Frontier Communications 2006 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

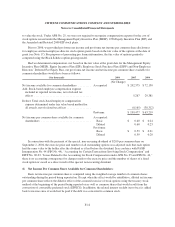

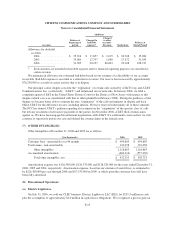

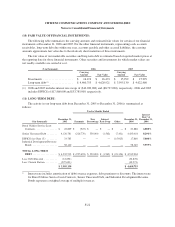

(10) FAIR VALUE OF FINANCIAL INSTRUMENTS:

The following table summarizes the carrying amounts and estimated fair values for certain of our financial

instruments at December 31, 2006 and 2005. For the other financial instruments, representing cash, accounts

receivables, long-term debt due within one year, accounts payable and other accrued liabilities, the carrying

amounts approximate fair value due to the relatively short maturities of those instruments.

The fair value of our marketable securities and long-term debt is estimated based on quoted market prices at

the reporting date for those financial instruments. Other securities and investments for which market values are

not readily available are carried at cost.

($ in thousands) 2006 2005

Carrying

Amount Fair Value

Carrying

Amount Fair Value

Investments ..................... $ 16,474 $ 16,474 $ 15,999 $ 15,999

Long-term debt (1) ................ $ 4,460,755 $ 4,620,921 $ 3,995,130 $ 4,022,960

(1) 2006 and 2005 includes interest rate swaps of ($10,289,000) and ($8,727,000), respectively. 2006 and 2005

includes EPPICS of $17,860,000 and $33,785,000, respectively.

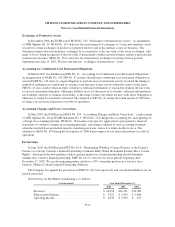

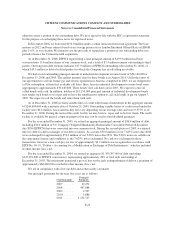

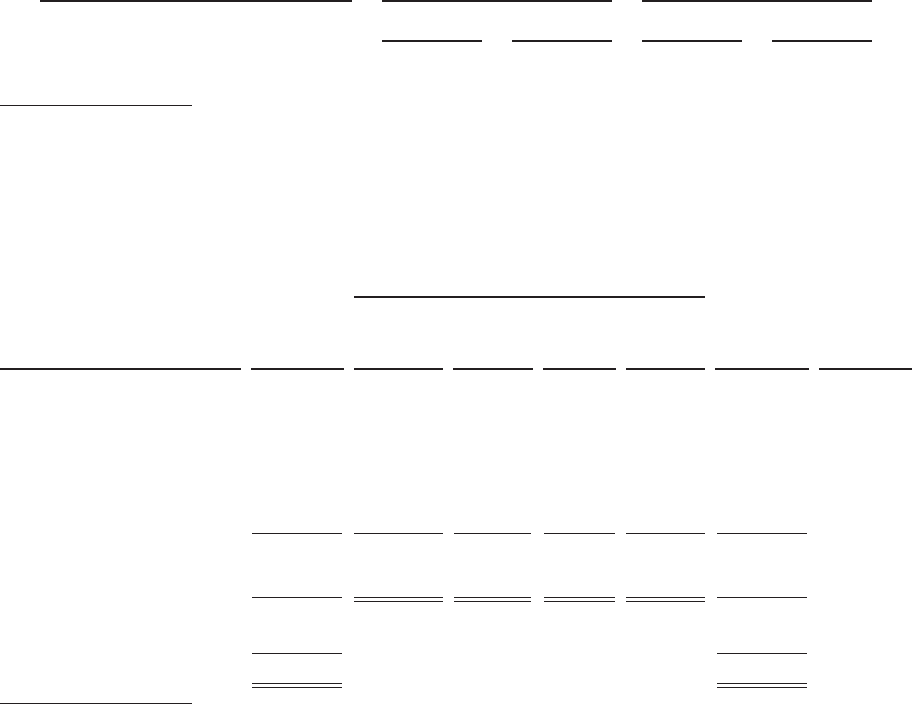

(11) LONG-TERM DEBT:

The activity in our long-term debt from December 31, 2005 to December 31, 2006 is summarized as

follows:

Twelve Months Ended

($ in thousands)

December 31,

2005 Payments

New

Borrowings

Interest

Rate Swap Other

December 31,

2006

Interest

Rate* at

December 31,

2006

Rural Utilities Service Loan

Contracts ................. $ 22,809 $ (923) $ — $ — $ — $ 21,886 6.080%

Senior Unsecured Debt ........ 4,120,781 (226,770) 550,000 (1,562) (7,431) 4,435,018 8.296%

EPPICS (see Note 15) ........ 33,785 — — — (15,925) 17,860 5.000%

Industrial Development Revenue

Bonds ................... 58,140 — — — — 58,140 5.559%

TOTAL LONG TERM

DEBT ................... $ 4,235,515 $ (227,693) $ 550,000 $ (1,562) $ (23,356) $ 4,532,904

Less: Debt Discount .......... (12,692) (32,878)

Less: Current Portion ......... (227,693) (39,271)

$ 3,995,130 $ 4,460,755

* Interest rate includes amortization of debt issuance expenses, debt premiums or discounts. The interest rate

for Rural Utilities Service Loan Contracts, Senior Unsecured Debt, and Industrial Development Revenue

Bonds represent a weighted average of multiple issuances.

F-22