Frontier Communications 2006 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

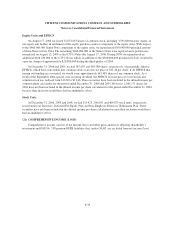

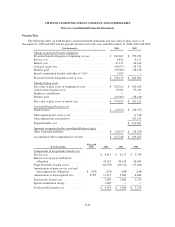

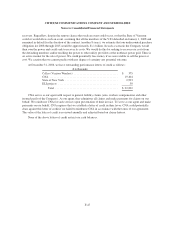

minimum rental commitments for all long-term noncancelable operating leases and future minimum capital lease

payments for continuing operations as of December 31, 2006 are as follows:

($ in thousands)

Operating

Leases

Year ending December 31:

2007 ............................................ $ 15,794

2008 ............................................ 9,817

2009 ............................................ 9,693

2010 ............................................ 8,593

2011 ............................................ 7,311

Thereafter ........................................ 18,185

Total minimum lease payments ....................... $ 69,393

Total rental expense included in our results of operations for the years ended December 31, 2006, 2005 and

2004 was $16,281,000, $16,859,000 and $17,410,000, respectively.

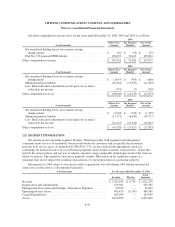

We are a party to contracts with several unrelated long distance carriers. The contracts provide fees based on

traffic they carry for us subject to minimum monthly fees.

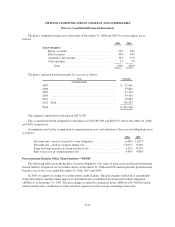

At December 31, 2006, the estimated future payments for obligations under our noncancelable long distance

contracts and service agreements are as follows:

Year

($ in thousands)

2007 ................................................ $ 26,449

2008 ................................................ 18,899

2009 ................................................ 16,610

2010 ................................................ 7,382

2011 ................................................ 165

Thereafter ............................................ 660

Total ................................................ $ 70,165

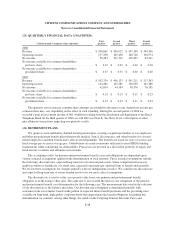

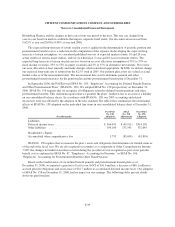

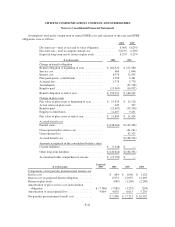

We sold all of our utility businesses as of April 1, 2004. However, we have retained a potential payment

obligation associated with our previous electric utility activities in the state of Vermont. The Vermont Joint

Owners (VJO), a consortium of 14 Vermont utilities, including us, entered into a purchase power agreement with

Hydro-Quebec in 1987. The agreement contains “step-up” provisions that state that if any VJO member defaults

on its purchase obligation under the contract to purchase power from Hydro-Quebec the other VJO participants

will assume responsibility for the defaulting party’s share on a pro-rata basis. Our pro-rata share of the purchase

power obligation is 10%. If any member of the VJO defaults on its obligations under the Hydro-Quebec

agreement, then the remaining members of the VJO, including us, may be required to pay for a substantially

larger share of the VJO’s total power purchase obligation for the remainder of the agreement (which runs through

2015). Paragraph 13 of FIN No. 45 requires that we disclose “the maximum potential amount of future payments

(undiscounted) the guarantor could be required to make under the guarantee.” Paragraph 13 also states that we

must make such disclosure “… even if the likelihood of the guarantor’s having to make any payments under the

guarantee is remote…” As noted above, our obligation only arises as a result of default by another VJO member,

such as upon bankruptcy. Therefore, to satisfy the “maximum potential amount” disclosure requirement we must

assume that all members of the VJO simultaneously default, a highly unlikely scenario given that the two

members of the VJO that have the largest potential payment obligations are publicly traded with credit ratings

equal to or superior to ours, and that all VJO members are regulated utility providers with regulated cost

F-46