Home Depot 2009 Annual Report Download - page 30

Download and view the complete annual report

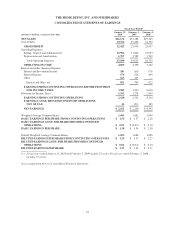

Please find page 30 of the 2009 Home Depot annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.of January 31, 2010, there were no borrowings outstanding under the commercial paper programs or the related

credit facility. The credit facility expires in December 2010 and contains various restrictive covenants. As of

January 31, 2010, we were in compliance with all of the covenants, and they are not expected to impact our

liquidity or capital resources. In August 2009, we filed a shelf registration statement with the SEC for the

potential future issuance of debt securities, replacing a shelf registration statement that had expired.

We use capital and operating leases to finance a portion of our real estate, including our stores, distribution

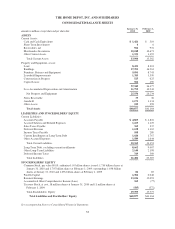

centers and store support centers. The net present value of capital lease obligations is reflected in our

Consolidated Balance Sheets in Long-Term Debt and Current Installments of Long-Term Debt. In accordance

with generally accepted accounting principles, the operating leases are not reflected in our Consolidated

Balance Sheets. As of the end of fiscal 2009, our long-term debt-to-equity ratio was 44.7% compared to 54.4%

at the end of fiscal 2008.

As of January 31, 2010, we guaranteed a $1.0 billion senior secured amortizing term loan (“guaranteed loan”)

in connection with the sale of HD Supply. The fair value of the guarantee, which was determined to be

approximately $16 million, is recorded as a liability and included in Other Long-Term Liabilities. We are

responsible for up to $1.0 billion and any unpaid interest in the event of nonpayment by HD Supply. The

guaranteed loan is collateralized by certain assets of HD Supply. The original expiration date of the guarantee

was August 30, 2012. On March 19, 2010, we amended the expiration date and extended it to April 1, 2014.

As of January 31, 2010, we had $1.4 billion in Cash, Cash Equivalents and Short-Term Investments. We

believe that our current cash position, access to the debt capital markets and cash flow generated from

operations should be sufficient to enable us to complete our capital expenditure programs and fund dividend

payments and any required long-term debt payments through the next several fiscal years. In addition, we have

funds available from our commercial paper programs and the ability to obtain alternative sources of financing.

At January 31, 2010, we had outstanding interest rate swaps, accounted for as fair value hedges, that expire on

December 16, 2013 with a notional amount of $1.25 billion that swap fixed rate interest on our $1.25 billion

5.25% Senior Notes for variable interest equal to LIBOR plus 259 basis points. At January 31, 2010, the

approximate fair value of these agreements was an asset of $12 million, which is the estimated amount we

would have received to settle the agreements.

In November 2009, we entered into a forward starting interest rate swap agreement with a notional amount of

$500 million, accounted for as a cash flow hedge, to hedge interest rate fluctuations in anticipation of issuing

long-term debt to refinance debt maturing in fiscal 2010. At January 31, 2010, the approximate fair value of this

agreement was an asset of $3 million, which is the estimated amount we would have received to settle the

agreement.

During fiscal 2008 and 2007, we entered into interest rate swaps, accounted for as fair value hedges, with

notional amounts of $3.0 billion, that swapped fixed rate interest on our $3.0 billion 5.40% Senior Notes for

variable rate interest equal to LIBOR plus 60 to 149 basis points. In fiscal 2008, we received $56 million to

settle these swaps, which is being amortized to reduce net Interest Expense over the remaining term of the debt.

Off-Balance Sheet Arrangements

In accordance with generally accepted accounting principles, operating leases for a portion of our real estate

and other assets are not reflected in our Consolidated Balance Sheets.

24