Frontier Communications 2006 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

connection with the Commonwealth transaction. We expect the need to borrow $200.0 million—$300.0 million

under the remaining commitment to close the Commonwealth transaction, pay all closing transaction costs and

implementation costs.

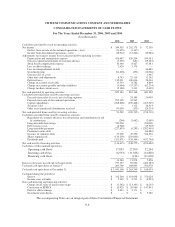

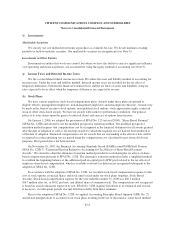

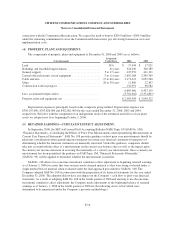

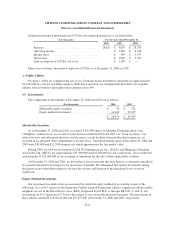

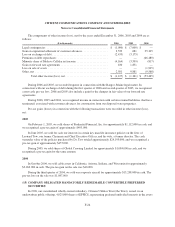

(4) PROPERTY, PLANT AND EQUIPMENT:

The components of property, plant and equipment at December 31, 2006 and 2005 are as follows:

($ in thousands)

Estimated

Useful Lives 2006 2005

Land .................................................. N/A $ 17,944 $ 17,921

Buildings and leasehold improvements ....................... 41years 324,230 320,789

General support ......................................... 5to17years 425,952 411,191

Central office/electronic circuit equipment .................... 5to11years 2,602,168 2,509,769

Cable and wire .......................................... 15to60years 3,171,421 3,052,560

Other .................................................. 20to30years 11,800 22,307

Construction work in progress .............................. 131,951 98,582

6,685,466 6,433,119

Less: accumulated depreciation ............................. (3,701,962) (3,374,807)

Property, plant and equipment, net .......................... $2,983,504 $ 3,058,312

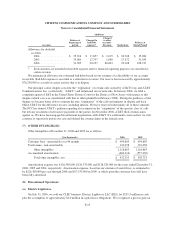

Depreciation expense is principally based on the composite group method. Depreciation expense was

$350,107,000, $393,826,000 and $422,861,000 for the years ended December 31, 2006, 2005 and 2004,

respectively. Effective with the completion of an independent study of the estimated useful lives of our plant

assets we adopted new lives beginning October 1, 2006.

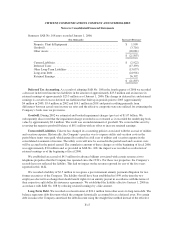

(5) RETAINED EARNINGS—CUMULATIVE EFFECT ADJUSTMENT:

In September 2006, the SEC staff issued Staff Accounting Bulletin (SAB) Topic 1N (SAB No. 108),

“Financial Statements—Considering the Effects of Prior Year Misstatements when Quantifying Misstatements in

Current Year Financial Statements”. SAB No. 108 provides guidance on how prior year misstatements should be

taken into consideration when quantifying misstatements in current year financial statements for purposes of

determining whether the financial statements are materially misstated. Under this guidance, companies should

take into account both the effect of a misstatement on the current year balance sheet as well as the impact upon

the current year income statement in assessing the materiality of a current year misstatement. Once a current year

misstatement has been quantified, the guidance in SAB Topic 1M, “Financial Statements Materiality,”

(SAB No. 99) will be applied to determine whether the misstatement is material.

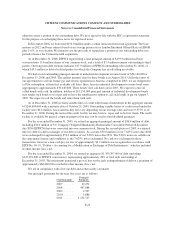

SAB No. 108 allows for a one-time transitional cumulative effect adjustment to beginning retained earnings

as of January 1, 2006 for errors that were not previously deemed material as they were being evaluated under a

single method but are material when evaluated under the dual approach proscribed by SAB No. 108. The

Company adopted SAB No. 108 in connection with the preparation of its financial statements for the year ended

December 31, 2006. The adoption did not have any impact on the Company’s cash flow or prior year financial

statements. As a result of adopting SAB No. 108 in the fourth quarter of 2006 and electing to use the one-time

transitional cumulative effect adjustment, the Company made adjustments to the beginning balance of retained

earnings as of January 1, 2006 in the fourth quarter of 2006 for the following errors (all of which were

determined to be immaterial under the Company’s previous methodology):

F-16