Frontier Communications 2006 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

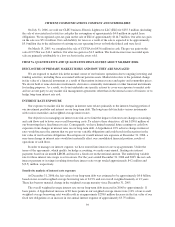

Stock-Based Compensation

In December 2004, the FASB issued SFAS No. 123 (revised 2004), “Share-Based Payment” (SFAS

No. 123R). SFAS No. 123R requires that stock-based employee compensation be recorded as a charge to

earnings. In April 2005, the SEC required adoption of SFAS No. 123R for annual periods beginning after

June 15, 2005. Accordingly, we have adopted SFAS No. 123R commencing January 1, 2006 using a modified

prospective application, as permitted by SFAS No. 123R. Accordingly, prior period amounts have not been

restated. Under this application, we are required to record compensation expense for all awards granted after the

date of adoption and for the unvested portion of previously granted awards that remain outstanding at the date of

adoption.

Prior to the adoption of SFAS No. 123R, we applied APB No. 25 and related interpretations to account for

our stock plans resulting in the use of the intrinsic value to value the stock. Under APB No. 25, we were not

required to recognize compensation expense for the cost of stock options. In accordance with the adoption of

SFAS No. 123R, we recorded stock-based compensation expense for the cost of stock options, restricted shares

and stock units issued under our stock plans (together, Stock-Based Awards). Stock-based compensation expense

for the year ended December 31, 2006 was $10.3 million ($6.7 million after tax or $0.02 per basic and diluted

share of common stock).

Accounting for Endorsement Split-Dollar Life Insurance Arrangements

In September 2006, the FASB reached consensus on the guidance provided by EITF No. 06-4, Accounting

for Deferred Compensation and Postretirement Benefit Aspects of Endorsement Split-Dollar Life Insurance

Arrangements. The guidance is applicable to endorsement split-dollar life insurance arrangements, whereby the

employer owns and controls the insurance policy, that are associated with a postretirement benefit. EITF

No. 06-4 requires that for a split-dollar life insurance arrangement within the scope of the issue, an employer

should recognize a liability for future benefits in accordance with FAS No. 106 (if, in substance, a postretirement

benefit plan exists) or Accounting Principles Board Opinion No. 12 (if the arrangement is, in substance, an

individual deferred compensation contract) based on the substantive agreement with the employee. EITF

No. 06-4 is effective for fiscal years beginning after December 15, 2007. The Company is currently evaluating

the impact the adoption of the standard will have on the Company’s results of operations or financial condition.

Accounting for Purchases of Life Insurance

In September 2006, the FASB reached consensus on the guidance provided by EITF No. 06-5, Accounting

for Purchases of Life Insurance-Determining the Amount That Could Be Realized in Accordance with FASB

Technical Bulletin No. 85-4, Accounting for Purchases of Life Insurance. EITF No. 06-5 states that a

policyholder should consider any additional amounts included in the contractual terms of the insurance policy

other than the cash surrender value in determining the amount that could be realized under the insurance contract.

EITF No. 06-5 also states that a policyholder should determine the amount that could be realized under the life

insurance contract assuming the surrender of an individual-life by individual-life policy (or certificate by

certificate in a group policy). EITF No. 06-5 is effective for fiscal years beginning after December 15, 2006. The

Company is currently evaluating the impact the adoption of the standard will have on the Company’s results of

operations or financial condition.

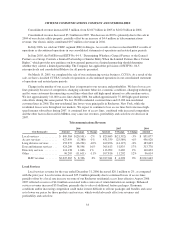

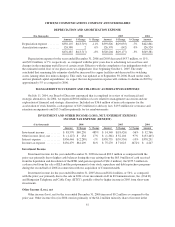

(b) RESULTS OF OPERATIONS

REVENUE

Revenue is generated primarily through the provision of local, network access, long distance and data

services. Such services are provided under either a monthly recurring fee or based on usage at a tariffed rate and

is not dependent upon significant judgments by management, with the exception of a determination of a

provision for uncollectible amounts.

32