Home Depot 2009 Annual Report Download - page 54

Download and view the complete annual report

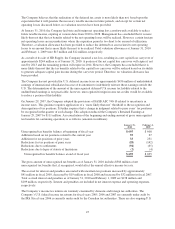

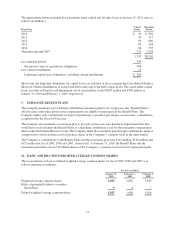

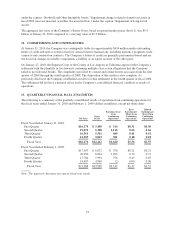

Please find page 54 of the 2009 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.state and local and other foreign audits covering tax years 2002 to 2008. At this time, the Company does not

expect the results from any income tax audit to have a material impact on the Company’s financial statements.

The Company believes that certain adjustments under examination in certain states will be agreed upon within

the next twelve months. The Company has classified approximately $23 million of the reserve for unrecognized

tax benefits as a short-term liability in the accompanying Consolidated Balance Sheets. Final settlement of

these audit issues may result in payments that are more or less than these amounts, but the Company does not

anticipate the resolution of these matters will result in a material change to its consolidated financial position or

results of operations.

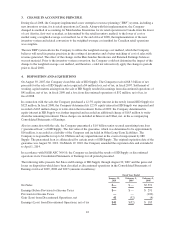

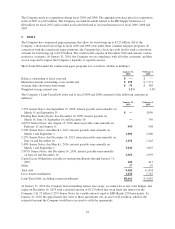

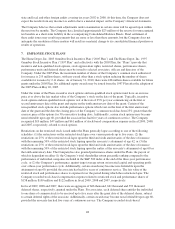

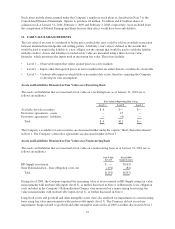

7. EMPLOYEE STOCK PLANS

The Home Depot, Inc. 2005 Omnibus Stock Incentive Plan (“2005 Plan”) and The Home Depot, Inc. 1997

Omnibus Stock Incentive Plan (“1997 Plan” and collectively with the 2005 Plan, the “Plans”) provide that

incentive and non-qualified stock options, stock appreciation rights, restricted shares, performance shares,

performance units and deferred shares may be issued to selected associates, officers and directors of the

Company. Under the 2005 Plan, the maximum number of shares of the Company’s common stock authorized

for issuance is 255 million shares, with any award other than a stock option reducing the number of shares

available for issuance by 2.11 shares. As of January 31, 2010, there were 188 million shares available for future

grants under the 2005 Plan. No additional equity awards may be issued from the 1997 Plan after the adoption of

the 2005 Plan on May 26, 2005.

Under the terms of the Plans, incentive stock options and non-qualified stock options must have an exercise

price at or above the fair market value of the Company’s stock on the date of the grant. Typically, incentive

stock options and non-qualified stock options vest at the rate of 25% per year commencing on the first or

second anniversary date of the grant and expire on the tenth anniversary date of the grant. Certain of the

non-qualified stock options also include performance options which vest on the later of the first anniversary

date of the grant and the date the closing price of the Company’s common stock has been 25% greater than the

exercise price of the options for 30 consecutive trading days. Additionally, certain stock options may become

non-forfeitable upon age 60, provided the associate has had five years of continuous service. The Company

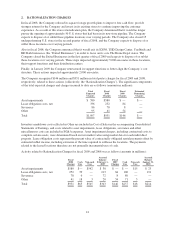

recognized $19 million, $47 million and $61 million of stock-based compensation expense in fiscal 2009, 2008

and 2007, respectively, related to stock options.

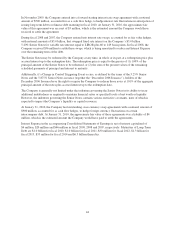

Restrictions on the restricted stock issued under the Plans generally lapse according to one of the following

schedules: (1) the restrictions on the restricted stock lapse over various periods up to five years, (2) the

restrictions on 25% of the restricted stock lapse upon the third and sixth anniversaries of the date of issuance

with the remaining 50% of the restricted stock lapsing upon the associate’s attainment of age 62, or (3) the

restrictions on 25% of the restricted stock lapse upon the third and sixth anniversaries of the date of issuance

with the remaining 50% of the restricted stock lapsing upon the earlier of the associate’s attainment of age 60 or

the tenth anniversary date. The Company has also granted performance shares under the Plans, the payout of

which is dependent on either (1) the Company’s total shareholder return percentile ranking compared to the

performance of individual companies included in the S&P 500 index at the end of the three-year performance

cycle, or (2) the Company’s performance against target average return on invested capital and operating profit

over a three-year performance cycle. Additionally, certain awards may become non-forfeitable upon the

attainment of age 60, provided the associate has had five years of continuous service. The fair value of the

restricted stock and performance shares is expensed over the period during which the restrictions lapse. The

Company recorded stock-based compensation expense related to restricted stock and performance shares of

$158 million, $109 million and $122 million in fiscal 2009, 2008 and 2007, respectively.

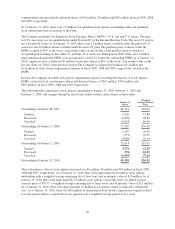

In fiscal 2009, 2008 and 2007, there were an aggregate of 666 thousand, 641 thousand and 593 thousand

deferred shares, respectively, granted under the Plans. For associates, each deferred share entitles the individual

to one share of common stock to be received up to five years after the grant date of the deferred shares, subject

to certain deferral rights of the associate. Additionally, certain awards may become non-forfeitable upon age 60,

provided the associate has had five years of continuous service. The Company recorded stock-based

48