Home Depot 2009 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2009 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

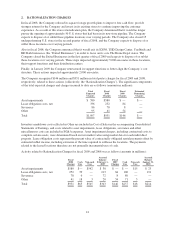

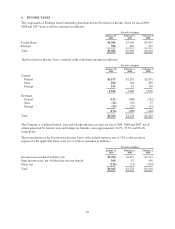

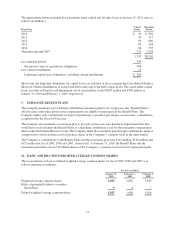

The following table summarizes restricted stock and performance shares outstanding at January 31, 2010

(shares in thousands):

Number of

Shares

Weighted

Average Grant

Date Fair Value

Outstanding at January 28, 2007 10,130 $39.20

Granted 7,091 39.10

Restrictions lapsed (2,662) 39.01

Canceled (2,844) 39.37

Outstanding at February 3, 2008 11,715 $39.14

Granted 7,938 27.14

Restrictions lapsed (1,251) 34.37

Canceled (2,115) 34.86

Outstanding at February 1, 2009 16,287 $34.22

Granted 8,257 23.41

Restrictions lapsed (1,686) 34.65

Canceled (2,195) 31.84

Outstanding at January 31, 2010 20,663 $30.11

As of January 31, 2010, there was $332 million of unamortized stock-based compensation expense related to

restricted stock and performance shares which is expected to be recognized over a weighted average period of

three years. The total fair value of restricted stock and performance shares vesting during fiscal 2009, 2008 and

2007 was $41 million, $33 million and $103 million, respectively.

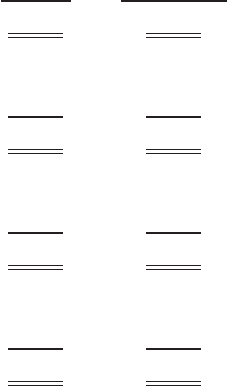

8. LEASES

The Company leases certain retail locations, office space, warehouse and distribution space, equipment and

vehicles. While most of the leases are operating leases, certain locations and equipment are leased under capital

leases. As leases expire, it can be expected that, in the normal course of business, certain leases will be renewed

or replaced.

Certain lease agreements include escalating rents over the lease terms. The Company expenses rent on a

straight-line basis over the lease term which commences on the date the Company has the right to control the

property. The cumulative expense recognized on a straight-line basis in excess of the cumulative payments is

included in Other Accrued Expenses and Other Long-Term Liabilities in the accompanying Consolidated

Balance Sheets.

Total rent expense, net of minor sublease income for fiscal 2009, 2008 and 2007 was $823 million,

$846 million and $824 million, respectively. Certain store leases also provide for contingent rent payments

based on percentages of sales in excess of specified minimums. Contingent rent expense for fiscal 2009, 2008

and 2007 was approximately $4 million, $5 million and $6 million, respectively. Real estate taxes, insurance,

maintenance and operating expenses applicable to the leased property are obligations of the Company under the

lease agreements.

50