Home Depot 2009 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2009 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

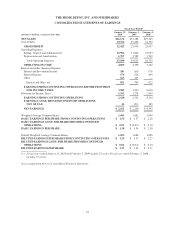

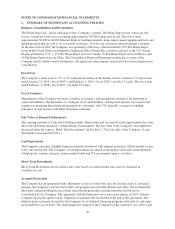

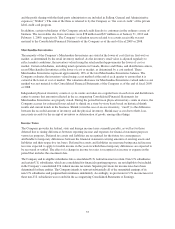

Depreciation and Amortization

The Company’s Buildings, Furniture, Fixtures and Equipment are recorded at cost and depreciated using the

straight-line method over the estimated useful lives of the assets. Leasehold Improvements are amortized using

the straight-line method over the original term of the lease or the useful life of the improvement, whichever is

shorter. The Company’s Property and Equipment is depreciated using the following estimated useful lives:

Life

Buildings 5 – 45 years

Furniture, Fixtures and Equipment 3 – 20 years

Leasehold Improvements 5 – 45 years

Capitalized Software Costs

The Company capitalizes certain costs related to the acquisition and development of software and amortizes

these costs using the straight-line method over the estimated useful life of the software, which is three to six

years. These costs are included in Furniture, Fixtures and Equipment in the accompanying Consolidated

Balance Sheets. Certain development costs not meeting the criteria for capitalization are expensed as incurred.

Revenues

The Company recognizes revenue, net of estimated returns and sales tax, at the time the customer takes

possession of merchandise or receives services. The liability for sales returns is estimated based on historical

return levels. When the Company receives payment from customers before the customer has taken possession

of the merchandise or the service has been performed, the amount received is recorded as Deferred Revenue in

the accompanying Consolidated Balance Sheets until the sale or service is complete. The Company also records

Deferred Revenue for the sale of gift cards and recognizes this revenue upon the redemption of gift cards in Net

Sales. Gift card breakage income is recognized based upon historical redemption patterns and represents the

balance of gift cards for which the Company believes the likelihood of redemption by the customer is remote.

During fiscal 2009, 2008 and 2007, the Company recognized $40 million, $37 million and $36 million,

respectively, of gift card breakage income. This income is recorded as other income and is included in the

accompanying Consolidated Statements of Earnings as a reduction in SG&A.

Services Revenue

Net Sales include services revenue generated through a variety of installation, home maintenance and

professional service programs. In these programs, the customer selects and purchases material for a project and

the Company provides or arranges professional installation. These programs are offered through the Company’s

stores. Under certain programs, when the Company provides or arranges the installation of a project and the

subcontractor provides material as part of the installation, both the material and labor are included in services

revenue. The Company recognizes this revenue when the service for the customer is complete.

All payments received prior to the completion of services are recorded in Deferred Revenue in the

accompanying Consolidated Balance Sheets. Services revenue was $2.6 billion, $3.1 billion and $3.5 billion for

fiscal 2009, 2008 and 2007, respectively.

Self-Insurance

The Company is self-insured for certain losses related to general liability, product liability, automobile,

workers’ compensation and medical claims. The expected ultimate cost for claims incurred as of the balance

sheet date is not discounted and is recognized as a liability. The expected ultimate cost of claims is estimated

based upon analysis of historical data and actuarial estimates.

38