Home Depot 2009 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2009 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Rationalization Charges, Operating Income as a percent of Net Sales was 7.5% for fiscal 2009 compared to

7.4% for fiscal 2008.

Interest and Other, net

In fiscal 2009, we recognized $821 million of Interest and Other, net, compared to $769 million in fiscal 2008.

Interest and Other, net, as a percent of Net Sales was 1.2% for fiscal 2009 compared to 1.1% for fiscal 2008.

Interest and Other, net, reflects a $163 million charge in each of fiscal 2009 and 2008 to write-down our

investment in HD Supply. Excluding these charges, Interest and Other, net, as a percent of Net Sales was 1.0%

for fiscal 2009 compared to 0.9% for fiscal 2008. The increase in Interest and Other, net, as a percent of Net

Sales was primarily due to lower sales.

Provision for Income Taxes

Our combined effective income tax rate for continuing operations decreased to 34.2% for fiscal 2009 from

35.6% for fiscal 2008. The decrease in our effective income tax rate for fiscal 2009 reflects benefits arising

from a favorable foreign tax settlement and realignment of our foreign corporate structure. These benefits

positively impacted Diluted Earnings per Share by approximately $0.06 for fiscal 2009.

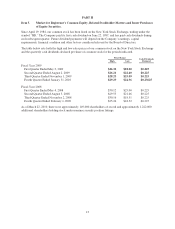

Diluted Earnings per Share from Continuing Operations

Diluted Earnings per Share from Continuing Operations were $1.55 for fiscal 2009 and $1.37 for fiscal 2008.

Excluding the Rationalization Charges and the write-downs of our investment in HD Supply, Diluted Earnings

per Share from Continuing Operations for fiscal 2009 were $1.66 compared to $1.78 for fiscal 2008, a decrease

of 6.7%.

Discontinued Operations

On August 30, 2007, the Company closed the sale of HD Supply. Discontinued operations for fiscal 2009

consist of earnings of $41 million, net of tax, or $0.02 per diluted share, compared to a loss of $52 million, net

of tax, or $0.03 per diluted share in fiscal 2008, in each case for the settlement of working capital matters

arising from the sale of HD Supply.

Non-GAAP Measures

To provide clarity, internally and externally, about our operating performance for fiscal 2009 and 2008, we

supplement our reporting with non-GAAP financial measures to reflect adjustments for the Rationalization

Charges as described more fully in Note 2 to the Consolidated Financial Statements, as well as the Net Sales

from Exited Businesses during the period from closing announcement to actual closing, and the charges to

write-down our investment in HD Supply as described in Note 4 to the Consolidated Financial Statements. We

believe these non-GAAP financial measures better enable management and investors to understand and analyze

our performance by providing them with meaningful information relevant to events of unusual nature or

frequency. However, this supplemental information should not be considered in isolation or as a substitute for

the related GAAP measures.

20