Diluted

Earnings per

Share from

Continuing

Operations

Fiscal Year Ended January 31, 2010:

First Quarter $16,175 $ 5,450 $ 514 $0.31 $0.30

Second Quarter 19,071 6,388 1,116 0.66 0.66

Third Quarter 16,361 5,561 689 0.41 0.41

Fourth Quarter 14,569 5,013 301 0.18 0.18

Fiscal Year $66,176 $22,412 $2,620 $1.56 $1.55

Fiscal Year Ended February 1, 2009:

First Quarter $17,907 $ 6,072 $ 356 $0.21 $0.21

Second Quarter 20,990 6,964 1,202 0.72 0.71

Third Quarter 17,784 5,994 756 0.45 0.45

Fourth Quarter 14,607 4,960 (2) 0.00 0.00

Fiscal Year $71,288 $23,990 $2,312 $1.37 $1.37

Note: The quarterly data may not sum to fiscal year totals.

53