Home Depot 2009 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2009 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

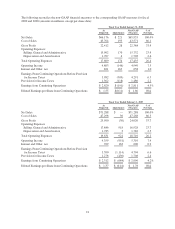

Results of Operations

For an understanding of the significant factors that influenced our performance during the past three fiscal

years, the following discussion should be read in conjunction with the Consolidated Financial Statements and

the Notes to Consolidated Financial Statements presented in this report.

Fiscal 2009 Compared to Fiscal 2008

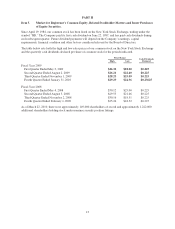

Net Sales

Net Sales for fiscal 2009 decreased 7.2% to $66.2 billion from $71.3 billion for fiscal 2008. The decrease in Net

Sales for fiscal 2009 reflects the impact of negative comparable store sales as well as the net impact of fewer

open stores in fiscal 2009 versus fiscal 2008. Total comparable store sales decreased 6.6% for fiscal 2009

compared to a decrease of 8.7% for fiscal 2008.

There were a number of factors that contributed to our comparable store sales decline. The U.S. residential

construction, housing and home improvement markets continued to be soft, and consumers were challenged due

to a number of factors including higher unemployment. We saw relative strength in our Building Materials,

Flooring, Paint, Plumbing and Garden/Seasonal product categories as comparable store sales in these areas

were above the Company average for fiscal 2009. Comparable store sales for our Lumber, Hardware, Electrical,

Kitchen/Bath and Millwork product categories were below the Company average for fiscal 2009. In fiscal 2009,

we also saw significant strengthening of the U.S. dollar against all currencies. Fluctuating exchange rates

negatively impacted our total Company sales by approximately $565 million for fiscal 2009 compared to last

year.

We believe that our sales performance has been, and could continue to be, negatively impacted by the level of

competition that we encounter in various markets. We estimate our share of the U.S. home improvement market

is approximately 21%.

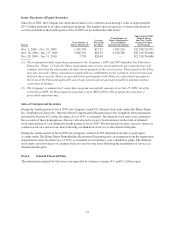

Gross Profit

Gross Profit decreased 6.6% to $22.4 billion for fiscal 2009 from $24.0 billion for fiscal 2008. Gross Profit as a

percent of Net Sales was 33.9% for fiscal 2009 compared to 33.7% for fiscal 2008, an increase of 22 basis

points. Through our focused bay portfolio approach, our U.S. merchants continued to introduce new lower

prices while growing overall gross margin. Additionally, gross margin expansion for fiscal 2009 was driven by

lower markdowns as compared to last year.

Operating Expenses

Selling, General and Administrative expenses (“SG&A”) decreased 10.9% to $15.9 billion for fiscal 2009 from

$17.8 billion for fiscal 2008. As a percent of Net Sales, SG&A was 24.0% for fiscal 2009 compared to 25.0%

for fiscal 2008. Excluding the Rationalization Charges, SG&A as a percent of Net Sales was 23.9% for fiscal

2009 compared to 23.7% for fiscal 2008. Our SG&A results for fiscal 2009 reflect the impact of a negative

comparable store sales environment, offset by a lower cost of credit associated with the private label credit card

program and solid expense control. For fiscal 2009, the penetration of the private label credit card sales was

25.1% compared to 28.1% for fiscal 2008.

Depreciation and Amortization decreased 4.4% to $1.7 billion for fiscal 2009 from $1.8 billion for fiscal 2008.

Depreciation and Amortization as a percent of Net Sales was 2.6% for fiscal 2009 and 2.5% for fiscal 2008.

The increase in Depreciation and Amortization as a percent of Net Sales was primarily due to lower sales.

Operating Income

Operating Income increased 10.2% to $4.8 billion for fiscal 2009 from $4.4 billion for fiscal 2008. Operating

Income as a percent of Net Sales was 7.3% for fiscal 2009 compared to 6.1% for fiscal 2008. Excluding the

19