Frontier Communications 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

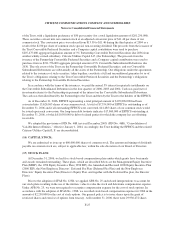

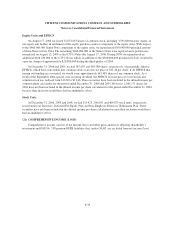

We account for the Deferred Fee Plan and Directors’ Equity Plan in accordance with SFAS No. 123R. To

the extent directors elect to receive the distribution of their stock unit account in cash, they are considered

liability-based awards. To the extent directors elect to receive the distribution of their stock unit accounts in

common stock, they are considered equity-based awards. Compensation expense for stock units that are

considered equity-based awards is based on the market value of our common stock at the date of grant.

Compensation expense for stock units that are considered liability-based awards is based on the market value of

our common stock at the end of each period. For awards granted prior to 1999, a director could elect to be paid in

stock options. Generally, compensation cost was not recorded because the options were granted at the fair market

value of our common stock on the grant date under APB No. 25 and related interpretations.

We had also maintained a Non-Employee Directors’ Retirement Plan providing for the payment of specified

sums annually to our non-employee directors, or their designated beneficiaries, starting at the director’s

retirement, death or termination of directorship. In 1999, we terminated this Plan. The vested benefit of each

non-employee director, as of May 31, 1999, was credited to the director’s account in the form of stock units.

Such benefit will be payable to each director upon retirement, death or termination of directorship. Each

participant had until July 15, 1999 to elect whether the value of the stock units awarded would be payable in our

common stock (convertible on a one-for-one basis) or in cash. As of December 31, 2006, the liability for such

payments was $686,000 all of which will be payable in stock (based on the July 15, 1999 stock price).

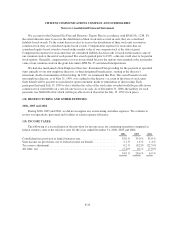

(18) RESTRUCTURING AND OTHER EXPENSES:

2006, 2005 and 2004

During 2006, 2005 and 2004, we did not recognize any restructuring and other expenses. We continue to

review our operations, personnel and facilities to achieve greater efficiency.

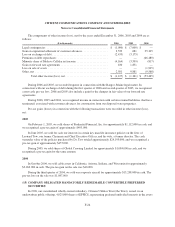

(19) INCOME TAXES:

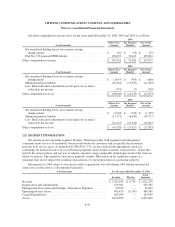

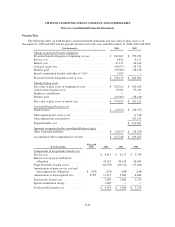

The following is a reconciliation of the provision for income taxes for continuing operations computed at

federal statutory rates to the effective rates for the years ended December 31, 2006, 2005 and 2004:

2006 2005 2004

Consolidated tax provision at federal statutory rate ......................... 35.0 % 35.0 % 35.0 %

State income tax provisions, net of federal income tax benefit ................ 2.1% 1.6% 1.4%

Tax reserve adjustment ............................................... 0.2% (8.2)% (22.5)%

All other, net ....................................................... (2.4)% 0.2 % (7.0)%

34.9 % 28.6 % 6.9 %

F-32