Frontier Communications 2006 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

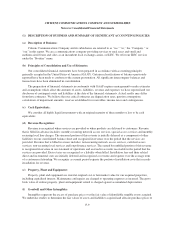

Notes to Consolidated Financial Statements

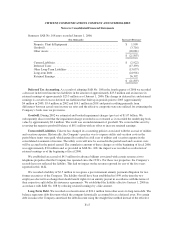

Accounting for Endorsement Split-Dollar Life Insurance Arrangements

In September 2006, the FASB reached consensus on the guidance provided by EITF No. 06-4, Accounting

for Deferred Compensation and Postretirement Benefit Aspects of Endorsement Split-Dollar Life Insurance

Arrangements. The guidance is applicable to endorsement split-dollar life insurance arrangements, whereby the

employer owns and controls the insurance policy, that are associated with a postretirement benefit.

EITF No. 06-4 requires that for a split-dollar life insurance arrangement within the scope of the issue, an

employer should recognize a liability for future benefits in accordance with FAS No. 106 (if, in substance, a

postretirement benefit plan exists) or Accounting Principles Board Opinion No. 12 (if the arrangement is, in

substance, an individual deferred compensation contract) based on the substantive agreement with the employee.

EITF No. 06-4 is effective for fiscal years beginning after December 15, 2007. The Company is currently

evaluating the impact the adoption of the standard will have on the Company’s results of operations or financial

condition.

Accounting for Purchases of Life Insurance

In September 2006, the FASB reached consensus on the guidance provided by EITF No. 06-5, Accounting

for Purchases of Life Insurance—Determining the Amount That Could Be Realized in Accordance with FASB

Technical Bulletin No. 85-4, Accounting for Purchases of Life Insurance. EITF No. 06-5 states that a

policyholder should consider any additional amounts included in the contractual terms of the insurance policy

other than the cash surrender value in determining the amount that could be realized under the insurance contract.

EITF No. 06-5 also states that a policyholder should determine the amount that could be realized under the life

insurance contract assuming the surrender of an individual-life by individual-life policy (or certificate by

certificate in a group policy). EITF No. 06-5 is effective for fiscal years beginning after December 15, 2006. The

Company is currently evaluating the impact the adoption of the standard will have on the Company’s results of

operations or financial condition.

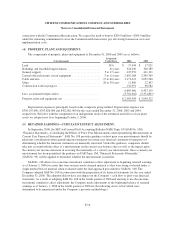

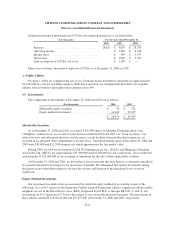

(3) PROPOSED ACQUISITION OF COMMONWEALTH TELEPHONE:

On September 17, 2006, we entered into a definitive agreement to acquire Commonwealth Telephone for

$41.72 per share, in a cash-and-stock taxable transaction, for a total purchase price of $1.2 billion. Each

Commonwealth share will receive $31.31 in cash and 0.768 shares of Citizens’ common stock. We expect to

issue approximately 21 million shares in the merger.

The acquisition has been approved by the Boards of Directors of both Citizens and Commonwealth and by

Commonwealth’s shareholders. The acquisition has received the requisite Hart-Scott Rodino and FCC approvals,

but is still subject to Pennsylvania PUC approval. We expect the transaction to be consummated in the first half

of 2007.

We intend to finance the cash portion of the transaction with a combination of cash on hand and debt. We

obtained a commitment letter for a $990.0 million senior unsecured term loan, the proceeds of which may be

used to pay the cash portion of the acquisition consideration (including cash payable upon the assumed

conversion of $300.0 million of the Commonwealth convertible notes in connection with the acquisition), to cash

out restricted shares, options and other equity awards of Commonwealth, to repay all of Commonwealth’s

outstanding indebtedness (which was $35.0 million as of December 31, 2006) and to pay fees and expenses

related to the acquisition. We expect to refinance this term loan, which matures within one year, with long-term

debt prior to the maturity thereof. On December 22, 2006, this commitment was reduced by $400.0 million as the

result of our issuance of 7.875% senior notes due 2027 in the amount of $400.0 million. In December 2006, we

borrowed $150.0 million from CoBank under a 6 year unsecured term loan. These proceeds can be used to

repurchase existing indebtedness or to essentially reduce the amount of additional borrowings needed in

F-15