Frontier Communications 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Share Repurchase Programs

In February 2007, our Board of Directors authorized us to repurchase up to $250 million of our common

stock in public or private transactions over the following twelve month period.

In February 2006, our Board of Directors authorized us to repurchase up to $300.0 million of our common

stock in public or private transactions over the following twelve-month period. This share repurchase program

commenced on March 6, 2006. As of December 31, 2006, we had repurchased 10,199,900 shares of our common

stock at an aggregate cost of approximately $135.2 million. No more shares can be repurchased under this

authorization.

On May 25, 2005, our Board of Directors authorized us to repurchase up to $250.0 million of our common

stock. This share repurchase program commenced on June 13, 2005. As of December 31, 2005, we completed the

repurchase program and had repurchased a total of 18,775,156 shares of our common stock at an aggregate cost

of $250.0 million.

Dividends

Our ongoing annual dividends of $1.00 per share of common stock under our current policy utilize a

significant portion of our cash generated by operations and therefore could limit our operating and financial

flexibility. While we believe that the amount of our dividends will allow for adequate amounts of cash flow for

other purposes, any reduction in cash generated by operations and any increases in capital expenditures, interest

expense or cash taxes would reduce the amount of cash generated in excess of dividends.

Off-Balance Sheet Arrangements

We do not maintain any off-balance sheet arrangements, transactions, obligations or other relationship with

unconsolidated entities that would be expected to have a material current or future effect upon our financial

statements.

Future Commitments

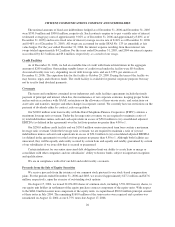

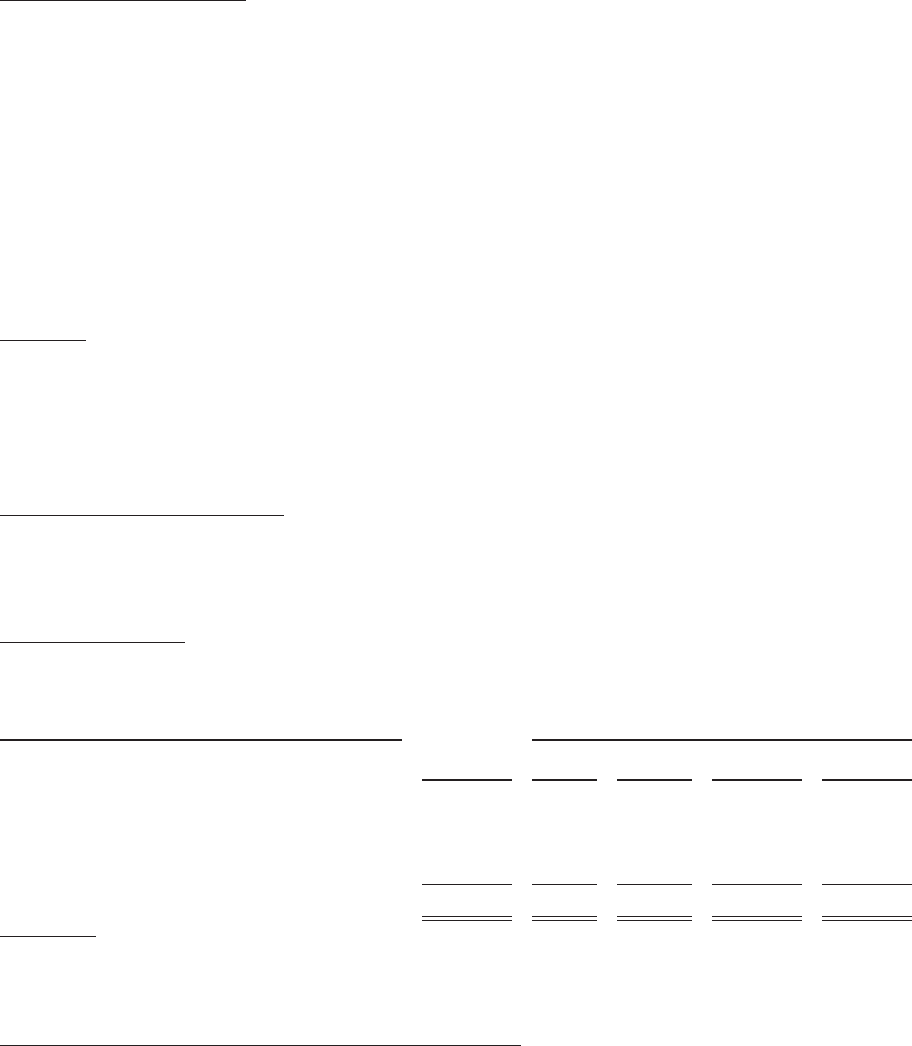

A summary of our future contractual obligations and commercial commitments as of December 31, 2006 is

as follows:

Contractual Obligations: Payment due by period

($ in thousands)

Total

Less than

1 year 1-3 years 3-5 years

More than

5 years

Long-term debt obligations,

excluding interest (see Note 11) (1) .......... $4,532,904 $39,271 $500,195 $1,258,403 $2,735,035

Operating lease obligations (see Note 25) ...... 69,393 15,794 19,510 15,904 18,185

Purchase obligations (see Note 25) ............ 70,165 26,449 35,509 7,547 660

Total ................................. $4,672,462 $81,514 $555,214 $1,281,854 $2,753,880

(1) Includes interest rate swaps (($10.3) million).

At December 31, 2006, we have outstanding performance letters of credit totaling $22.8 million.

Management Succession and Strategic Alternatives Expenses

On July 11, 2004, our Board of Directors announced that it completed its review of our financial and

strategic alternatives. In 2004, we expensed $90.6 million of costs related to management succession and our

exploration of financial and strategic alternatives. Included are $36.6 million of non-cash expenses for the

acceleration of stock benefits, cash expenses of $19.2 million for advisory fees, $19.3 million for severance and

retention arrangements and $15.5 million primarily for tax reimbursements.

27