Frontier Communications 2006 Annual Report Download - page 59

Download and view the complete annual report

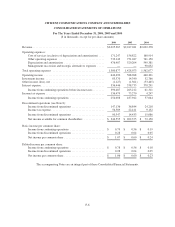

Please find page 59 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

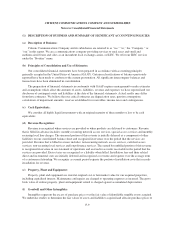

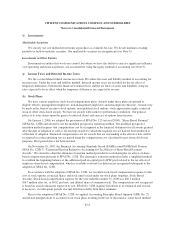

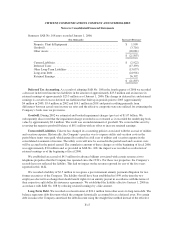

(i) Investments:

Marketable Securities

We classify our cost method investments at purchase as available-for-sale. We do not maintain a trading

portfolio or held-to-maturity securities. Our marketable securities are insignificant (see Note 9).

Investments in Other Entities

Investments in entities that we do not control, but where we have the ability to exercise significant influence

over operating and financial policies, are accounted for using the equity method of accounting (see Note 9).

(j) Income Taxes and Deferred Income Taxes:

We file a consolidated federal income tax return. We utilize the asset and liability method of accounting for

income taxes. Under the asset and liability method, deferred income taxes are recorded for the tax effect of

temporary differences between the financial statement basis and the tax basis of assets and liabilities using tax

rates expected to be in effect when the temporary differences are expected to reverse.

(k) Stock Plans:

We have various employee stock-based compensation plans. Awards under these plans are granted to

eligible officers, management employees, non-management employees and non-employee directors. Awards may

be made in the form of incentive stock options, non-qualified stock options, stock appreciation rights, restricted

stock or other stock-based awards. We have no awards with market or performance conditions. Our general

policy is to issue shares upon the grant of restricted shares and exercise of options from treasury.

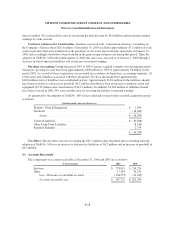

On January 1, 2006, we adopted the provisions of SFAS No. 123 (revised 2004), “Share-Based Payment”

(SFAS No. 123R) and elected to use the modified prospective transition method. The modified prospective

transition method requires that compensation cost be recognized in the financial statements for all awards granted

after the date of adoption as well as for existing awards for which the requisite service had not been rendered as

of the date of adoption. Estimated compensation cost for awards that are outstanding at the effective date will be

recognized over the remaining service period using the compensation cost calculated for pro forma disclosure

purposes. Prior periods have not been restated.

On November 10, 2005, the Financial Accounting Standards Board (FASB) issued FASB Staff Position

SFAS No. 123R-3, “Transition Election Related to Accounting for Tax Effects of Share-Based Payment

Awards.” We elected to adopt the alternative transition method provided for calculating the tax effects of share-

based compensation pursuant to SFAS No. 123R. The alternative transition method includes a simplified method

to establish the beginning balance of the additional paid-in capital pool (APIC pool) related to the tax effects of

employee share-based compensation, which is available to absorb tax deficiencies recognized subsequent to the

adoption of SFAS No. 123R.

In accordance with the adoption of SFAS No. 123R, we recorded stock-based compensation expense for the

cost of stock options, restricted shares and stock units issued under our stock plans (together, Stock-Based

Awards). Stock-based compensation expense for the year ended December 31, 2006 was $10.3 million

($6.7 million after tax, or $0.02 per basic and diluted share of common stock). The compensation cost recognized

is based on awards ultimately expected to vest. SFAS No. 123R requires forfeitures to be estimated and revised,

if necessary, in subsequent periods if actual forfeitures differ from those estimates.

Prior to the adoption of SFAS No. 123R, we applied Accounting Principles Board Opinion (APB) No. 25

and related interpretations to account for our stock plans resulting in the use of the intrinsic-value based method

F-11