Frontier Communications 2006 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

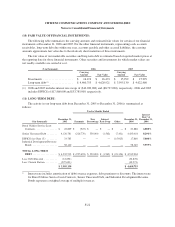

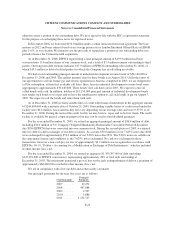

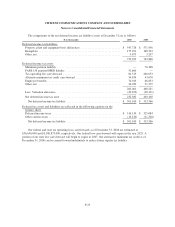

(12) DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES:

Interest rate swap agreements are used to hedge a portion of our debt that is subject to fixed interest rates.

Under our interest rate swap agreements, we agree to pay an amount equal to a specified variable rate of interest

times a notional principal amount, and to receive in return an amount equal to a specified fixed rate of interest

times the same notional principal amount. The notional amounts of the contracts are not exchanged. No other

cash payments are made unless the agreement is terminated prior to maturity, in which case the amount paid or

received in settlement is established by agreement at the time of termination and represents the market value, at

the then current rate of interest, of the remaining obligations to exchange payments under the terms of the

contracts.

The interest rate swap contracts are reflected at fair value in our consolidated balance sheets and the related

portion of fixed-rate debt being hedged is reflected at an amount equal to the sum of its book value and an

amount representing the change in fair value of the debt obligations attributable to the interest rate risk being

hedged. Changes in the fair value of interest rate swap contracts, and the offsetting changes in the adjusted

carrying value of the related portion of the fixed-rate debt being hedged, are recognized in the consolidated

statements of operations in interest expense. The notional amounts of interest rate swap contracts hedging fixed-

rate indebtedness as of December 31, 2006 and December 31, 2005 were $550,000,000 and $500,000,000,

respectively. Such contracts require us to pay variable rates of interest (average pay rates of approximately 9.02%

and 8.60% as of December 31, 2006 and 2005, respectively) and receive fixed rates of interest (average receive

rates of 8.26% and 8.46% as of December 31, 2006 and 2005, respectively). The fair value of these derivatives is

reflected in other liabilities as of December 31, 2006 and 2005, in the amount of ($10,289,000) and ($8,727,000),

respectively. The related underlying debt has been decreased in 2006 and 2005 by a like amount. For the year

ended December 31, 2006 , the interest expense resulting from these interest rate swaps totaled approximately

$4.2 million. For the years ended December 31, 2005 and 2004 our interest expense was reduced by $2.5 million

and $9.4 million, respectively.

We do not anticipate any nonperformance by counter-parties to our derivative contracts as all counter-

parties have investment grade credit ratings.

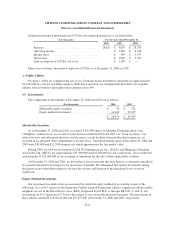

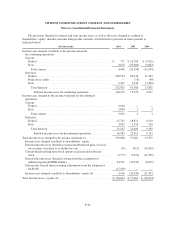

(13) MANAGEMENT SUCCESSION AND STRATEGIC ALTERNATIVES EXPENSES:

On July 11, 2004, our Board of Directors announced that it had completed its review of our financial and

strategic alternatives, and on September 2, 2004, we paid a special, non-recurring dividend of $2.00 per common

share and a quarterly dividend of $0.25 per common share to shareholders of record on August 18, 2004.

Concurrently, Leonard Tow decided to step down from his position as chief executive officer, effective

immediately, and resigned his position as Chairman of the Board on September 27, 2004. The Board of Directors

named Mary Agnes Wilderotter president and chief executive officer in November 2004.

In 2004, we expensed approximately $90,632,000 of costs related to management succession and our

exploration of financial and strategic alternatives. Included are $36,618,000 of non-cash expenses for the

acceleration of stock benefits, cash expenses of $19,229,000 for advisory fees, $19,339,000 for severance and

retention arrangements and $15,446,000 primarily for tax reimbursements.

(14) INVESTMENT INCOME AND OTHER INCOME (LOSS), NET:

During 2006 we recognized a gain of $61.4 million (recorded in investment income) arising from the

liquidation and dissolution of the RTB.

F-25