Home Depot 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

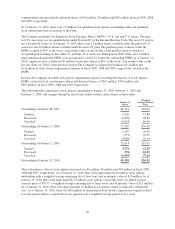

Stock plans include shares granted under the Company’s employee stock plans as described in Note 7 to the

Consolidated Financial Statements. Options to purchase 48 million, 52 million and 43 million shares of

common stock at January 31, 2010, February 1, 2009 and February 3, 2008, respectively, were excluded from

the computation of Diluted Earnings per Share because their effect would have been anti-dilutive.

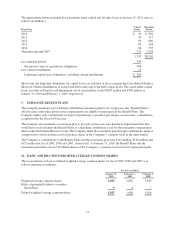

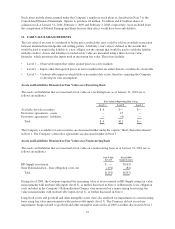

11. FAIR VALUE MEASUREMENTS

The fair value of an asset is considered to be the price at which the asset could be sold in an orderly transaction

between unrelated knowledgeable and willing parties. A liability’s fair value is defined as the amount that

would be paid to transfer the liability to a new obligor, not the amount that would be paid to settle the liability

with the creditor. Assets and liabilities recorded at fair value are measured using a three-tier fair value

hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include:

• Level 1 – Observable inputs that reflect quoted prices in active markets

• Level 2 – Inputs other than quoted prices in active markets that are either directly or indirectly observable

• Level 3 – Unobservable inputs in which little or no market data exists, therefore requiring the Company

to develop its own assumptions

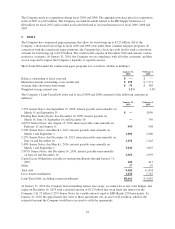

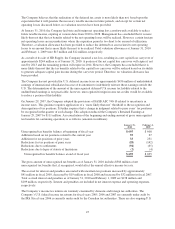

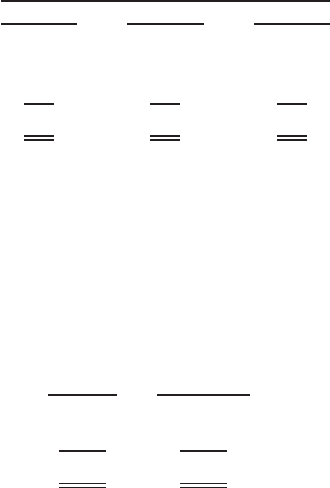

Assets and Liabilities Measured at Fair Value on a Recurring Basis

The assets and liabilities that are measured at fair value on a recurring basis as of January 31, 2010 are as

follows (in millions):

Fair Value at Reporting Date Using

Level 1 Level 2 Level 3

Available-for-sale securities $ 6 $— $—

Derivative agreements - assets — 15 —

Derivative agreements - liabilities — (4) —

Total $ 6 $11 $—

The Company’s available-for-sale securities are discussed further under the caption “Short-Term Investments”

in Note 1. The Company’s derivative agreements are discussed further in Note 5.

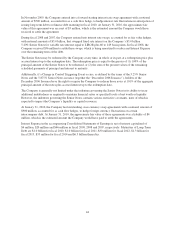

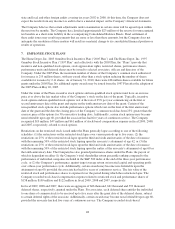

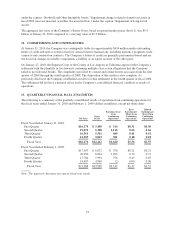

Assets and Liabilities Measured at Fair Value on a Nonrecurring Basis

The assets and liabilities that are measured at fair value on a nonrecurring basis as of January 31, 2010 are as

follows (in millions):

Fair Value

Level 3 Fiscal 2009

Gains (Losses)

HD Supply investment $ — $(163)

Store Rationalization - lease obligation costs, net (191) (84)

Total $(191) $(247)

During fiscal 2009, the Company impaired the remaining value of its investment in HD Supply using fair value

measurements with unobservable inputs (level 3), as further discussed in Note 4. Additionally, lease obligation

costs included in the Company’s Rationalization Charges were measured on a nonrecurring basis using fair

value measurements with unobservable inputs (level 3), as further discussed in Note 2.

Long-lived assets and goodwill and other intangible assets were also analyzed for impairment on a nonrecurring

basis using fair value measurements with unobservable inputs (level 3). The Company did not record any

impairment charges related to goodwill and other intangible assets in fiscal 2009 as further discussed in Note 1

52