Home Depot 2009 Annual Report Download - page 42

Download and view the complete annual report

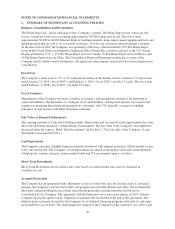

Please find page 42 of the 2009 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Business, Consolidation and Presentation

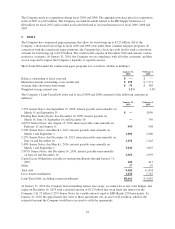

The Home Depot, Inc. and its subsidiaries (the “Company”) operate The Home Depot stores, which are full-

service, warehouse-style stores averaging approximately 105,000 square feet in size. The stores stock

approximately 30,000 to 40,000 different kinds of building materials, home improvement supplies and lawn and

garden products that are sold to do-it-yourself customers, do-it-for-me customers and professional customers.

At the end of fiscal 2009, the Company was operating 2,244 stores, which included 1,976 The Home Depot

stores in the United States, including the Commonwealth of Puerto Rico and the territories of the U.S. Virgin

Islands and Guam (“U.S.”), 179 The Home Depot stores in Canada, 79 The Home Depot stores in Mexico and

10 The Home Depot stores in China. The Consolidated Financial Statements include the accounts of the

Company and its wholly-owned subsidiaries. All significant intercompany transactions have been eliminated in

consolidation.

Fiscal Year

The Company’s fiscal year is a 52- or 53-week period ending on the Sunday nearest to January 31. Fiscal years

ended January 31, 2010 (“fiscal 2009”) and February 1, 2009 (“fiscal 2008”) include 52 weeks. The fiscal year

ended February 3, 2008 (“fiscal 2007”) includes 53 weeks.

Use of Estimates

Management of the Company has made a number of estimates and assumptions relating to the reporting of

assets and liabilities, the disclosure of contingent assets and liabilities, and reported amounts of revenues and

expenses in preparing these financial statements in conformity with U.S. generally accepted accounting

principles. Actual results could differ from these estimates.

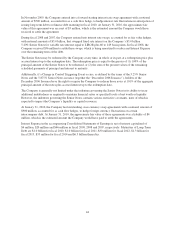

Fair Value of Financial Instruments

The carrying amounts of Cash and Cash Equivalents, Receivables and Accounts Payable approximate fair value

due to the short-term maturities of these financial instruments. The fair value of the Company’s investments is

discussed under the caption “Short-Term Investments” in this Note 1. The fair value of the Company’s Long-

Term Debt is discussed in Note 11.

Cash Equivalents

The Company considers all highly liquid investments purchased with original maturities of three months or less

to be cash equivalents. The Company’s Cash Equivalents are carried at fair market value and consist primarily

of high-grade commercial paper, money market funds and U.S. government agency securities.

Short-Term Investments

Short-Term Investments are recorded at fair value based on current market rates and are classified as

available-for-sale.

Accounts Receivable

The Company has an agreement with a third-party service provider who directly extends credit to customers,

manages the Company’s private label credit card program and owns the related receivables. We evaluated the

third-party entities holding the receivables under the program and concluded that they should not be

consolidated by the Company. The agreement with the third-party service provider expires in 2018, with the

Company having the option, but no obligation, to purchase the receivables at the end of the agreement. The

deferred interest charges incurred by the Company for its deferred financing programs offered to its customers

are included in Cost of Sales. The interchange fees charged to the Company for the customers’ use of the cards

36