Frontier Communications 2006 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

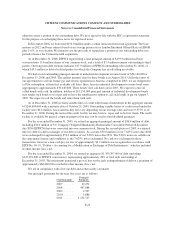

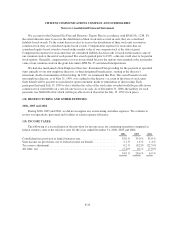

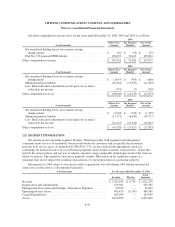

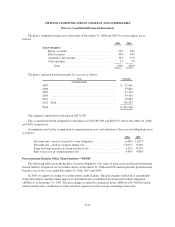

The components of the net deferred income tax liability (asset) at December 31 are as follows:

($ in thousands) 2006 2005

Deferred income tax liabilities:

Property, plant and equipment basis differences ............................ $ 547,726 $ 571,956

Intangibles ......................................................... 175,991 168,703

Other, net .......................................................... 9,675 3,207

733,392 743,866

Deferred income tax assets:

Minimum pension liability ............................................ — 76,368

FASB 158 pension/OPEB liability ...................................... 51,660 —

Tax operating loss carryforward ........................................ 81,515 260,053

Alternate minimum tax credit carryforward ............................... 54,834 43,678

Employee benefits ................................................... 70,013 66,853

Other, net .......................................................... 24,039 21,279

282,061 468,231

Less: Valuation allowance ............................................ (49,679) (38,131)

Net deferred income tax asset .......................................... 232,382 430,100

Net deferred income tax liability ...................................... $ 501,010 $ 313,766

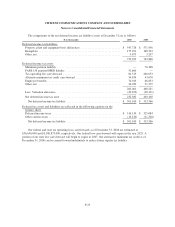

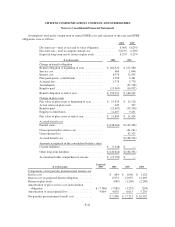

Deferred tax assets and liabilities are reflected in the following captions on the

balance sheet:

Deferred income taxes ................................................ $ 514,130 $ 325,084

Other current assets .................................................. (13,120) (11,318)

Net deferred income tax liability ...................................... $ 501,010 $ 313,766

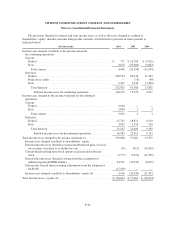

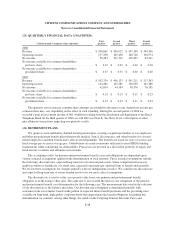

Our federal and state tax operating loss carryforwards as of December 31, 2006 are estimated at

$56,636,000 and $1,186,873,000, respectively. Our federal loss carryforward will expire in the year 2025. A

portion of our state loss carryforward will begin to expire in 2007. Our alternative minimum tax credit as of

December 31, 2006 can be carried forward indefinitely to reduce future regular tax liability.

F-33