Frontier Communications 2006 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2006 Frontier Communications annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CITIZENS COMMUNICATIONS COMPANY AND SUBSIDIARIES

Notes to Consolidated Financial Statements

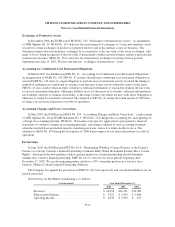

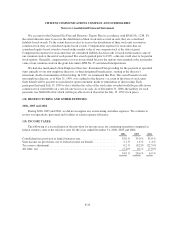

otherwise retire a portion of our outstanding debt. We have agreed to file with the SEC a registration statement

for the purpose of exchanging these notes for registered notes.

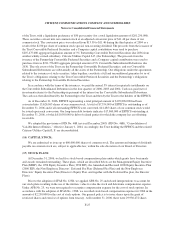

In December 2006, we borrowed $150.0 million under a senior unsecured term loan agreement. The loan

matures in 2012 and bears interest based on an average prime rate or London Interbank Offered Rate or LIBOR

plus 1

3

⁄

8

%, at our election. We intend to use the proceeds to repurchase a portion of our outstanding debt or to

partially finance the Commonwealth acquisition.

As of December 31, 2006, EPPICS representing a total principal amount of $193.9 million had been

converted into 15.6 million shares of our common stock, and a total of $7.4 million remains outstanding to third

parties. Our long term debt footnote indicates $17.9 million of EPPICS outstanding at December 31, 2006, of

which $10.5 million is debt of related parties for which the Company has an offsetting receivable.

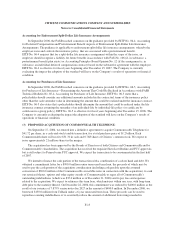

We had a total outstanding principal amount of industrial development revenue bonds of $58,140,000 at

December 31, 2006 and 2005. The earliest maturity date for these bonds is in August 2015. Under the terms of

our agreements to sell our former gas and electric operations in Arizona, completed in 2003, we are obligated to

call for redemption, at their first available call dates, three Arizona industrial development revenue bond series

aggregating to approximately $33,440,000. These bonds’ first call dates are in 2007. We expect to retire all

called bonds with cash. In addition, holders of $11,150,000 principal amount of industrial development bonds

may tender such bonds to us at par and we have the simultaneous option to call such bonds at par on August 7,

2007. We expect to call the bonds and retire them with cash.

As of December 31, 2006 we had available lines of credit with financial institutions in the aggregate amount

of $249,600,000 with a maturity date of October 29, 2009. Outstanding standby letters of credit issued under the

facility were $0.4 million. Associated facility fees vary depending on our leverage ratio and were 0.375% as of

December 31, 2006. During the term of the credit facility we may borrow, repay and re-borrow funds. The credit

facility is available for general corporate purposes but may not be used to fund dividend payments.

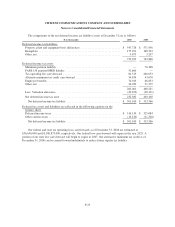

For the year ended December 31, 2005, we retired an aggregate principal amount of $36.4 million of debt,

including $30.0 million of 5% Company Obligated Mandatorily Redeemable Convertible Preferred Securities

due 2036 (EPPICS) that were converted into our common stock. During the second quarter of 2005, we entered

into two debt-for-debt exchanges of our debt securities. As a result, $50.0 million of our 7.625% notes due 2008

were exchanged for approximately $52.2 million of our 9.00% notes due 2031. The 9.00% notes are callable on

the same general terms and conditions as the 7.625% notes exchanged. No cash was exchanged in these

transactions, however a non-cash pre-tax loss of approximately $3.2 million was recognized in accordance with

EITF No. 96-19, “Debtor’s Accounting for a Modification or Exchange of Debt Instruments,” which is included

in other income (loss), net.

For the year ended December 31, 2004, we retired an aggregate $1,350,397,000 of debt (including

$147,991,000 of EPPICS conversions), representing approximately 28% of total debt outstanding at

December 31, 2003. The retirements generated a pre-tax loss on the early extinguishment of debt at a premium of

approximately $66,480,000 recorded in other income (loss), net.

We are in compliance with all of our debt and credit facility covenants.

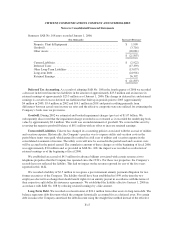

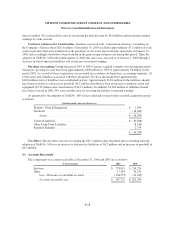

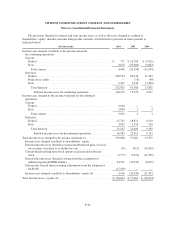

Our principal payments for the next five years are as follows:

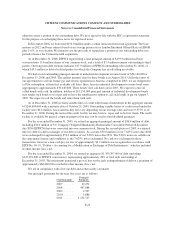

($ in thousands)

Principal

Payments

2007 ........ 39,271

2008 ........ 497,688

2009 ........ 2,507

2010 ........ 5,886

2011 ........ 1,252,517

F-24