Frontier Communications 2006 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

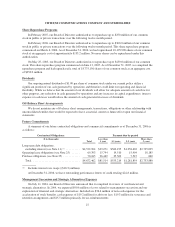

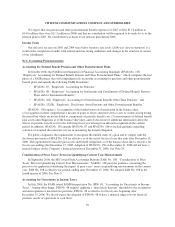

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

As of December 31,

2006 2005 2004 2003 2002

Total assets .......................... $6,791,205 $6,427,567 $6,679,899 $7,457,939 $8,153,078

Long-term debt ....................... $4,460,755 $3,995,130 $4,262,658 $4,179,590 $4,816,163

Equity units (2) ........................ $ — $ — $ — $ 460,000 $ 460,000

Company Obligated Mandatorily

Redeemable

Convertible Preferred Securities (3) ........ $ — $ — $ — $ 201,250 $ 201,250

Shareholders’ equity ................... $1,058,032 $1,041,809 $1,362,240 $1,415,183 $1,172,139

(1) The cumulative effect of change in accounting principles represents the $65.8 million after tax non-cash

gain resulting from the adoption of Statement of Financial Accounting Standards No. 143 in 2003.

(2) On August 17, 2004, we issued common stock to equity unit holders in settlement of the equity purchase

contract.

(3) The consolidation of this item changed effective January 1, 2004 as a result of the adoption of FIN No. 46R,

“Consolidation of Variable Interest Entities.”

(4) Operating results include activities from our Vermont Electric segment for three months of 2004 and the

years ended 2003 and 2002.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND

RESULTS OF OPERATIONS

FORWARD-LOOKING STATEMENTS

This annual report on Form 10-K contains forward-looking statements that are subject to risks and

uncertainties that could cause actual results to differ materially from those expressed or implied in the statements.

Statements that are not historical facts are forward-looking statements made pursuant to the Safe Harbor

Provisions of the Litigation Reform Act of 1995. Words such as “believes,” “anticipates,” “expects” and similar

expressions are intended to identify forward-looking statements. Forward-looking statements (including oral

representations) are only predictions or statements of current plans, which we review continuously. Forward-

looking statements may differ from actual future results due to, but not limited to, and our future results may be

materially affected by, any of the following possibilities:

• Our ability to complete the acquisition of Commonwealth, to successfully integrate their operations and

to realize the synergies from the acquisition;

• Our ability to refinance the bridge loan that will be used to finance any remaining cash portion of the

merger consideration with long-term debt;

• Changes in the number of our revenue generating units, which consists of access lines plus high-speed

internet subscribers;

• The effects of competition from wireless, other wireline carriers (through VOIP or otherwise), high-

speed cable modems and cable telephony;

• The effects of greater than anticipated competition requiring new pricing, marketing strategies or new

product offerings and the risk that we will not respond on a timely or profitable basis;

• The effects of general and local economic and employment conditions on our revenues;

• Our ability to effectively manage service quality;

• Our ability to successfully introduce new product offerings, including our ability to offer bundled

service packages on terms that are both profitable to us and attractive to our customers;

20