Frontier Communications 2006 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

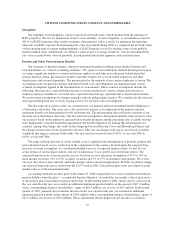

ISSUER PURCHASES OF EQUITY SECURITIES

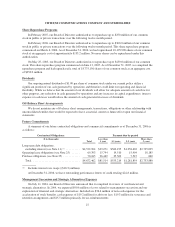

Period

(a) Total

Number

of Shares

Purchased

(b) Average

Price Paid

per Share

(c) Total Number

of Shares

Purchased as

Part of Publicly

Announced Plans

or Programs

(d) Maximum

Approximate Dollar

Value of Shares that May

Yet Be Purchased Under

the Plans or Programs

October 1, 2006 to October 31, 2006

Share Repurchase Program (1) .............. — $ — — $ —

Employee Transactions (2) ................. 722 $14.36 N/A N/A

November 1, 2006 to November 30, 2006

Share Repurchase Program (1) .............. — $ — — $ —

Employee Transactions (2) ................. 12,435 $14.66 N/A N/A

December 1, 2006 to December 31, 2006

Share Repurchase Program (1) .............. — $ — — $ —

Employee Transactions (2) ................. — $ — N/A N/A

Totals October 1, 2006 to December 31, 2006

Share Repurchase Program (1) .............. — $ — — $ —

Employee Transactions (2) ................. 13,157 $14.64 N/A N/A

(1) In February 2006, our Board of Directors authorized the Company to repurchase up to $300.0 million of the

Company’s common stock, in public or private transactions, over the following twelve month period. This

share repurchase program commenced on March 6, 2006. No shares were repurchased during the fourth

quarter of 2006.

(2) Includes restricted shares withheld (under the terms of grants under employee stock compensation plans) to

offset minimum tax withholding obligations that occur upon the vesting of restricted shares. The Company’s

stock compensation plans provide that the value of shares withheld shall be the average of the high and low

price of the Company’s common stock on the date the relevant transaction occurs.

ITEM 6. SELECTED FINANCIAL DATA

Year Ended December 31,

($ in thousands, except per share amounts) 2006 2005 2004 2003 2002

Revenue (4) ........................... $2,025,367 $2,017,041 $2,022,378 $2,268,561 $2,482,440

Income (loss) from continuing operations

before cumulative effect of change in

accounting principle (1) ............... $ 254,008 $ 187,942 $ 57,064 $ 71,879 $ (313,257)

Net income (loss) ..................... $ 344,555 $ 202,375 $ 72,150 $ 187,852 $ (682,897)

Basic income (loss) per share of common

stock from continuing operations before

cumulative effect of change in accounting

principle (1) ......................... $ 0.79 $ 0.56 $ 0.19 $ 0.26 $ (1.12)

Earnings (loss) available for common

shareholders per basic share ........... $ 1.07 $ 0.60 $ 0.24 $ 0.67 $ (2.43)

Earnings (loss) available for common

shareholders per diluted share .......... $ 1.06 $ 0.60 $ 0.23 $ 0.64 $ (2.43)

Cash dividends declared (and paid) per

common share ...................... $ 1.00 $ 1.00 $ 2.50 $ — $ —

19